Are Heloc Loans Tax Deductible

A home equity loan hel offers more than the stability of a fixed rate and payment schedule.

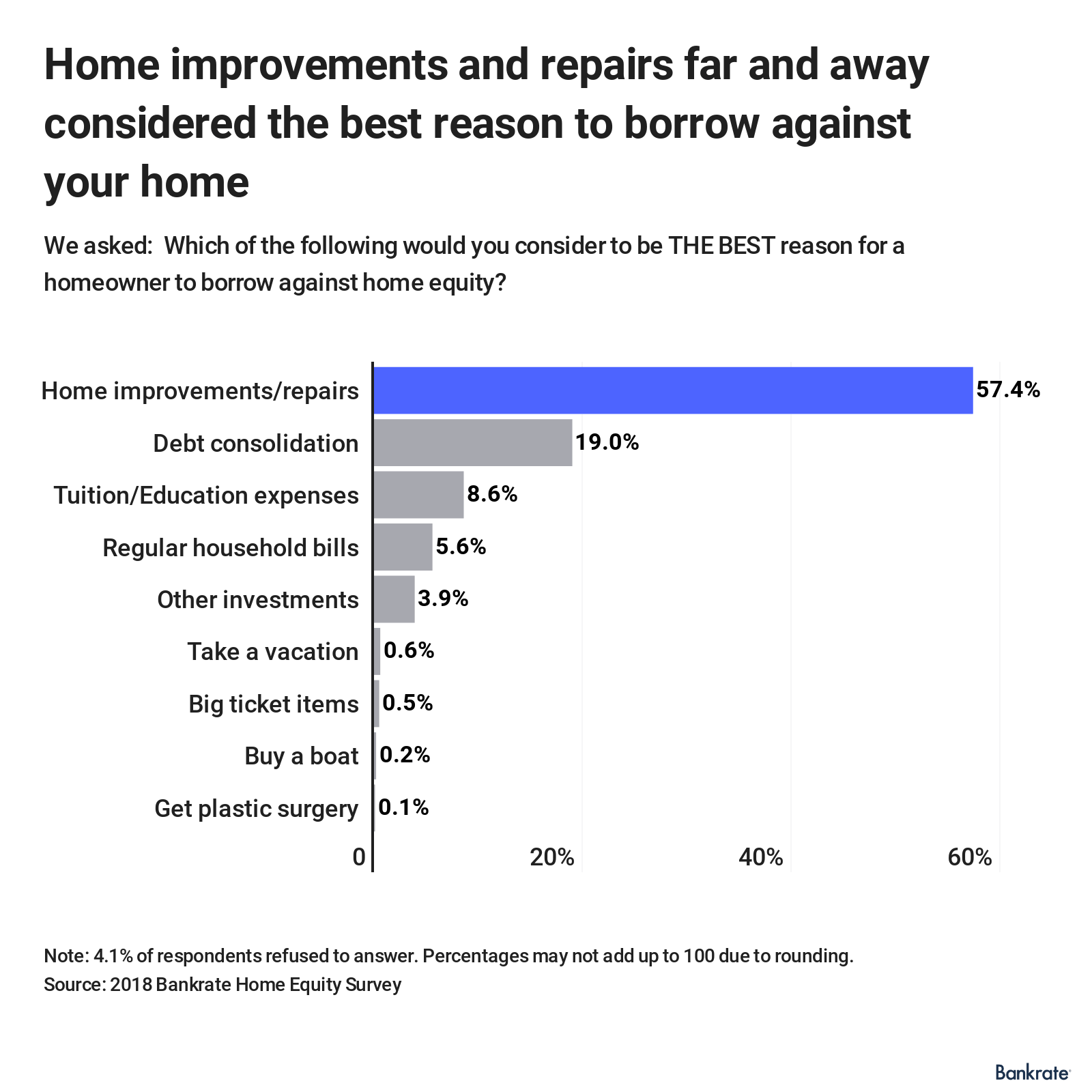

Are heloc loans tax deductible. A heloc is another story and here s where it gets more complicated. If you took on the debt before dec. The deduction applies to interest paid on home equity loans mortgages mortgage refinancing and home equity lines of credit. In the past a heloc was treated separately and the interest expense on up to 100 000 single or married filing jointly was tax deductible no matter how the money was spent.

Under the new law home equity loans and lines of credit are no longer tax deductible. If you use a home equity loan or heloc to renovate or improve your home the interest you pay on it is tax deductible. Changes to the home equity loans deduction is more likely to hit the average american family. Is 207 000 according to zillow.

Despite new provisions in the tax cut and jobs act the irs in a 2018 advisory memo stated that home equity loan interest may still be deductible along with interest on helocs and second mortgages. The tax cuts and jobs act of 2017 included significant changes in federal tax law for the home equity interest deduction that remain until 2026. The new law appeared to eliminate the deduction for interest on a home equity loan home equity line of credit heloc or second mortgage sometimes called a re fi but some tax professionals. 22 suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit unless they are used to buy build or substantially improve the taxpayer s home that secures the loan.

The deduction amount includes the interest you pay on your mortgage home equity loan home equity line of credit heloc or mortgage refinance. As of writing this post the median price of a home in the u s. If you took on the debt before december 15 th 2017 the deduction can be taken on up to a million dollars worth of qualified loans for married couples filing jointly and half that amount for single filers. Deborah kearns barbara marquand.

Often the mortgage interest is tax deductible. Home equity loan interest is tax deductible if your mortgage debt is within government limits and the borrowed money was used to buy build or improve your home.

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)