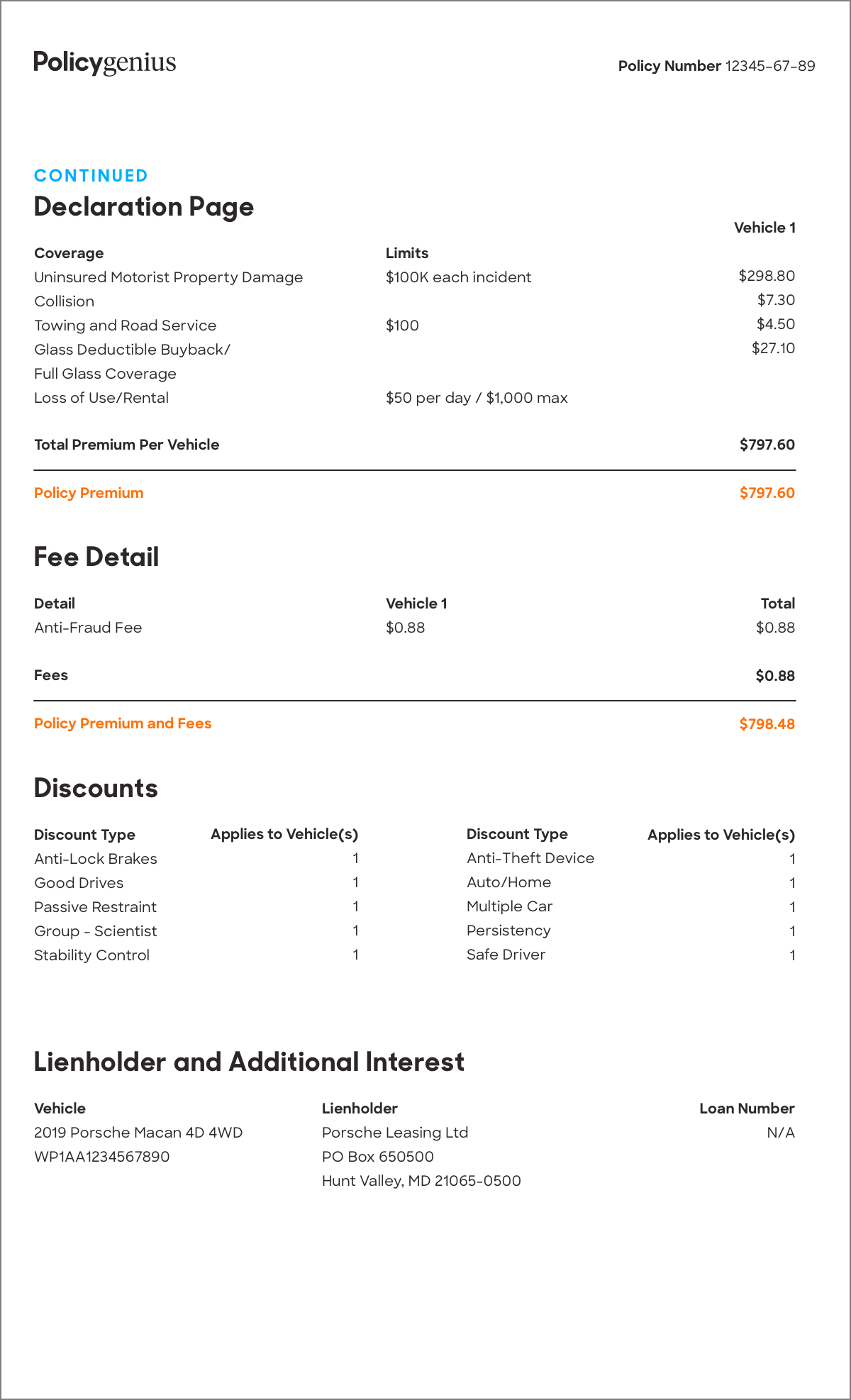

Car Insurance Check Made Out To Me And Lienholder

I was told by the lien holder today that the check was supposed to go to him then he would apply it to my loan balance if i got the vehicle repaired he would issue me a check to the body shop.

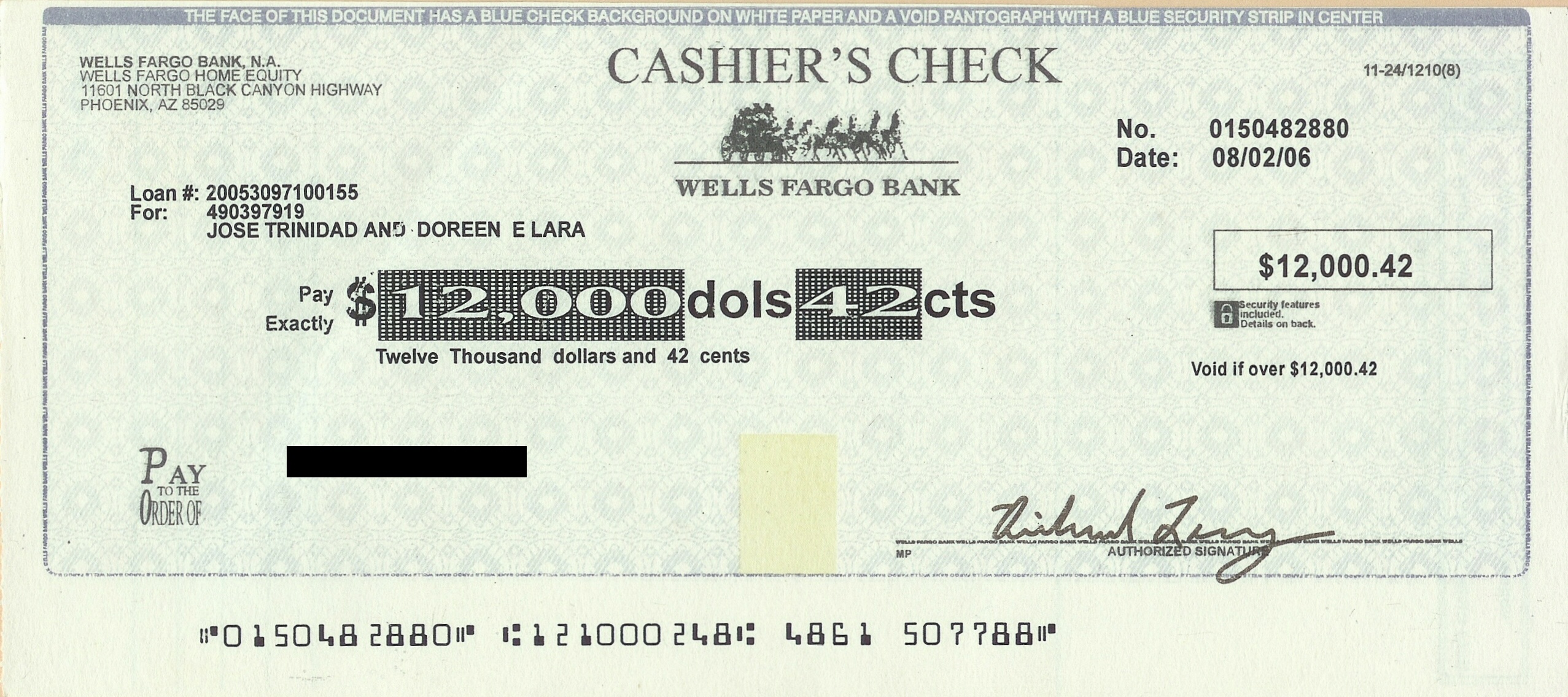

Car insurance check made out to me and lienholder. That means you have to go to the bank or even worse mail your check to the financial institution for its signature. Car leases and loans can throw an extra wrinkle into the first party claims paying process because your insurer will likely issue a check made out to you and your leaseholder or lienholder. I contacted the bank to try cashing the check so that a friend of the family that repairs cars as his profession can fix at a lower rate. If there is a loan on your car the insurance provider may make the claim check out to you and your lienholder.

When i called asked an insurance agent he said he never heard of this before. If you have a loan or lease your insurance claim check will probably be made out to both you and the lender or leasing company. As a result the settlement check will typically be made out directly to you. My auto insurance company issued a check made out to me and my lien holder.

They sent me the check weeks ago. Your insurer knows there is a loan on your vehicle and maintains information on that loan. I plan to pocket the remaining funds yet my lien holder is refusing to endorse the check so i can deposit it in my account. Even if you own your car outright some insurance companies pay the.

If your car is paid for then typically the insurance claim check will be made out to you. This type of check is referred to as a two party insurance check. Let s say you file a claim with your auto insurance company for damages to your car. Therefore when a policyholder makes a claim for damages the insurance company normally will make the claim check out to both the insured and the lien holder.

The car insurance check will almost certainly be made out to you and the lienholder if you have an unpaid loan against the car. He told me this was nebraska state law. Some rules apply to cashing one and disregarding the rules can result in financial and even legal penalties. But keep in mind that insurance check cashing laws different from state to state and that other factors such as lienholders auto body shops and company policies will have bearing on the pay out process.

If you total your vehicle for instance you will find that the insurance company did not just cut a check to you for the damage. But regardless of whether the loan company s name appears on the check you re required by the terms of your lease or loan to keep your car in good condition so it s best to repair your car according to the terms of your lease.

/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png)

:max_bytes(150000):strip_icc()/Balance_How_Is_Side_Mirror_Damage_Handled-a4662a48119246cd894b0c256aa6bde4.png)