Business Debt Restructuring

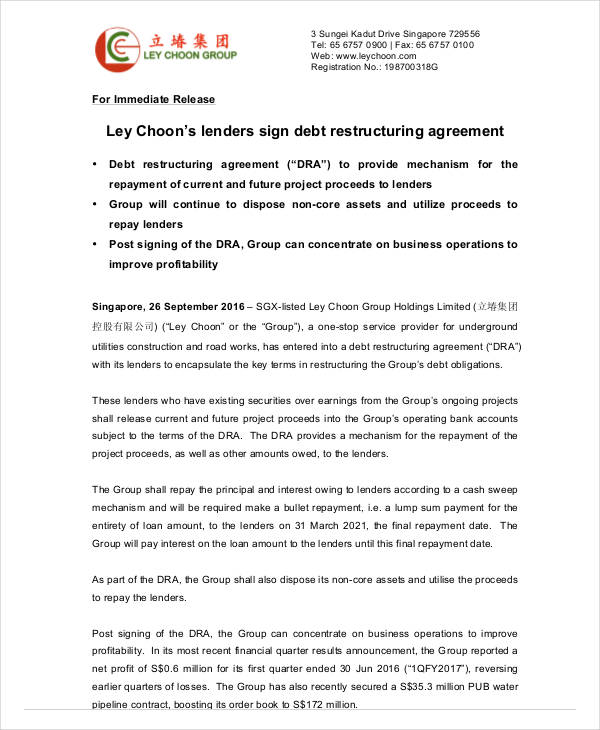

Over 5 600 companies rated by rating agency crisil across sectors will be eligible for a one time corporate debt restructuring based on parameters proposed by k v kamath panel.

Business debt restructuring. Thai airways international plc the nation s flagship carrier got court approval for its debt restructuring on monday. Although business debt relief is often looked at as a program term it s really what comes about from programs such as business debt restructuring and other such programs. By using debt restructuring companies are allowed to default on existing debt and take advantage of lower interest rates. Restructuring debt in the small business many small businesses find themselves in a precarious position.

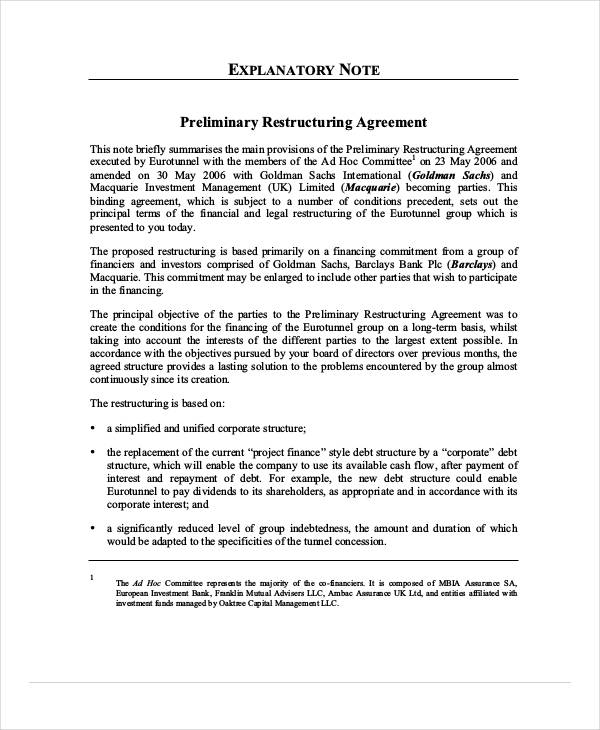

Restructuring is a type of corporate action taken when significantly modifying the debt operations or structure of a company as a means of potentially eliminating financial harm and improving the. Debt restructuring is a strategy that allows a business facing cash flow problems and financial distress to reduce and renegotiate its debts in order to improve and restore liquidity and rehabilitate so that it can continue its operations wikipedia s definition it is the process by which the outstanding debt of a distressed company is reorganized in order to. While the parameters for the scheme support debt restructuring across rating categories the study of over 8 500 entities indicated that companies in resilient sectors like pharma chemical consumer durable fmcg. Our work includes assisting governments to reform their business insolvency legislation strengthening the regulatory framework for insolvency office holders training insolvency professionals and developing strategies for the resolution of npls.

Business debt restructuring is a process allowing companies to reduce or negotiate its overdue debts. What is debt restructuring. Insolvency and debt restructuring work. A business debt restructuring program is designed to bring about relief from business debt like its alternative counterparts.

Debt restructuring can be a win win for both entities because the business avoids bankruptcy and the lenders typically receive more than what they would through a bankruptcy proceeding.