Business Invoice Factoring

We have helped over 7 000 small and mid sized businesses manage their working capital.

Business invoice factoring. Invoice factoring costs differ depending on some factors including the value of invoices in question the size of the company small business factoring or factoring invoices for larger companies and the apparent level of risk for the lending partner. We have helped over 7 000 small and mid sized businesses manage their working capital. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. The costs of using a small business invoice factoring company.

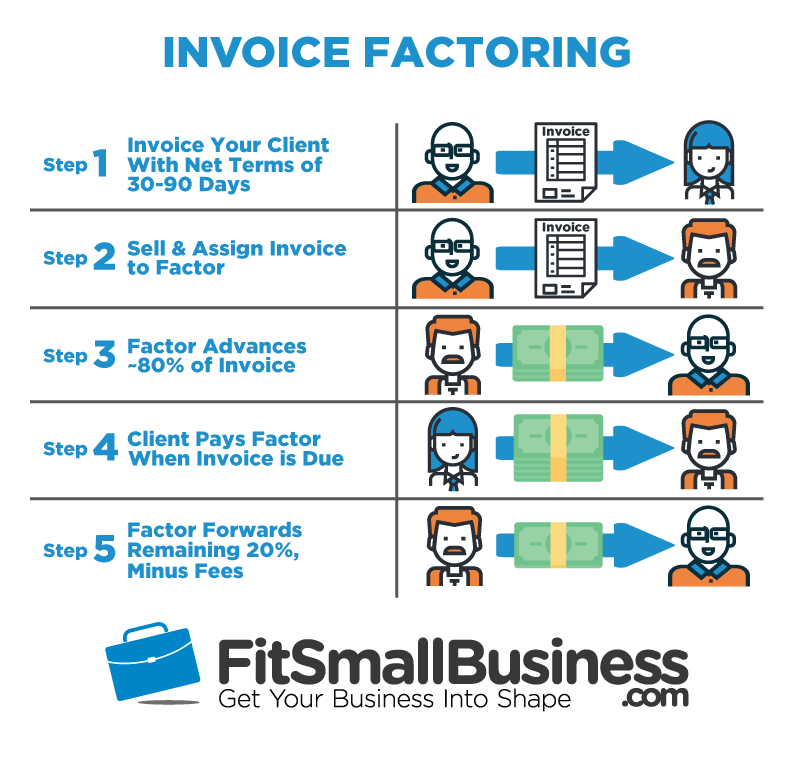

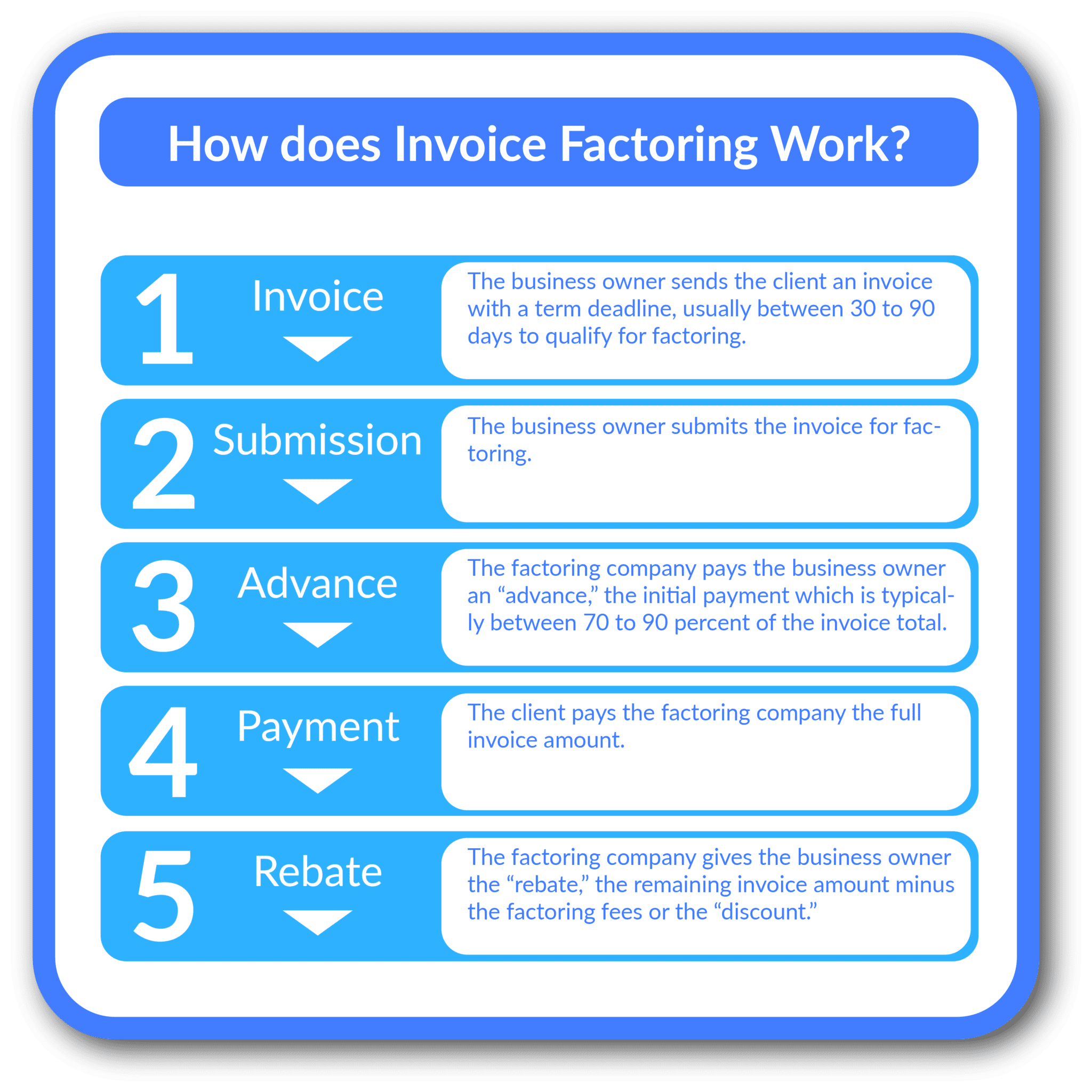

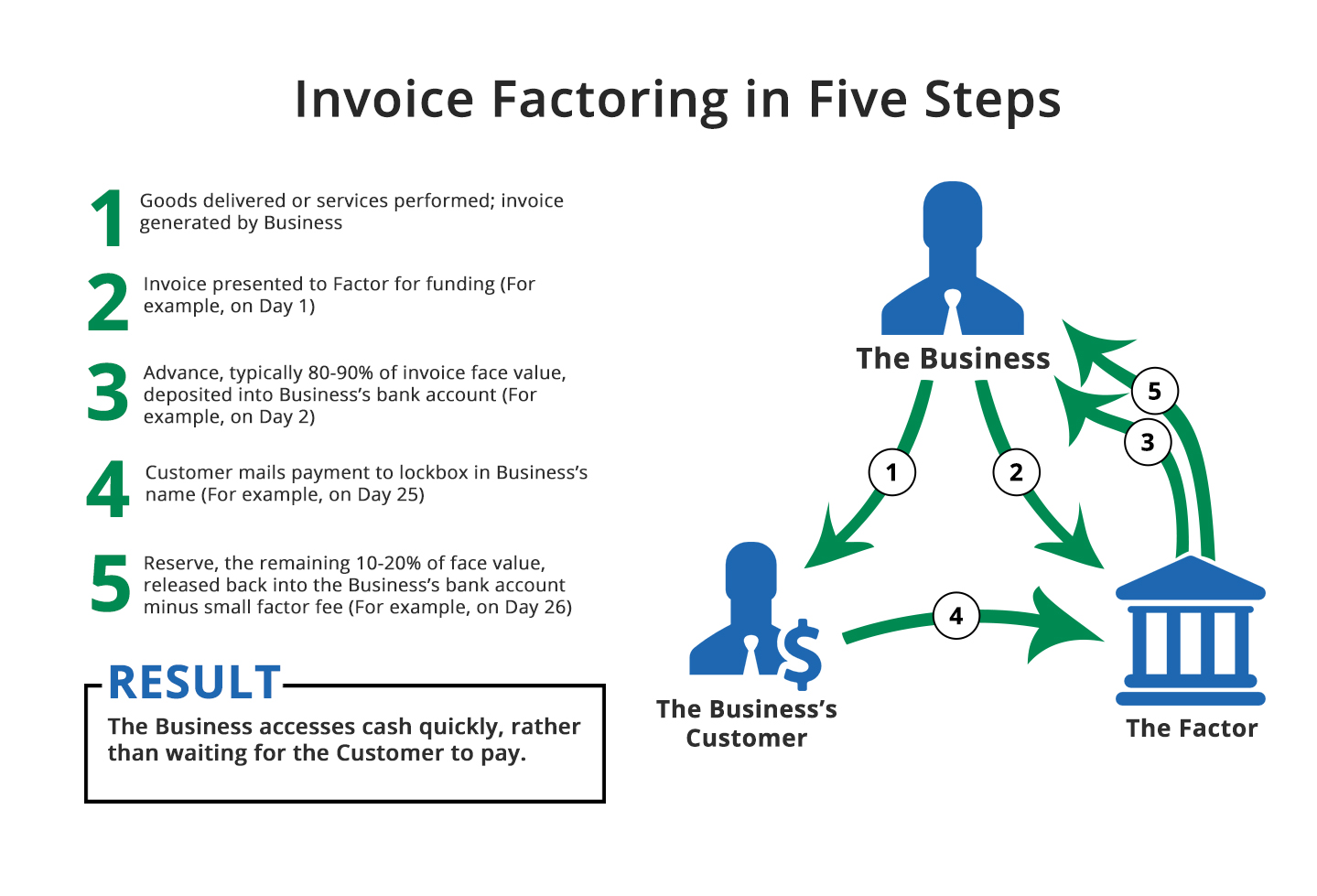

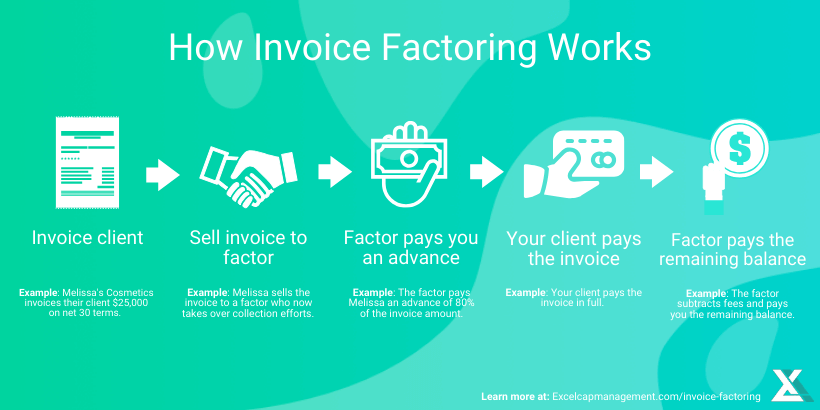

Invoice factoring is a financial transaction in which a business sells its accounts receivables invoices at a discount to an external financing company known as a factor or factoring company. Factoring companies typically advance 70 90 percent of the invoice value up front. Invoice factoring is our business. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount.

This has led many small businesses to consider invoice factoring but this is expensive and comes with other risks to your business. At capital for business invoice factoring is a quick and flexible source of funds for businesses that are waiting for outstanding receivables to pay. We re an invoice factoring company that provides invoice financing services in truck factoring as well as freight factoring or small business factoring. Advance business capital llc d b a triumph business capital.

For a fully comprehensive overview of how much using an invoice factoring company costs see our in depth guide to invoice factoring costs. Here s how it works and how a line of credit may be an alternative. Advance business capital llc d b a triumph business capital. So you turn to an invoice factoring company and it agrees to buy your invoice for 9 700 in cash 10 000 minus a 3 factoring fee 300.

We simply utilize your accounts receivable as the collateral and advance funds against the face value of your invoices. Essentially though there are two main fees to be aware of. We re an invoice factoring company that provides invoice financing services in truck factoring as well as freight factoring or small business factoring. The discount fee and the service fee.

Invoice factoring allows businesses to release cash tied up in outstanding invoices and is efficient because we manage your sales ledger credit control and collect payments from your customers. The invoice factoring company advances 85 of the.