Buy Ltc Insurance

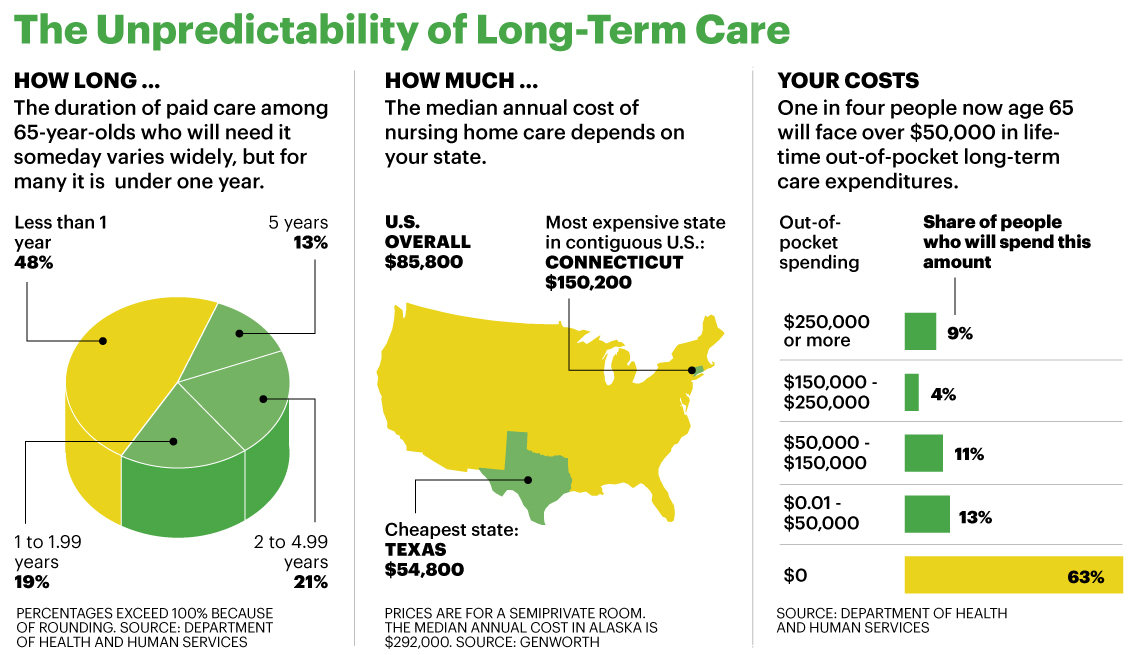

Long term care ltc insurance is a policy that can help cover the expenses associated with long term care such as stays in nursing home facilities or home health care provided by a professional.

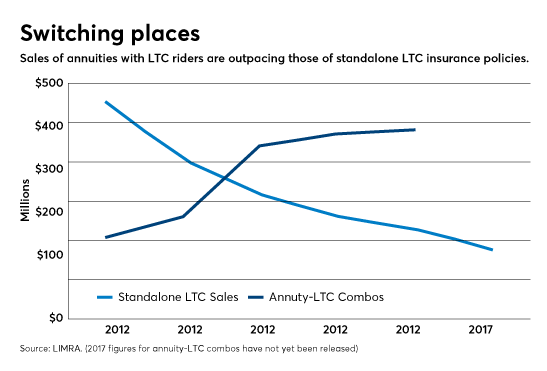

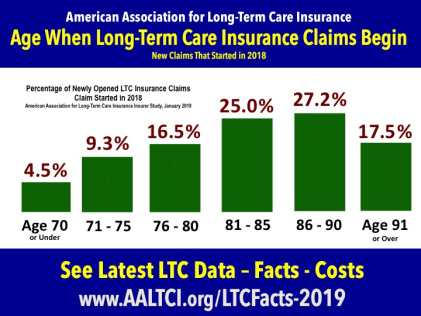

Buy ltc insurance. Since each insurance company works with its own underwriting standards it is helpful to have a checklist of items to ask about so you understand what you are shopping for and buying in the coverage. On the other hand insurance companies keep dropping out of this market because they can t seem to make a buck selling long term care insurance. Historically folks have advised buying long term care insurance in your 50 s as your health and relative youth make it easier to secure coverage. But it s not the only way to pay for in home care adult.

Like mcneill most financial advisers recommend buying long term care insurance in your fifties or early sixties. Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of coverage. The younger you are when you buy a policy the lower the annual premiums but the. Buying long term care insurance is one way to plan financially for a time when you might need to pay for help to take care of yourself.

For years long term care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day to day activities such as bathing dressing and eating meals.

/elder-care-center-3cdb6db725784ab0a33a46dc1d91133a.jpg)