Cash For Annuity Payment

How to cash in an annuity retirement payment.

Cash for annuity payment. Income after age 59 1 2 can be taken as lump sum distributions. Cashing out an annuity can provide cash for medical bills. A person who inherits an annuity from a relative might prefer that money in a lump sum rather than in monthly payments depending on their age and lifestyle. The value is negative because it represents a cash outflow.

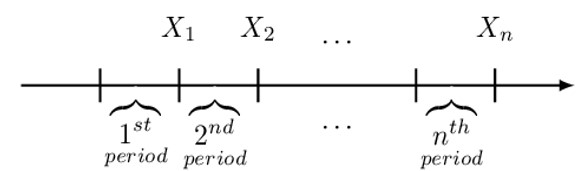

To calculate the payment for an annuity due use 1 for the type. With this option you are choosing to sell your annuity or structured settlement in its entirety ending any chance of periodic income payments in the future. Perhaps you would like to start your own business. As the years pass your financial goals may change.

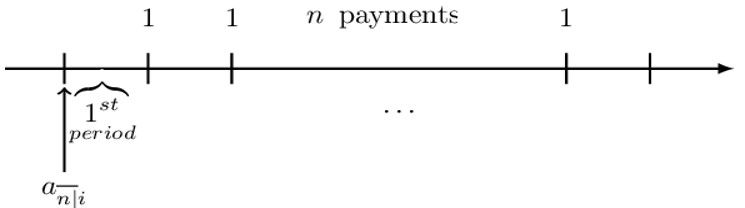

Working closely with one of our annuity payment brokers you ll receive individualized support that s offered with your best interests in mind. A partial annuity sale allows you to sell a period of your annuity payments for a lump sum of cash. Type 0 payment at end of period regular annuity. Money can be invested in a qualified retirement plan or a non qualified investment to supplement retirement funds.

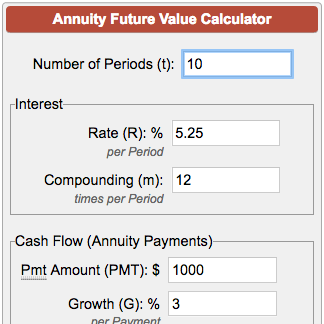

When selling your future structured settlement or selling annuity payments for cash whether guaranteed or life contingent settlement payments you should be confident you are going forward with a trustworthy company that will get your sale of your settlement payment transaction approved. With an annuity due payments are made at the beginning of the period instead of the end. By providing guaranteed annuity payments and annuity cash payments we re able to help our customers handle financial emergencies without worrying about long term consequences. With this information the pmt function returns 7 950 46.

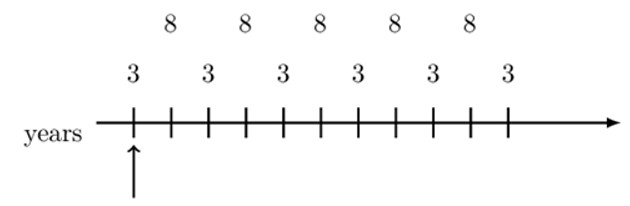

As you gather your financial resources you might find that receiving cash for your annuity payments could help you meet your objectives. For that time period your payments will stop. Annuities are great investments that allow retirement funds to grow on a tax deferred basis. Cash for annuity payments.

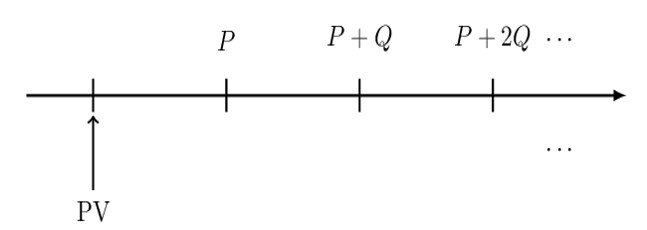

Maybe you would like to make a down payment on a new house. Just as it sounds this option is for those looking for the maximum sum of money. If you have received a settlement that includes an annuity payment we can help you to discover whether or not you qualify to sell your future annuity payments to get some or all of your cash at once. For example you can sell the first three years of your annuity payments in exchange for money you want for a down payment on a new home.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)