Can You Contribute To A 401k And Ira

The simple answer is yes you can although there are some caveats when it comes to deducting your ira contributions if you participate in both types of plans.

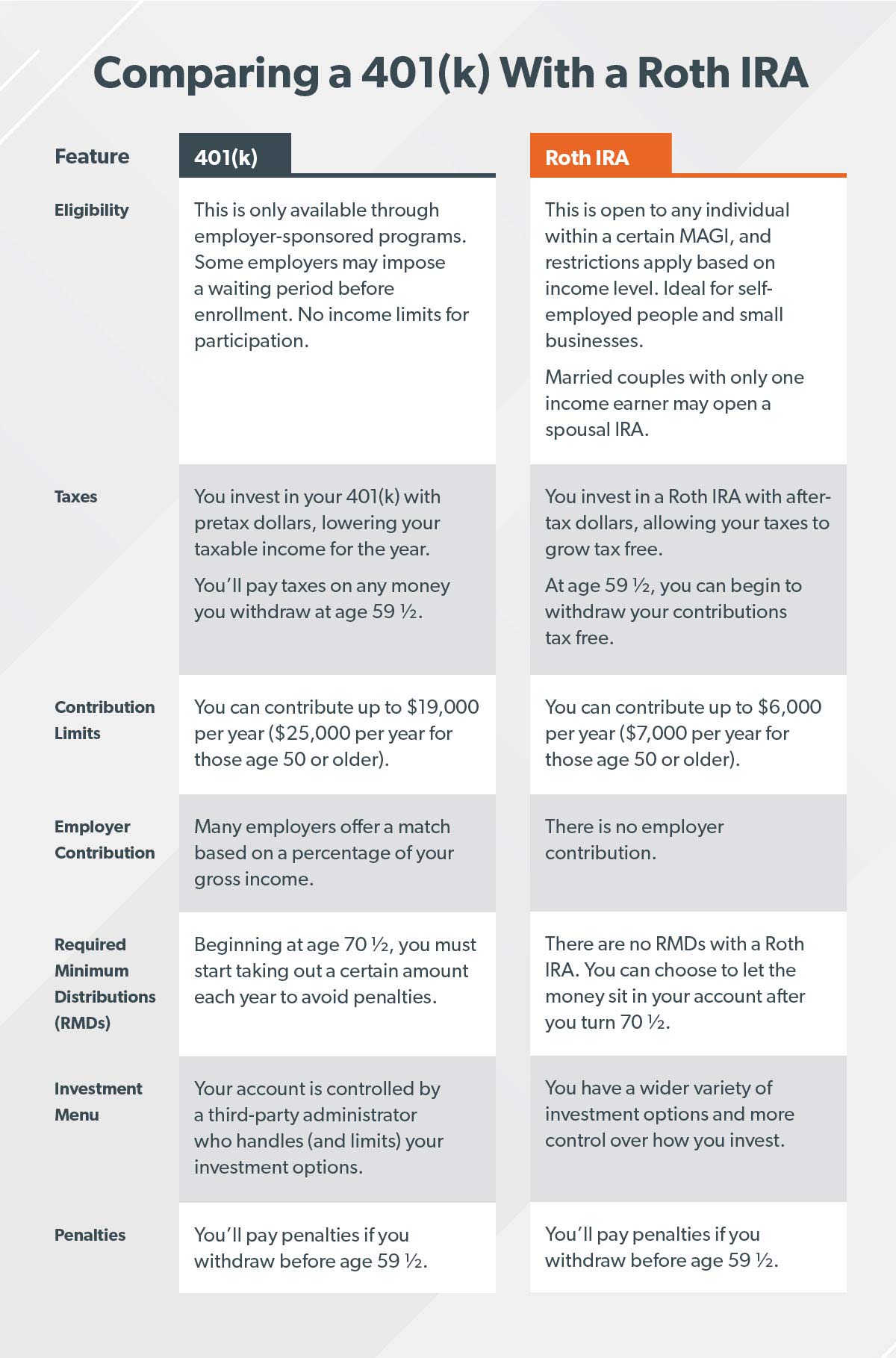

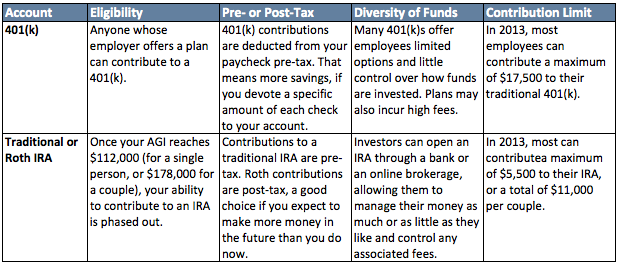

Can you contribute to a 401k and ira. This question comes up frequently when it comes to retirement planning. If you are an employee and you have both a 401 k and sep ira through your employer your deferral contribution to the 401 k cannot exceed 18 000 24 000 if over 50 and the total. You can always contribute to both an ira and 401 k. The good news is that you can always max out a retirement plan at work like a 401k 403b or 457 plan and still max out an ira for the same tax year.

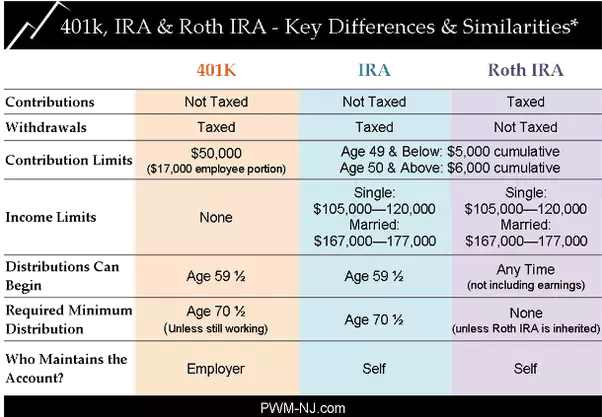

But fortunately for your retirement nest egg you can contribute to both types of retirement accounts. For 2017 workplace plans allow you to contribute up to 18 000 or up to 24 000 if you re 50 or older. Depending on your tax situation you may also be able to receive a tax. The traditional individual retirement account ira and 401 k provide the benefit of tax deferred savings for retirement.

Can i contribute to a 401k and an ira. People who earn average incomes will generally find that they can have and contribute to both a 401 k and a roth ira. See the discussion of ira contribution limits. For example if you did not participate in a 401 k plan and you contributed 6 000 to a traditional ira you would be able to deduct the full 6 000 amount.

As long as you meet the separate eligibility criteria for both a 401 k and a roth ira you can contribute to both accounts. However if your income exceeds the phase out limit 74 000 for individuals and 123 000 for joint filers then you will likely want to couple a traditional 401 k with a roth ira in order to maximize the tax benefits of each respective account. Yes you can contribute to a traditional and or roth ira even if you participate in an employer sponsored retirement plan including a sep or simple ira plan. While a 401 k and an ira will both.

There are certain limitations you should consider though.

/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/GettyImages-580502931-fe55d88033904806bc9533ac85619abc.jpg)