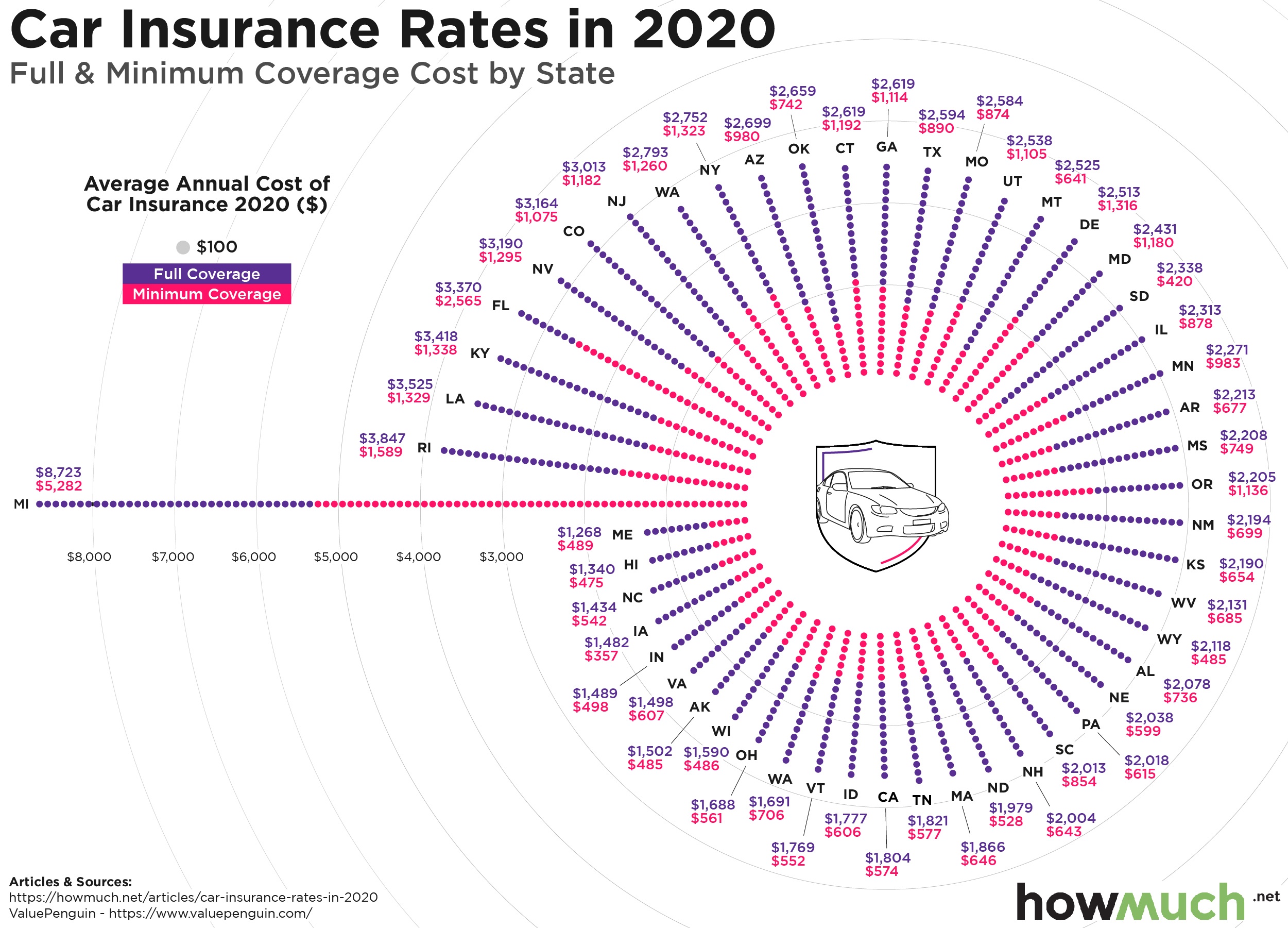

Compare Auto Insurance Rates By State

Average car insurance rates by state may vary based on legal regulations and insurance companies efforts to price accurately based on these differences.

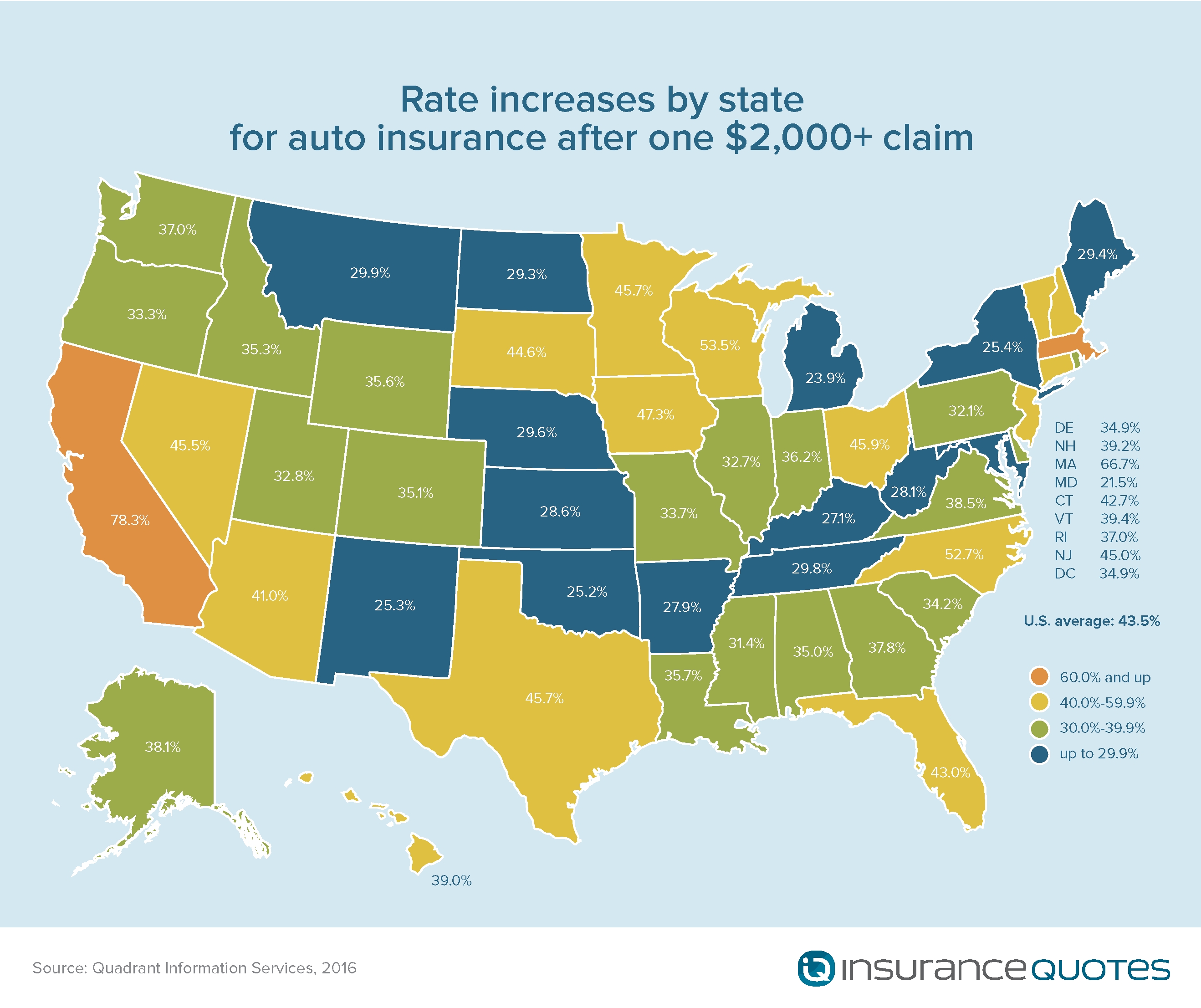

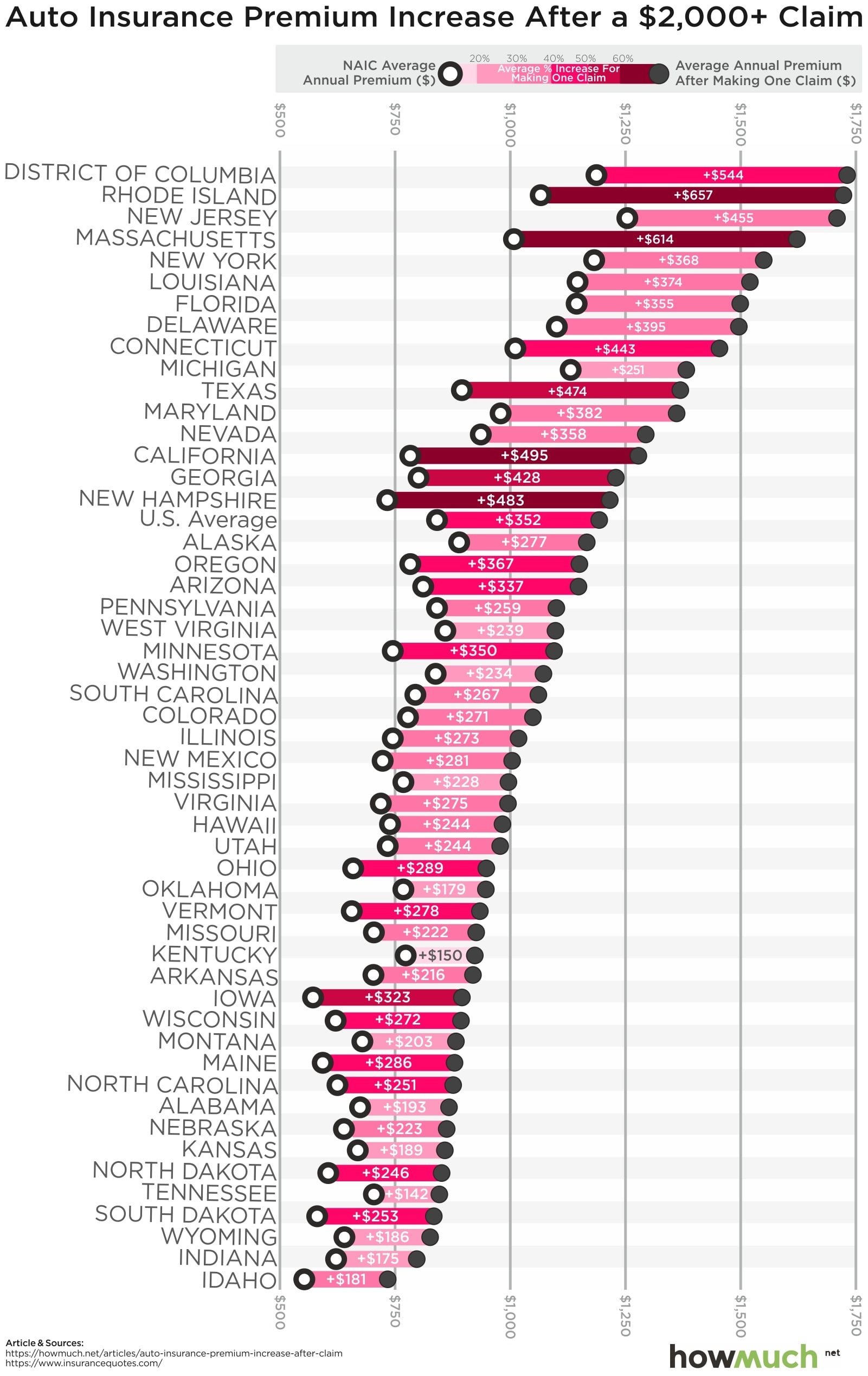

Compare auto insurance rates by state. Compare car insurance rates for a clean record and at fault crash in your state state legislators set limits on how much a company can increase your rates after a crash. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. State car insurance rates change dramatically by state and between cities. How where you live impacts auto insurance rates one of the primary factors used in car insurance pricing is location.

Each car insurance company has its own means of evaluating threat as well as setup rates. State required insurance minimums can also raise or lower insurance costs. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. Call us toll free.

Our hypothetical accident. Compare multiple auto insurance quotes. The best way to lower your car insurance rates might actually be to move to another state. You can be eligible to conserve on your auto insurance costs if you were continuously insured with your previous insurer.

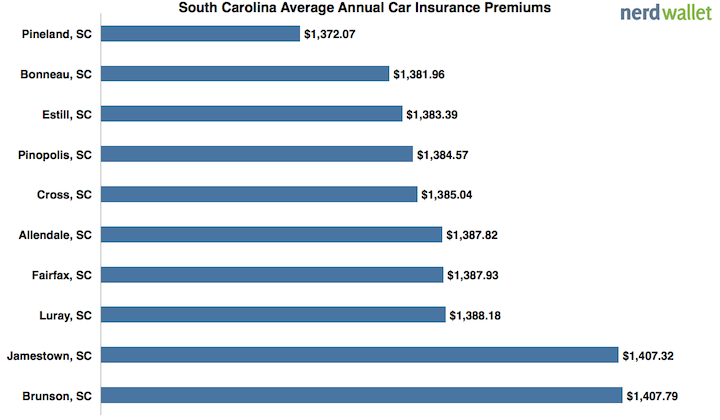

In fact in california a dui offense can stay on your insurance record for as long as ten years based on our analysis of the most popular insurance companies this could set you back an average of 1 200 per year in insurance rate increases during that ten year period to limit costs do your due diligence and compare rates. In many states a dui is the most costly violation you can receive. For instance drivers in no fault states such as michigan and florida often pay more for insurance than do drivers in. La has the most expensive car insurance rates at 117 08 mo or 1 405 yr.

Moving from new jersey to idaho for example could save the average driver nearly 700 per year on insurance. State car insurance rates id has the cheapest car insurance rates at 56 66 mo or 680 yr. Licensing information may be found above. See car insurance rates by zip code plus state laws.