Buying Life Insurance On Someone Else

While buying life insurance for someone else is possible and legal there are restrictions that must be followed.

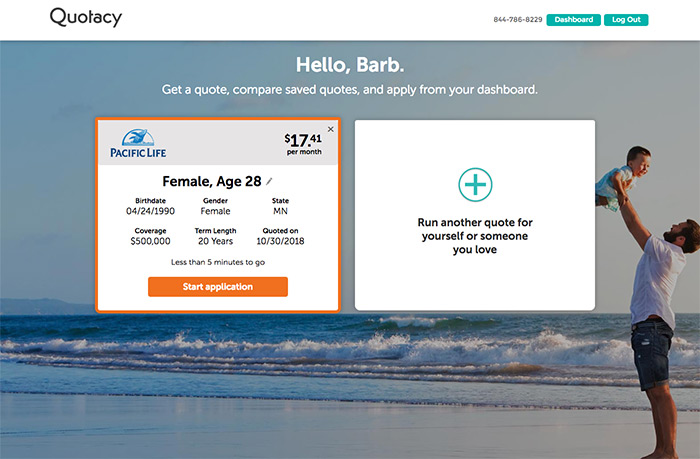

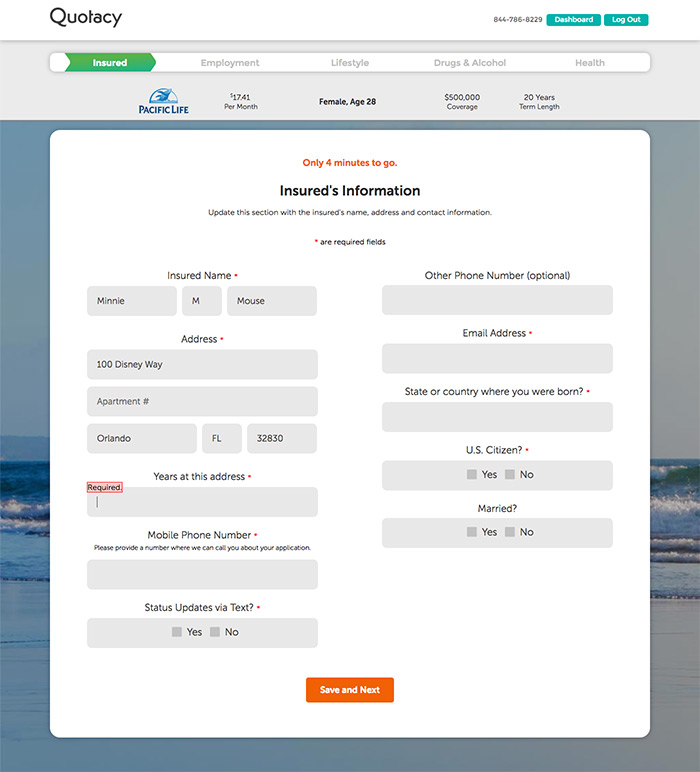

Buying life insurance on someone else. But what happens when the circumstances are reversed. Purchasing life insurance for someone else. Life insurance can provide your loved ones with financial protection should the worst happen to you. While you the policyholder are responsible for keeping up with premiums the insured person is involved in the application process providing answers about their medical background and potentially undergoing an exam.

The purchase of other people s life insurance policies is a viatical transaction. It would be nearly impossible to buy life insurance on someone without them knowing because most insurance companies will require a medical exam from the insured person. But taking out a policy on another person makes good sense in some. You cannot purchase life insurance for a total stranger or for someone else without their knowledge.

It s important to have options in order to pay the lowest premiums. There aren t any companies that specialize in this type of insurance but that is a good thing. How to buy other people s life insurance policies. The investor purchases the policy for much less than the face value.

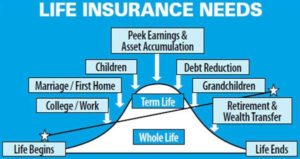

Not only do you need to prove insurable interest to buy life insurance on someone you also need their consent. This practice became popular in the 1980s as aids victims began to show up more frequently. Can you buy life insurance for someone else. In most cases it s only possible to buy life insurance for your spouse or civil partner but there may be a way to do so for someone else if you can prove an insurable interest exists.

Buying life insurance on someone else and naming yourself as beneficiary might sound like a plot point in a film noir mystery. Even policies that do not require an exam would need the signature of the insured. Buying life insurance for someone else looks a lot like buying life insurance for yourself but there are a few rules. Because buying life insurance on someone else can be more complicated than buying a policy for yourself consider working with a licensed agent who can help ensure things go smoothly.

The best companies for buying life insurance for someone else. Life insurance riders like a child term rider or parent protection rider can provide coverage in the event of the passing away of these people in your life though coverage is typically limited to the 20 000 30 000 range. Generally when people buy life insurance they are applying to be both the policyholder and the insured individual on the life insurance policy and plan to name one of their dependents as the beneficiary but there are some occasions when it may make sense to purchase a policy that insures someone else and names you as the beneficiary.