Can I Contribute To Sep Ira And 401k

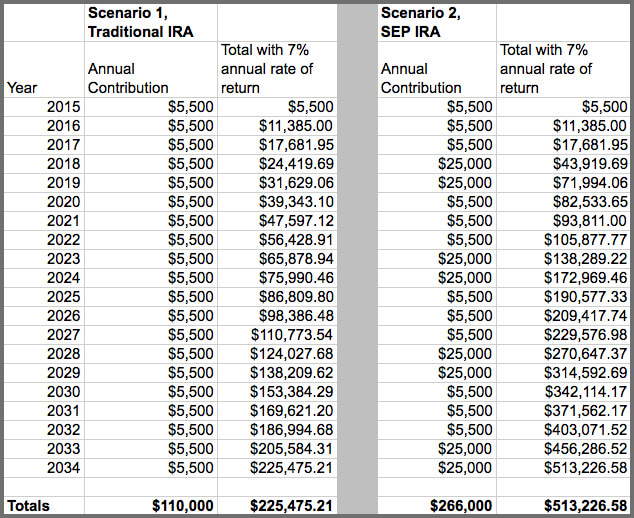

Even if you participate in a 401 k plan at work you can still contribute to a roth ira and or traditional ira as long as you meet the ira s eligibility requirements.

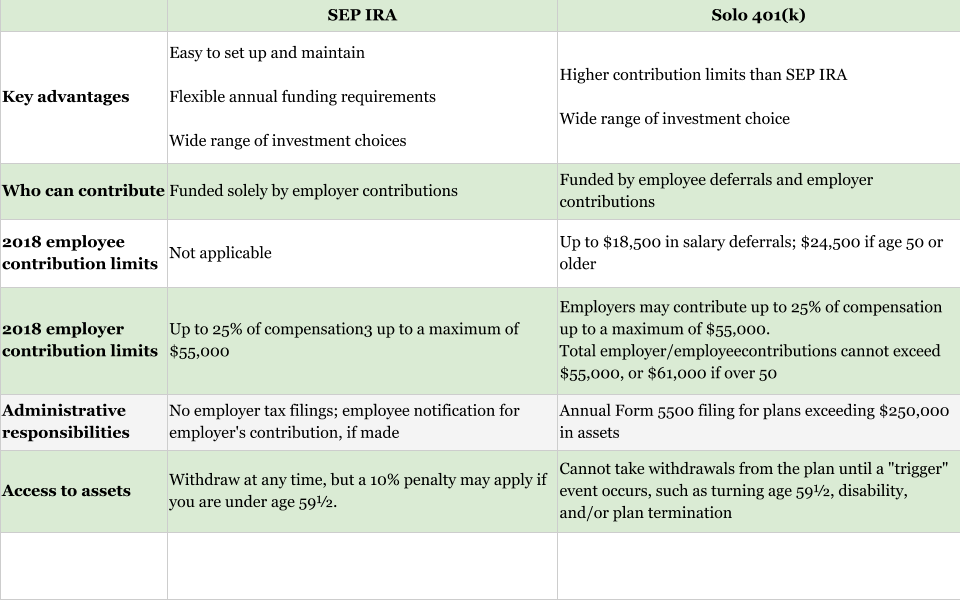

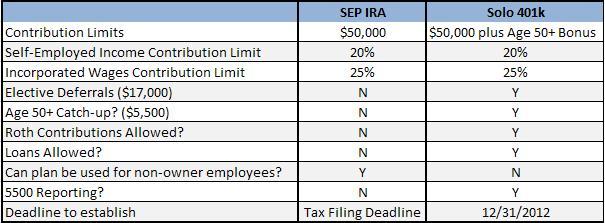

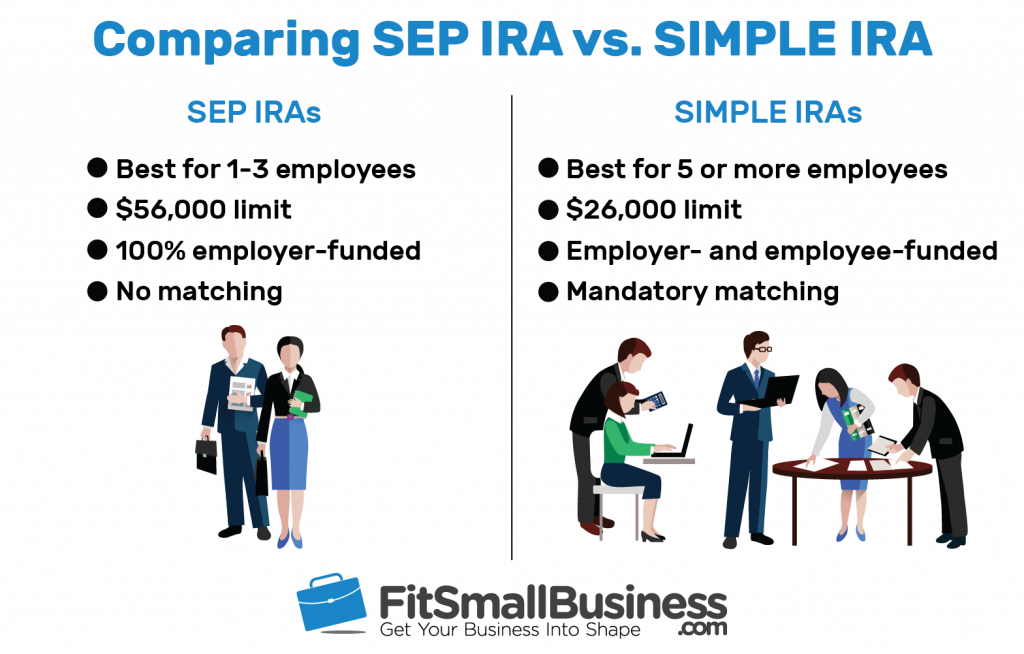

Can i contribute to sep ira and 401k. A 401 k plan lets employees put money aside through payroll deduction while a sep ira helps self employed individuals save for their retirements. In addition in the context of roth accounts the irs has stated that you can contribute. Employer contributions made under a sep plan do not affect the amount you can contribute to an ira on your own behalf. If you re deciding between a solo 401 k and a sep ira and you have employees the choice is easy.

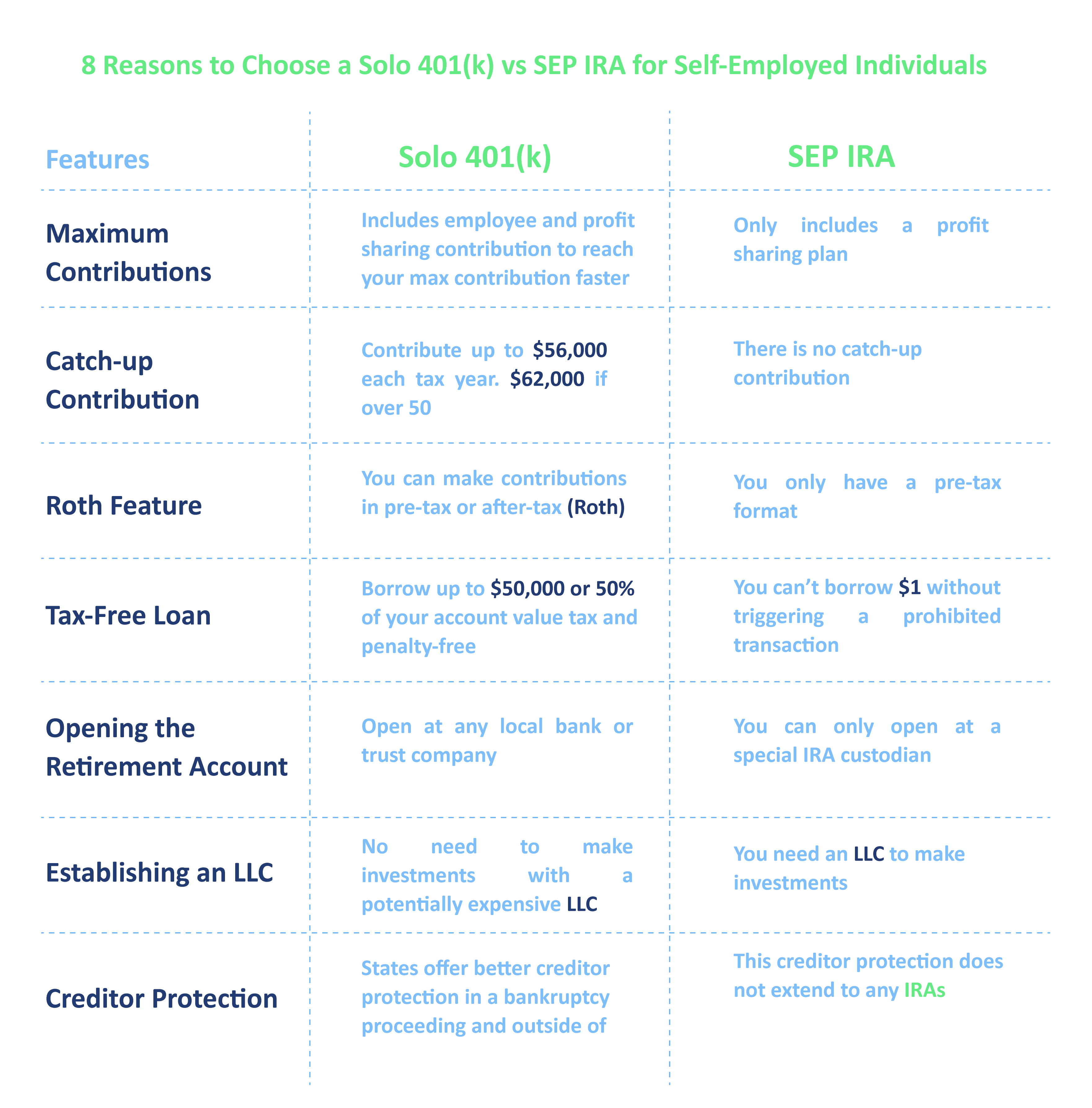

For a self employed individual contributions are limited to 25 of your net earnings from self. Sep plans that are not sarseps only allow employer contributions. A solo 401 k plan includes both an employee and profit sharing contribution option whereas a sep ira is purely a profit sharing plan. A 53 000 employer contribution to your sep ira assuming you make over 212 000 from your sep ira business.

Your contributions to your sep plan that is not a sarsep are not reduced by the contributions you or your employer make to your employer s simple ira plan. Your 401 k plan employer may also contribute another 35 000 to your 401 k plan to bring the total up to 106 000 of employer sponsored retirement plan savings but it s your employer s decision not yours. You can t open a solo 401 k plan if you have an employee other than your spouse. You might not be able to.

Yes you can contribute to both a roth ira and an employer sponsored retirement plan such as a 401 k sep or simple ira subject to income limits. If you are self employed you can open a solo 401 k and sep ira but your total contributions are limited to 53 000 59 000 including 401 k catch up contributions unless the 25 of. A sep ira is a traditional ira that holds contributions made by an employer under a sep plan. Of course you can contribute to a 401k and sep as i covered in this article.

Under the 2016 solo 401 k contribution rules a plan participant under the age of 50 can make a maximum employee deferral contribution in the amount of 18 000. You can both receive employer contributions to a sep ira and make regular annual contributions to a traditional or roth ira.

/iStock-512752254.kroach.IRA-7de1faaad37c4812a2221cd938a88810.jpg)