Can I Get A Home Improvement Loan With My Mortgage

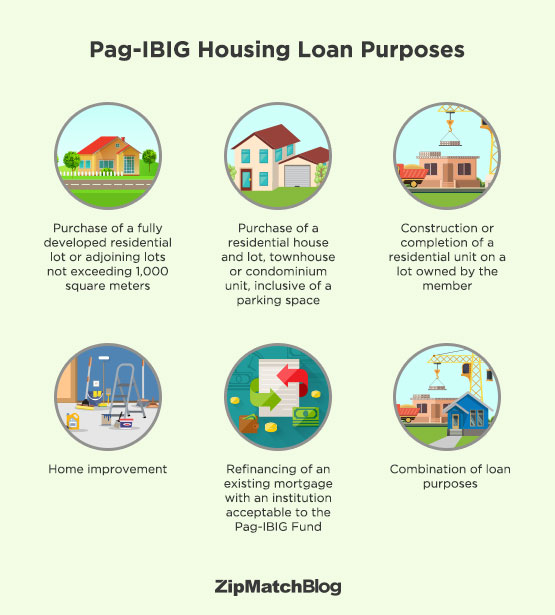

Taking out a home equity loan on your paid off house is an option to explore if your goal is to extract some cash for debt consolidation home improvements or repairs.

Can i get a home improvement loan with my mortgage. A home equity loan might be a good option if you re looking for a fixed monthly payment single lump sum distribution and fixed interest rate. Manage your mortgage and home improvement line of credit under one plan. Whether you re planning a new kitchen some new furniture or thinking about a loft conversion a home improvement loan could help you get the most out of your property sooner rather than later. Access additional funds by simply adding them on to your existing rbc royal bank mortgage based on the current appraised value of your home.

If you re wondering how to get a renovation loan your mortgage lender is an obvious choice but may not be the best one for a loan for home improvement. It allows you to borrow money to buy the house and for home improvement using only one loan. Your mortgage is secured on your home which you could lose if you do not keep up your mortgage repayments. You could qualify for this flexible financing option with a minimum of 20 equity in your home.

If you are coming to the end of your mortgage credit card or loan payment holiday we will contact you before it ends there is no need to call us. The additional loan would be linked to your property which you could lose if you weren t able to keep up your extra loan payments. A home improvement loan may not be the best option for older borrowers because this will cause them to be in debt in retirement. Increasing your mortgage for home improvements might add value to your property but using a further advance to pay off debts is rarely a good idea.

There s always something that needs doing around the house. Keeping the costs down home improvements can be a big outlay so it makes sense to save on costs where you can. A remortgage is the process of transferring your mortgage from one lender to another. You could consider remortgaging your home.

We could help you to find the best loan to suit your needs. A 203 k is a federal housing administration backed loan. With equity release you will never owe more than the value of your. Consider the alternatives first.

:max_bytes(150000):strip_icc()/sofi_light-blue-2f7ca8b3b08549faa7c255d118550609.png)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/Remodel-Project-Financed-By-Home-Equity-1500-x-1000-56a49eb45f9b58b7d0d7df93.jpg)