Can I Negotiate My Credit Card Interest Rate

You can t go to the negotiation table without some leverage says dvorkin.

Can i negotiate my credit card interest rate. If you carry any credit card debt you want the apr or annual percentage rate to be as low as possible. Credit card companies will be more favorable about lowering your interest rate if you have a healthy credit history. Credit card companies know that losing customers is very expensive for them so leveraging that knowledge provides you with some room for negotiation says conor richardson a certified public accountant and author of millennial. When you call to negotiate a lower rate you can use this information.

How to negotiate a lower rate for your credit card. Roughly 41 percent of american households have credit card debt while the average credit card balance is 5 700. Every credit card company sets standards on interest rates which are based on your credit history. While the issuer isn t guaranteed to say yes you re most likely to find success if you have a history of on time payments and your credit score is strong or has recently increased.

Though simply asking can work understand that you will likely have to engage in some negotiation to have your rate lowered. Know your current credit card terms including the grace period statement due date and your current balance. You can get an idea of what a fair interest rate would be by looking at the credit card offers you re receiving in the mail. As of january 2018 the average interest rate on new card offers for bad credit is 23 59 percent but it s 13 07 percent for those with good credit.

If you don t qualify for a lower rate then you can t count on a phone call for a quick fix. Ask that your card s interest rate be comparable to what you can get with the transfer. If you have missed payments or maxed out cards they may not play ball. Evaluate your current situation.

Odds are they won t bring the apr to 0 but you may get a preferred rate. The best way to avoid the black hole and reduce your credit card balance is to negotiate a lower interest rate with the credit card company. 1 eliminating this debt can help you improve your credit free up room in your budget and save you money the hard part is actually paying it off and staying out of debt. With the average credit card interest rate at 17 30 in december of 2019 it s no wonder monthly payments don t seem to make a difference.

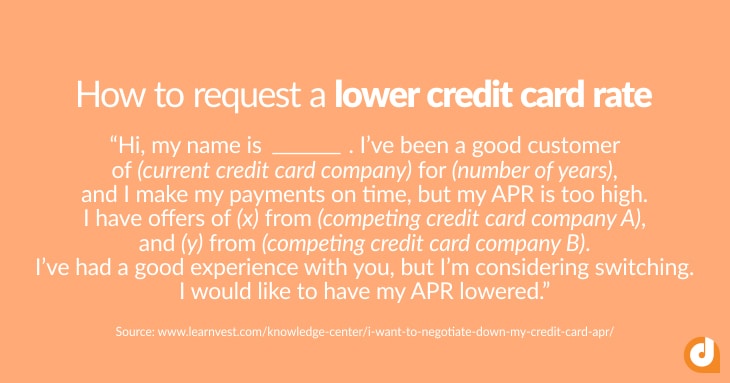

How to negotiate a lower credit card interest rate 1. Fortunately you have the upper hand. You can negotiate a lower interest rate on your credit card by calling your credit card issuer particularly the issuer of the account you ve had the longest and requesting a reduction. Sometimes all you have to do is call to get that lower apr and get that debt paid off faster.

It is a simple straightforward approach to get what you want.

/credit-cards-bad-56a634be5f9b58b7d0e067e6.jpg)