Can I Rollover Part Of My 401k

When rolling over into an ira you can do a partial rollover rolling over only part of your 401 k while leaving the rest in your 401 k account or cashing it out.

Can i rollover part of my 401k. Top 7 reasons to roll over your 401 k to an ira. You can still roll over the distribution within 60 days. After quitting my job is it possible to do a rollover with just part of my 401k. You can roll your money into almost any type of retirement plan or ira.

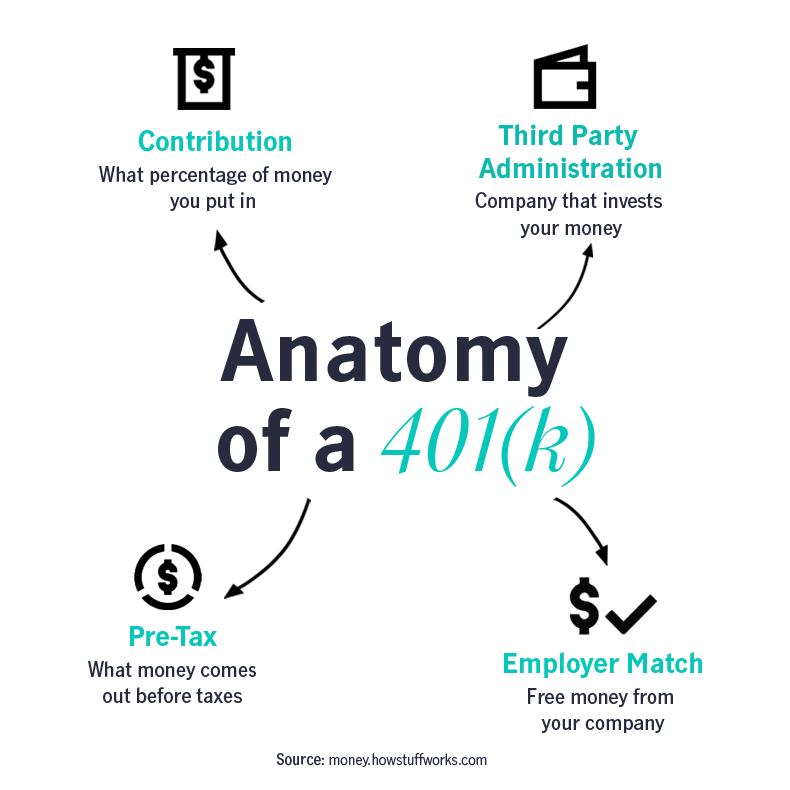

Roll over into an ira. You can roll money from your 401 k into a traditional ira. If you already have a traditional ira you can roll your 401 k money into that account. This is especially important with partial rollovers as you might change your mind and decide to rollover the entire account or a larger portion in the same year.

So if you roll over contributions made on a pre tax basis as from a traditional 401 k the amount involved must be included as taxable income for the year of the rollover. Depending on your plan s policies you might be able to make the rollover while you re still with the. The indirect rollover is more complex and limits your ability to make future tax free rollovers within the same year. Must know rules for converting your 401 k to a roth ira.

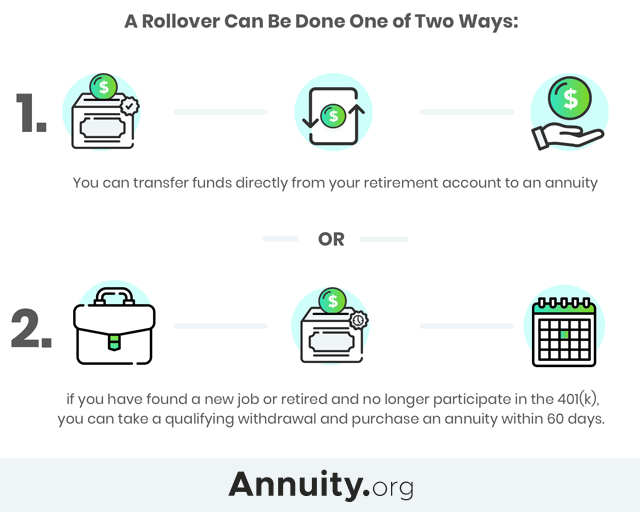

For a direct rollover your old plan sends the money directly into your new ira. Normally you can t cash out your 401 k unless you separate from your job reach age 59 1 2 or qualify for an early distribution. Which retirement accounts can accept rollovers. If you are considering moving your money out of your 401k use a direct rollover.

Your old plan withholds 20 of your funds. I would like to be able to move some money to an ira but keep some of it in the 401k yes from a tax standpoint you are allowed to roll over a portion of your 401 k while keeping the rest of it in place. Investopedia is part of the dotdash publishing family. You can roll over a part of a 401 k distribution into a qualified retirement account but the rollover is subject to certain restrictions.

You can choose to do a direct or indirect rollover. One other tax consideration. However if your plan administrator allows it you can request a partial rollover from your 401k 405b or 457b funds. If you withdrew the entire account but deposited only part of it into a roth ira you would owe a 10 percent penalty and income taxes on the amount you kept.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-01-f213028d0331407980819f8e344c1e30.jpg)