Can I Transfer 401k To Ira

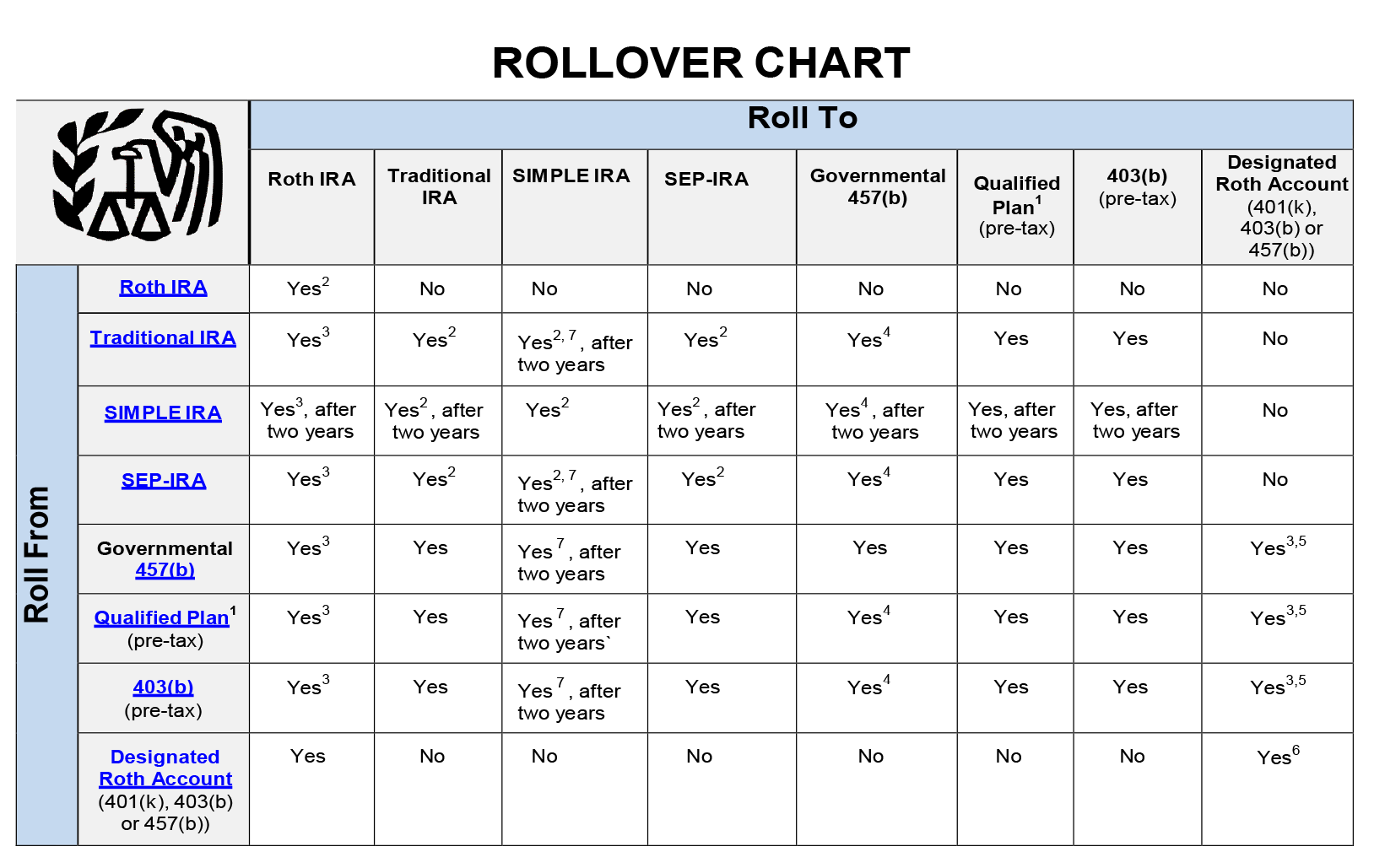

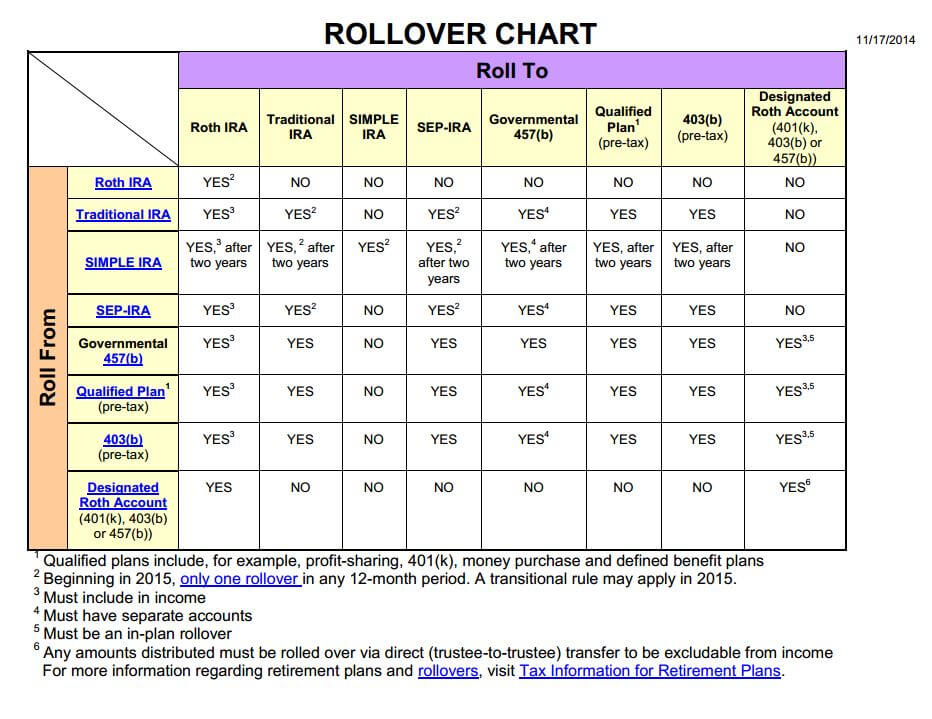

401 k s 403 b s sep accounts simple accounts keoghs individual 401 k s and some 457 plans can all be transferred into one ira account.

Can i transfer 401k to ira. By transferring your 401 k into a traditional ira you do not incur any tax consequences. If your 401 k plan is not eligible for a rollover directly to an rrsp i e. Having everything in one account makes it easy to update and change beneficiaries manage investments and take withdrawals. Another option is to roll 401 k accounts from former employers into your current employer s plan assuming.

As with a 401 k rollover the easiest way to roll a traditional ira into a 401 k is to request a direct transfer which moves the money from your ira into your 401 k without it ever touching. You can t transfer from a roth ira or into a roth 401 k. With many 401 k plans you cannot request a transfer using paperwork from the receiving ira custodian. Transfers can only be completed when you separate from the company or after you have reached age 59 1 2.

According to reuters as of 2014 about 69 percent of 401 k plans accept ira rollovers. If for some reason the plan administrator can t transfer the funds directly into your ira or new 401 k have the check they send you made out in the name of the new account care of its. Make sure you are eligible to transfer money from your 401 k plan into a traditional ira. You can cash it out leave it where it is transfer it into your new employer s 401 k plan if one exists or roll it over into an individual retirement account ira.

Most employer plans don t allow employees to transfer money from a 401 k account to an ira while they re still working but a few do offer what are known as in service rollovers that make that. In that case it can make sense to consolidate all of your old 401 k plans in an ira. Because the benefits were not attributable to services rendered by you your spouse or former spouse while a non resident in canada it can be rolled into an ira that qualifies for a transfer to an rrsp.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)