Car Insurance Med Pay

Most standard basic insurance policies include only liability coverage.

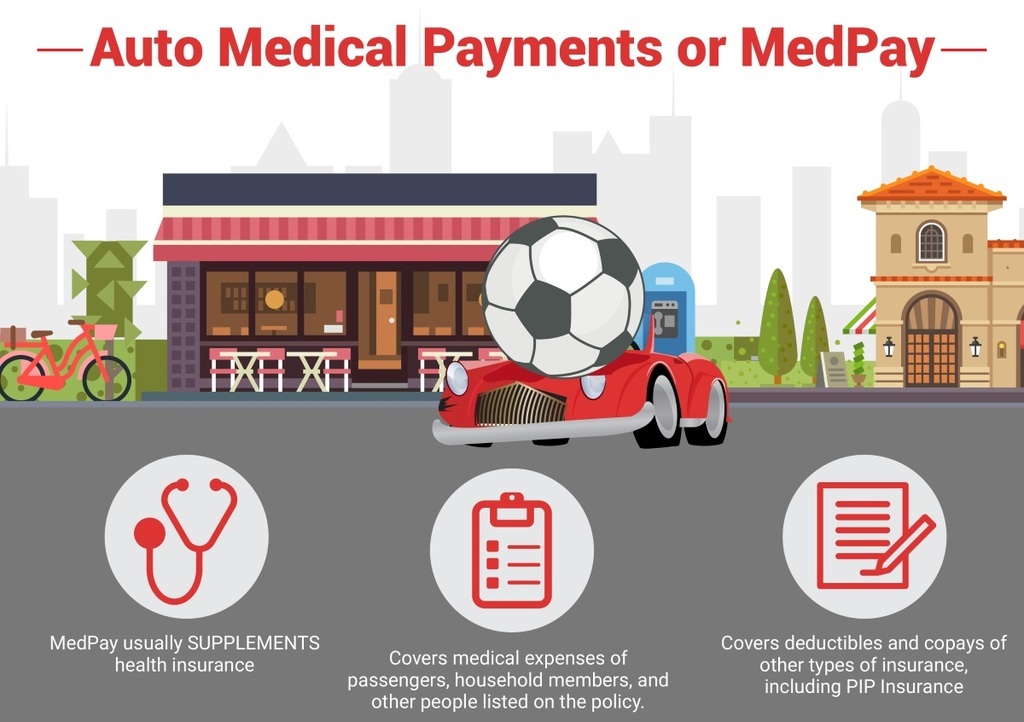

Car insurance med pay. Medical payment coverage may not offer as broad a coverage as pip but its cost can be as low as 20 annually for 10 000 of coverage. Med pay and personal injury protection pip overlap considerably as insurance coverages. Medical payments coverage is a type of car insurance policy that covers the bodily injury and medical expenses incurred in a collision. Personal injury protection pip and medical payments medpay insurance pay for immediate and necessary medical services following a car accident that results in injury.

Only injuries caused directly by the accident will be covered by med pay and limits are usually low p. Medical payments coverage helps pay for medical and funeral expenses after a car accident. Med pay covers the medical payments of all passengers in your vehicle if they are injured in an accident p p med pay covers the medical costs resulting from an car accident regardless of who was at fault. Medical payments coverage can supplement health insurance in the event of injuries from an auto accident.

It s an optional form of auto insurance that typically covers the policyholder family members driving the car and any passengers. Also known as medical payments coverage or medpay coverage applies no matter who s at fault. Medical payments coverage medpay is additional to your auto insurance policy and applies to medical expenses resulting from a vehicular accident for all individuals in your car. While each offer distinct features drivers often choose one or the other.

In the above scenario if you had selected a coverage limit of 3 000 your medical payments insurance could help pay your health insurance deductible and some of your co pay for your er visit. P car insurance protects your car not the people inside of it. That s where medical payments coverage on your car insurance policy may help. Medpay covers medical costs for you and your passengers in an accident regardless of fault.

Insurers take care of their own clients expenses regardless of who is at fault which helps accident victims pay for medical care promptly.

/GettyImages-840918402_2000-0e04e37d44cc48b7ac2cbc09b8986b3c.png)