Car Policy

Our company car policy describes our guidelines for using company cars.

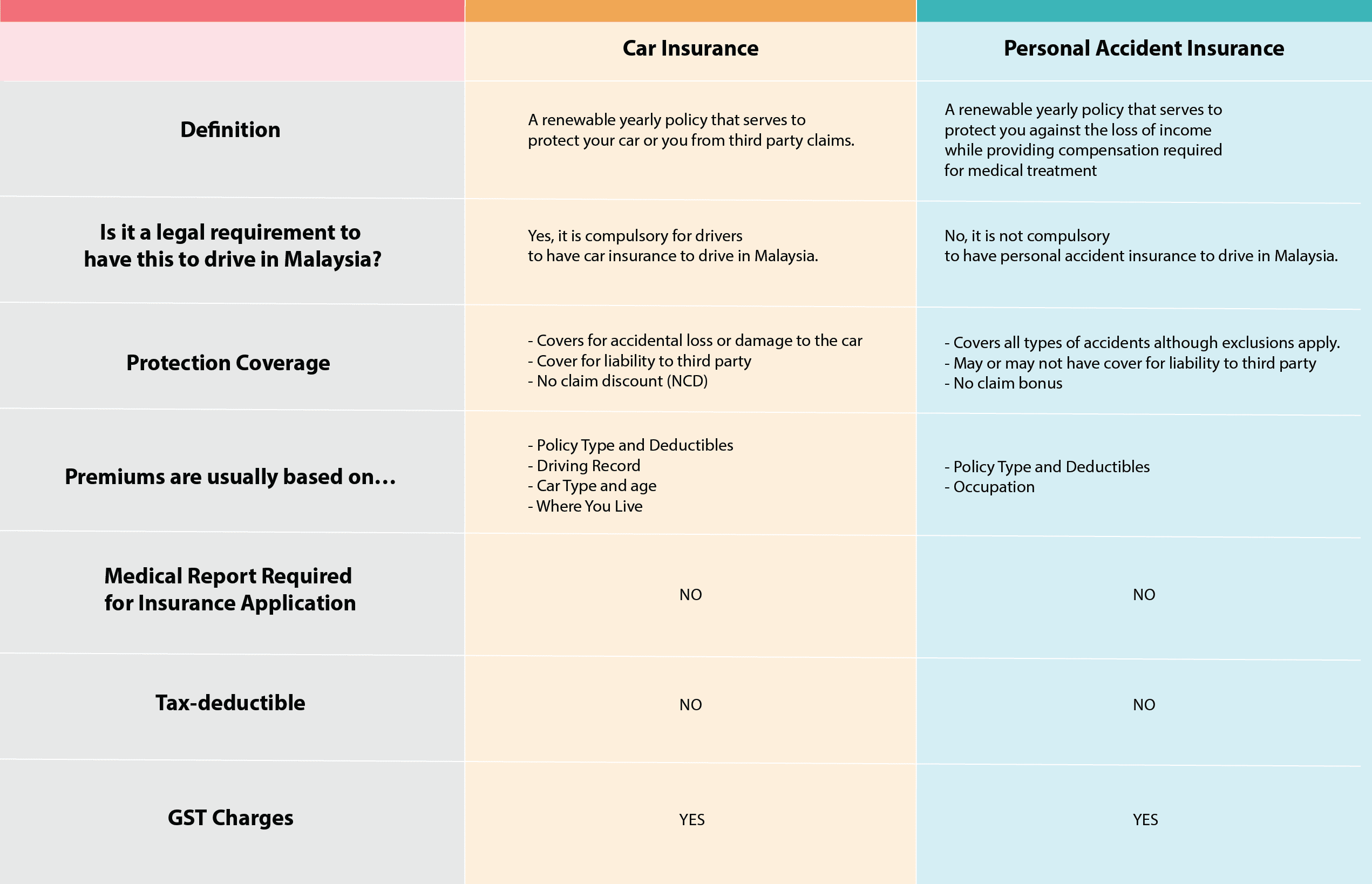

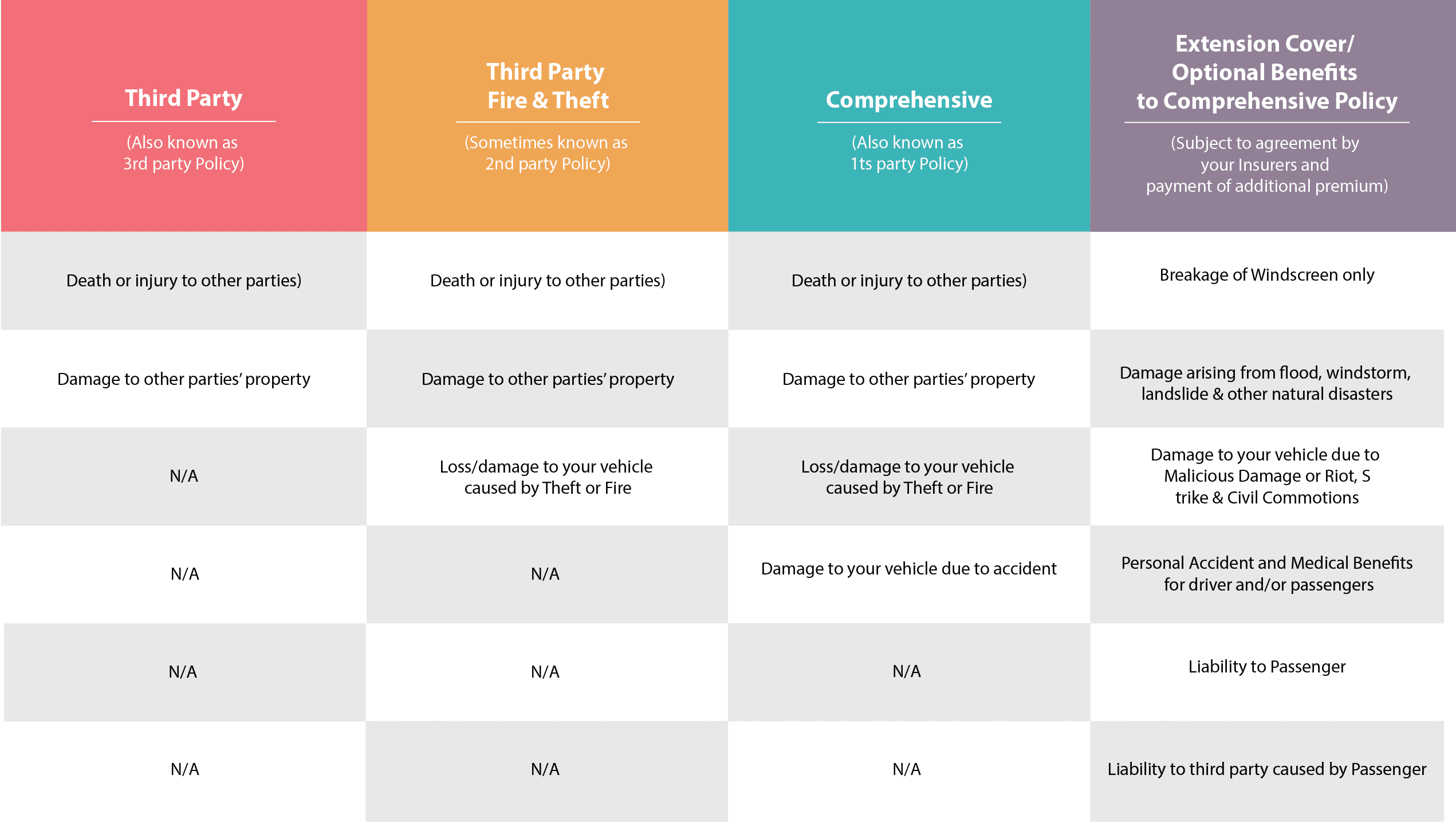

Car policy. A company car is any type of vehicle our company assigns to employees to support their transportation needs for their jobs. Car insurance policy is a contract between the motor vehicle company a car owner that provides on road protection against any loss or damages arising due to an accident. A car insurance policy provides financial coverage to the beneficiary of the car policy against any loss or damages arising out of road accidents third party liabilities theft manmade calamities fire or natural disaster. It covers not only the costs incurred on damages to a third party but also the damages to your car.

Important car insurance terms. Contractors all risks car insurance is a non standard insurance policy that provides coverage for property damage and third party injury or damage claims the two primary types of risks on. For enhanced coverage you can opt for add on covers such as zero depreciation quick road assistance engine and electronic circuit cover return to invoice no claim bonus protection personal accident cover loss of personal. 7 reasons to buy motor insurance from icici lombard.

A reduced online discount may apply on renewal if you originally bought the policy online. A company vehicle policy or company vehicle use agreement establishes which employees are eligible for a company fleet vehicle. A vehicle insurance policy provides all round protection to the vehicle against any physical damage or loss arising out of natural and manmade calamities fire accidents or theft. It is a part of car insurance policy coverage that protects the insured vehicle from damages due to accident theft natural calamities and human made.

Car insurance helps neutralize those risks and mitigate damage repair expenses in case of an accident. A comprehensive car insurance policy offers complete protection to the owner driver. 3900 cashless network garages for car. Company cars belong to our company and we want to make sure our employees use them properly.

To buy only third party cover for your new vehicle click here. This policy type also covers car theft and damages caused by fire burglary and natural disasters. Policy brief purpose. It is an additional cover that you can buy by paying an additional premium and widen the scope of coverage of your regular policy.

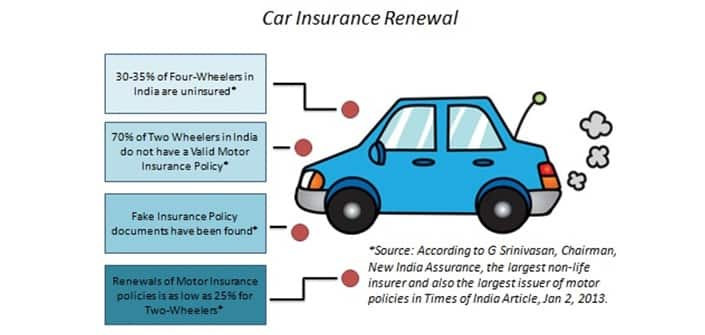

Private car package policy. It also provides protection against accidental bodily injuries death or physical damages caused to third party liabilities as well as the owner driver of the vehicle. In india driving exposes you to various risks.