Cash In Advance Payment Terms

There s no strain on cash flow.

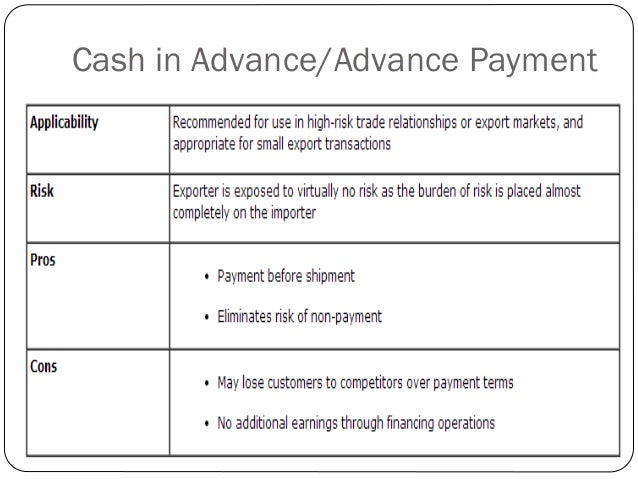

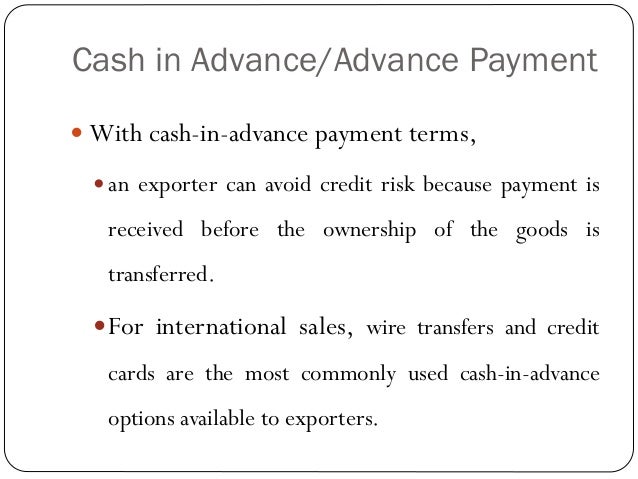

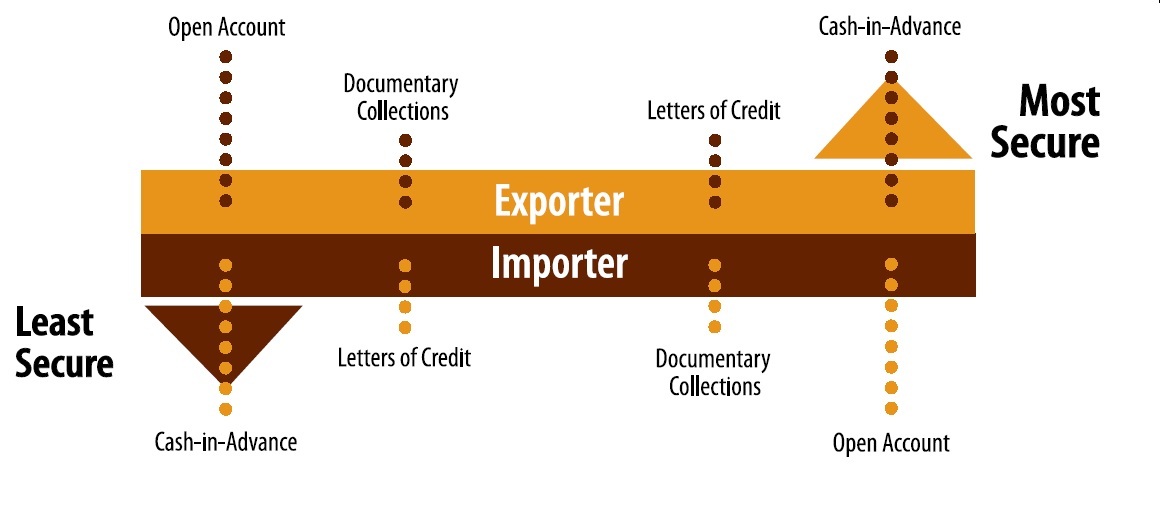

Cash in advance payment terms. The logic behind the structure of such a transaction is that if an exporter ships a product to an. However if they make a payment within ten days they ll receive a 2 discount. It is often combined with other terms such as free on board which require the buyer to take possession of the merchandise as soon as it is loaded onto transportation. This is considered the least attractive and competitive from the buyer s point of view as cash in advance is the riskiest way for them to do business they part with their money upfront but have no guarantee you ll deliver the goods.

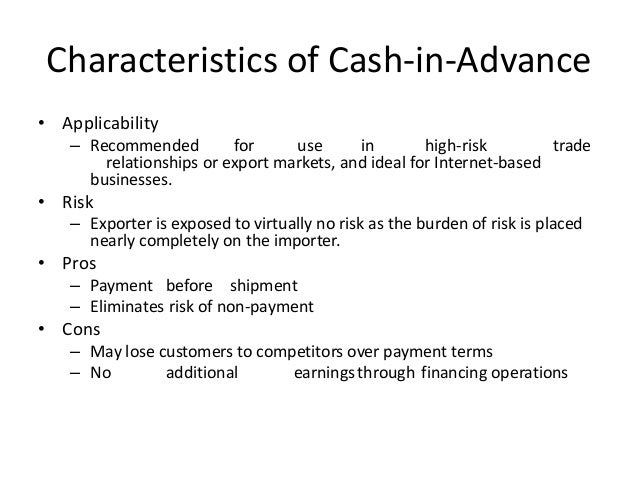

One of the main characteristics of a cash in advance payment is that the full order amount will be paid by the importer to the exporter prior to the transfer of ownership of the goods. Cash in advance provides the working capital you need to process the order. Cash in advance is also known as cash with order or advance payment by most exporters and importers. Also called cash with order.

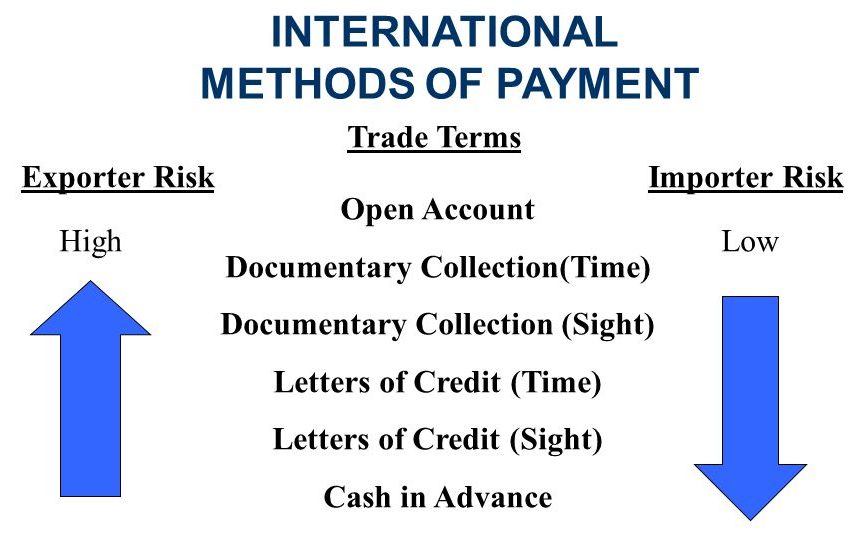

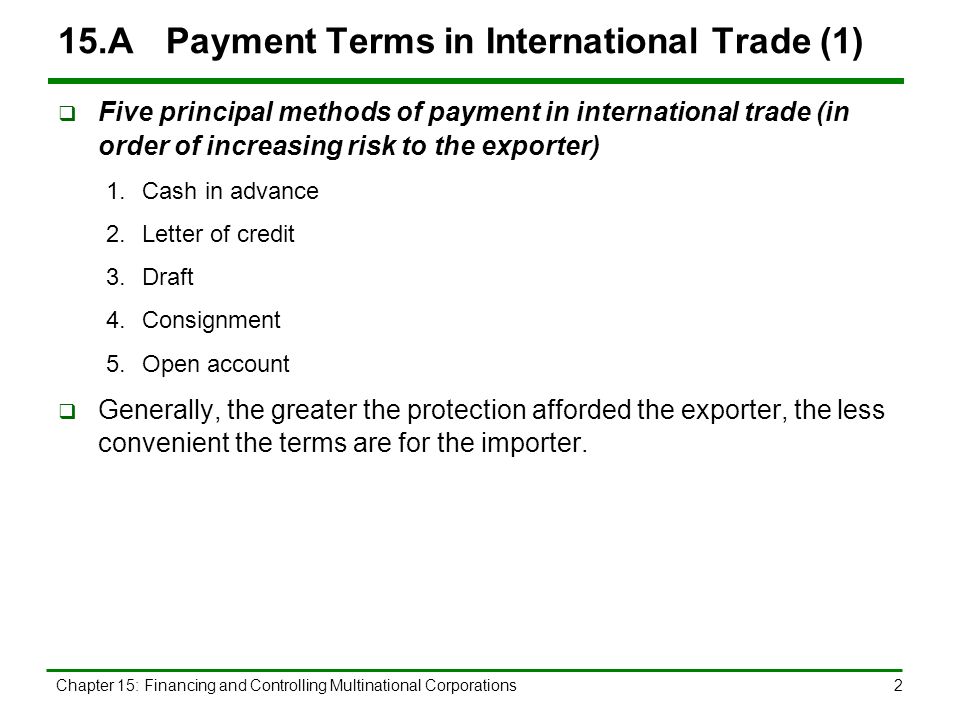

Cash in advance cia is a payment method in international trade. Payment method in which an order is not processed until full payment is received in advance. A term such as net 30 requires the client or customer to make a payment within 30 days. The most common payment terms for contracts are open account the seller delivers without any guarantee and expects the payment at a later stage documentary collections the exchange of the documents representative of the goods and the payment are managed via banks letters of credit cash in advance.

Cash in advance cia. Very simple to transact on your part. Furthermore to keep your cash flow positive use shorter terms like please make payment within 10 days 5. Of course you can change these terms as.