Casualty Loss

Casualty losses can occur for example when one drives a car through the garage or when a tornado destroys a business.

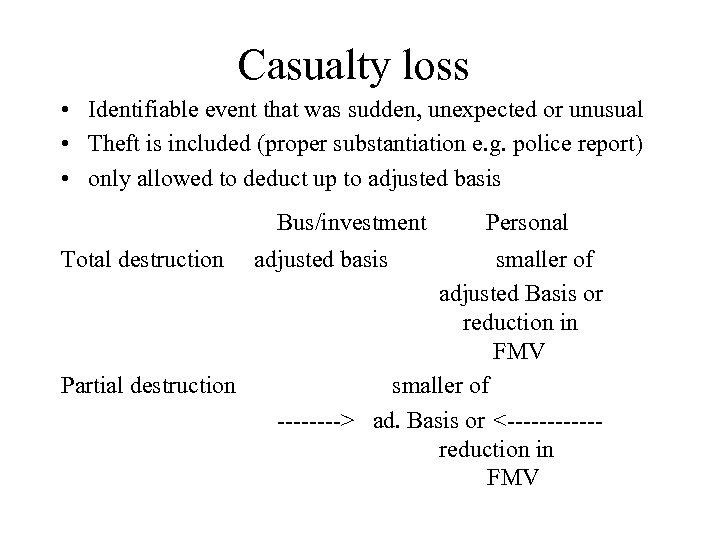

Casualty loss. A federal casualty loss is an individual s casualty or theft loss of personal use property that is attributable to a federally declared disaster. Prior to 2018 events that meet these criteria included. Casualty loss or theft of business or income producing property. A casualty doesn t include normal wear and tear or progressive deterioration.

Casualty losses a casualty loss can result from the damage destruction or loss of your property from any sudden unexpected or unusual event such as a flood hurricane tornado fire earthquake or volcanic eruption. The event must be identifiable unexpected and unusual. It must be caused by a sudden unexpected or unusual occurrence such as a storm flood fire shipwreck or earthquake but would not include gradual damage from water seepage or erosion. Casualty and theft loss deductions are only allowed for one off events that are out of the ordinary and not a routine part of everyday life.

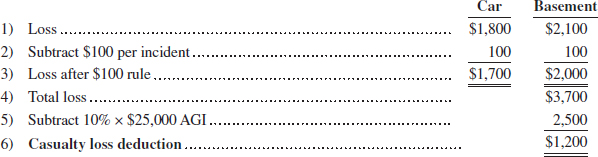

If the loss occurs as part of a federally declared disaster you also have the option of reporting it. How casualty and theft losses work. In taxation loss due to damage which qualifies for a casualty loss tax deduction. One may deduct a casualty loss from one s taxable income subject to certain conditions.

You report a casualty or theft loss on schedule a of that year s tax return. The days when you could claim deductions for run of the mill casualty and theft losses of personal property are gone at least temporarily. As a result business casualty and theft losses of property used in performing services as an employee cannot be deducted nor applied in the netting process to offset gains. The tax cuts and jobs act tcja generally suspends write offs for such expenses for 2018 through 2025.

The event also. Damage or loss resulting from progressive deterioration of property through a steadily operating cause would not be a casualty loss. Financial losses from gradual environmental degradation would not qualify as casualty losses. Defining casualty losses a casualty is the loss of property including damage and destruction that occurs because of a sudden event.

You can no longer claim any miscellaneous itemized deductions. Other casualty are events similar to fire storm or shipwreck. However you can still claim deductions for personal property losses caused by certain federally declared disasters such as the covid 19 pandemic. A loss that occurs as a result of an unforeseen catastrophic event.