Catering Liability Insurance Cost

Simply business offers between 1 million and 5 million in cover to protect you against this cost.

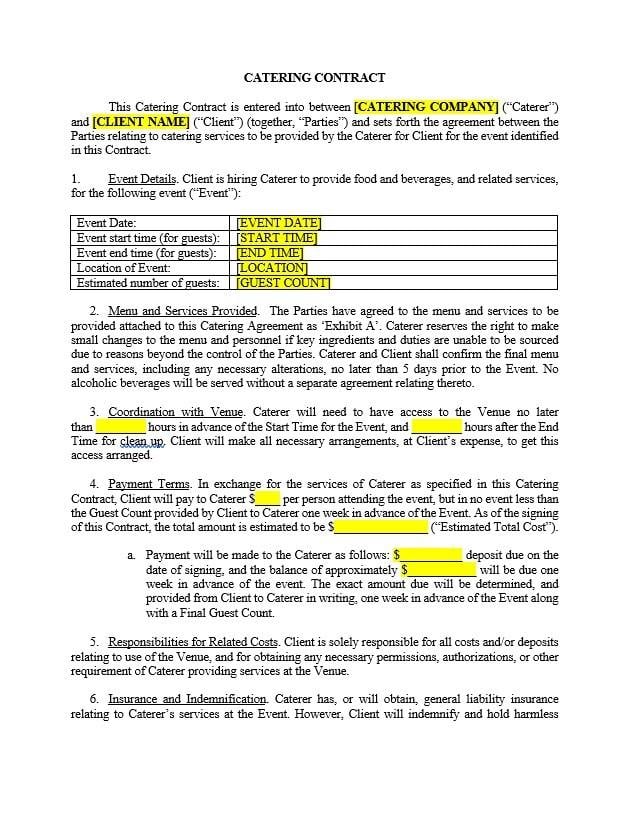

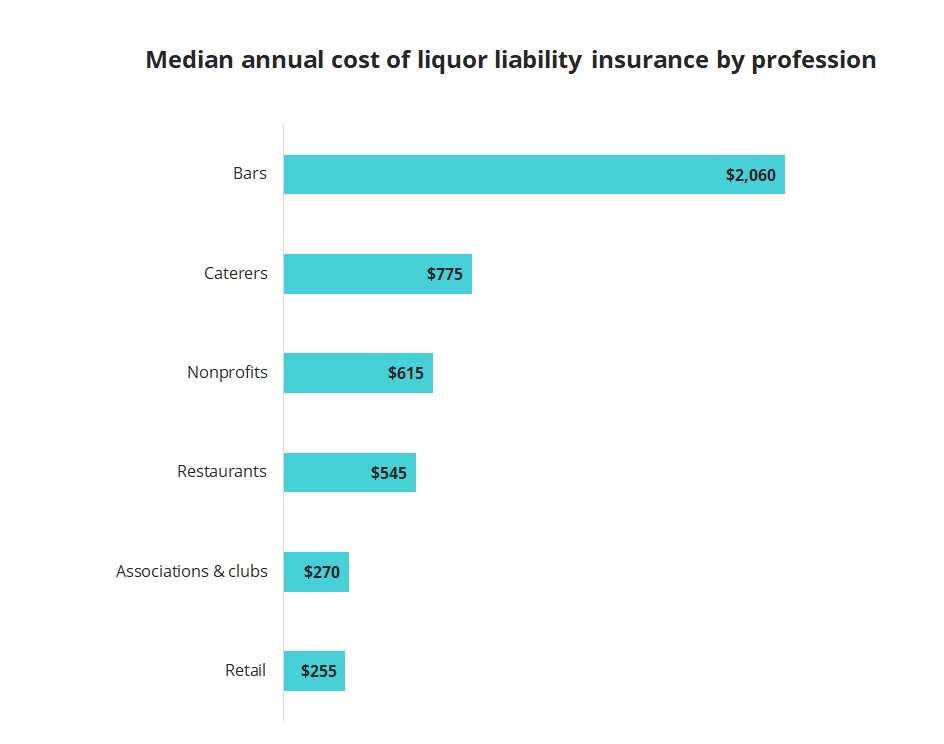

Catering liability insurance cost. With these catering liability insurance policies you ll be covered for the costs of correcting any damage medical fees for injuries legal representation and other related expenses. Low cost cover caterers with trailers vans trucks regardless of the type and kind. Catering insurance cost coverage 2020 855 767 7828. We have a dedicated team of catering specialists who would love to hear from you.

General liability could cover the cost to replace it. Get a fast quote and your certificate of insurance now. The median cost of commercial auto insurance is about 80 per month for caterers or 950 annually. If your catering business is based out of your home you can add an endorsement for your business equipment and materials to your home insurance policy.

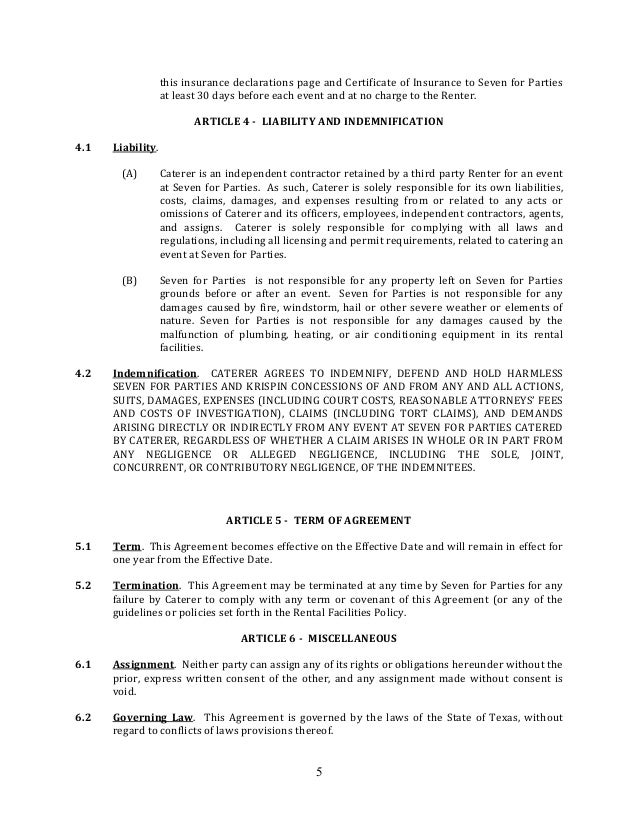

Catering liability insurance can provide a full suite of coverage to protect you from possible lawsuits that may be filed against you. Rather than buying multiple event policies each year our annual policy is a cost saving solution for you if your business operations include. Free insurance quote within short period of time. 10m public products employers liability as standard.

Damage to business property. This policy can pay expenses related to injuries and property damage if someone driving your catering vehicle is held liable for an accident. Protection against claims if the public get hurt because of your business. This catering liability insurance coverage protects against accidents that can happen while on the job and any resulting lawsuits for example while catering a house party a server accidentally breaks an expensive vase.

Catering insurance protects your business from lawsuits with rates as low as 27 mo. We have been operating for many years and we have more than 10 000 happy customers. Catering insurance is one of the leading catering insurance brokers in the uk. Basic caterer insurance coverage.

Public liability insurance is often an important cover for caterers and most other trades as it can protect you if someone is injured or their property is damaged because of your business. Employers liability insurance quote. Liability insurance policy with 500 stock cover included free of charge.