Checking Account Number On A Check

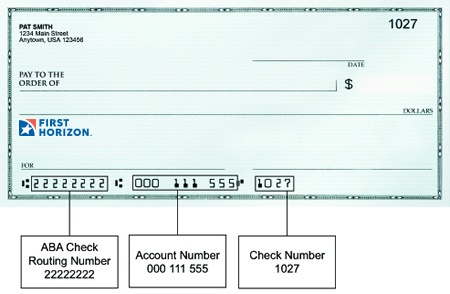

The set of numbers on the far right should be a check number which is just used to identify an individual check for your own accounting.

Checking account number on a check. You can also find your account number on your monthly statement. The owner of an account usually identified using a unique string of numbers may be or mixed with numbers and letters and this number called checking account number. The account number tells the bank which account it should take money from to pay the checks you write. Knowing what your checking account number is an important piece of your financial information.

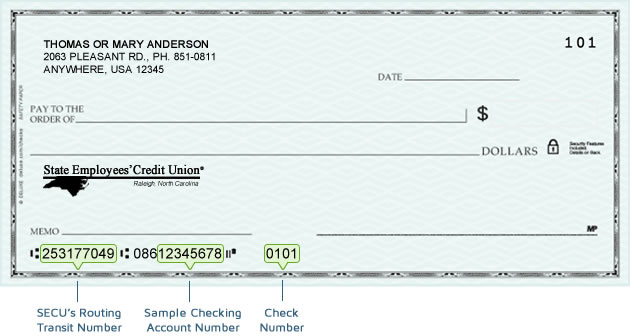

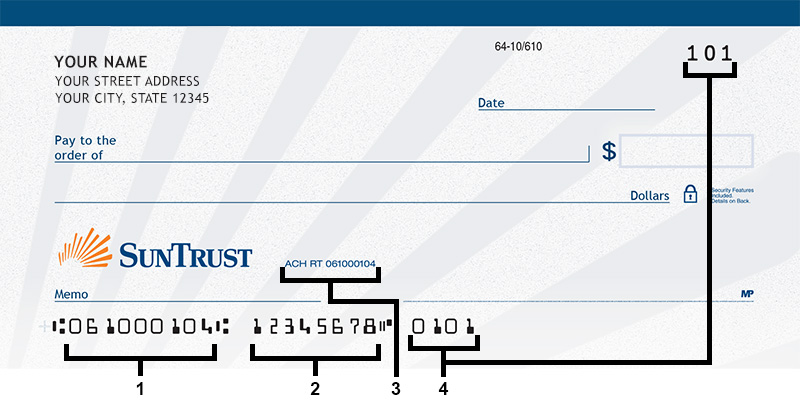

The information will be located on a variety of bank documents since it is a unique identifying number specified for only you. As far as the united states of america is concerned in this technological era it can be said that the whole important account number for several people is the checking account number. When you open a checking account at a bank or credit union the account is assigned a unique identifier called an account number. The account number on a check could be in a different spot depending on your bank but chances are the account number on your check will be where it is in our diagram.

The account number on a check is used to identify your unique account. Every check for that account at that bank will have the same. You might need to find the checking account number on your check if someone has asked you for your account number because that person wants to give you some money. By locating it on your check you can more easily reconcile any discrepancies in your financial.

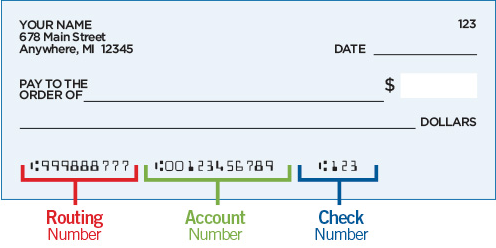

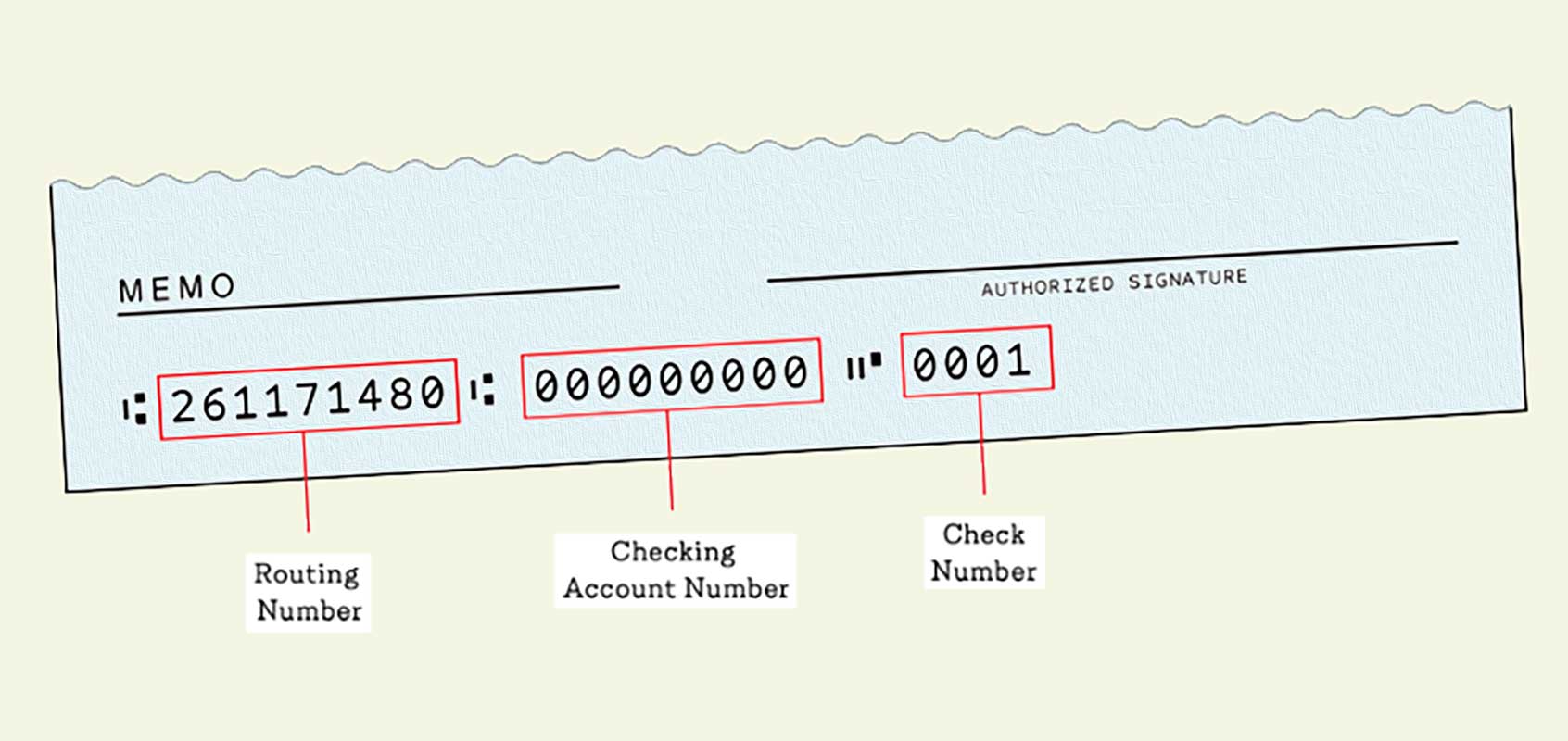

A check number does not reference your bank or your account it s a unique identifier for every check you write helping you track your spending and balance your checkbook. An account number typically is located at the bottom of a check. It s the second set of numbers printed on the bottom of your checks just to the right of the bank routing number. In most cases there are three numbers at the bottom of a check and your account number is the one in the middle.

It s the second group of numbers from the left next to your nine digit routing number. Your account number usually 10 12 digits is specific to your personal account. The second number in the micr line is the account number. Without the right account number you may face delayed or missing paychecks or fees for failing to pay your bills on time.

Some checks use a different format so it s a good idea to confirm your account number. Banks have varying amounts of digits in the account numbers as many as 12 digits they assign to their customers.

:max_bytes(150000):strip_icc()/ScreenShot2020-04-30at5.02.36PM-d672a55d2cfe42d7b4f30fa5dff93bd1.jpg)

/where-is-the-account-number-on-a-check-315278-final-5b60d3d346e0fb0082b23a62.png)