Checking Vs Savings Account

Savings accounts are used for just that.

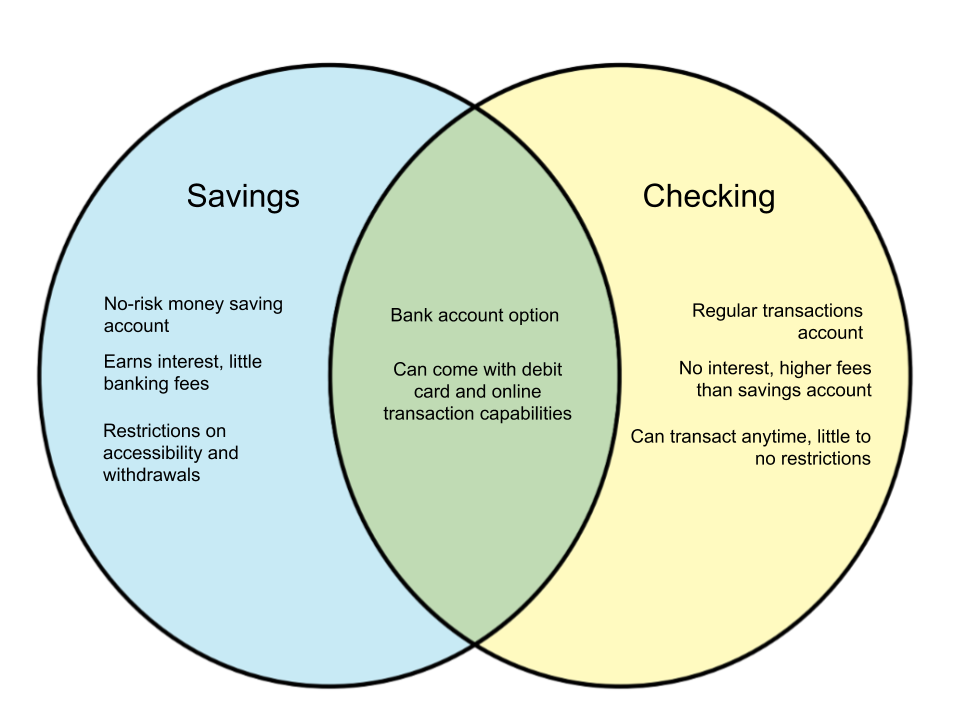

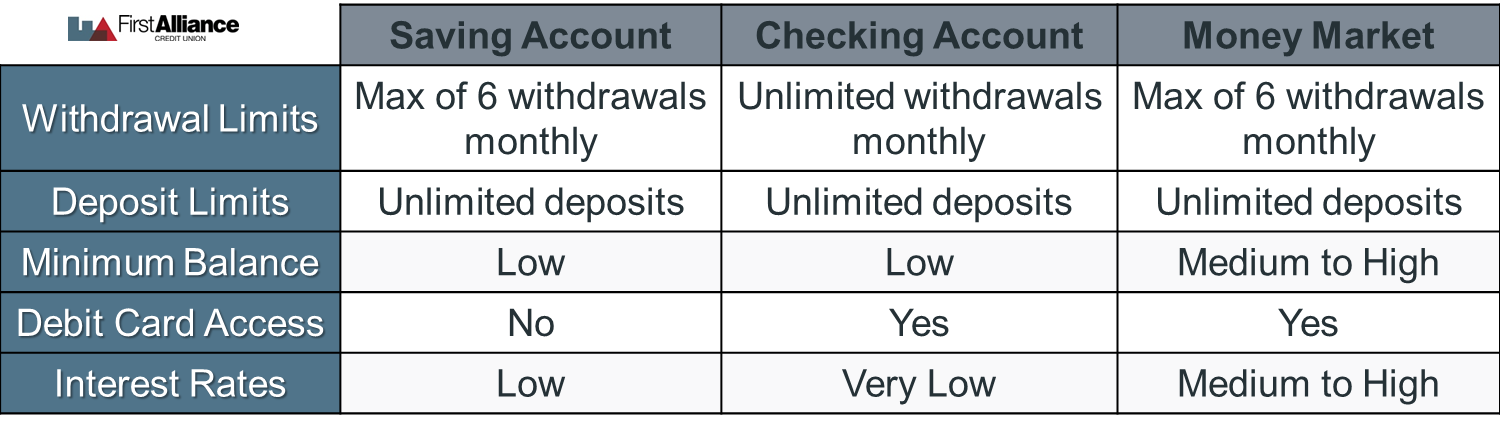

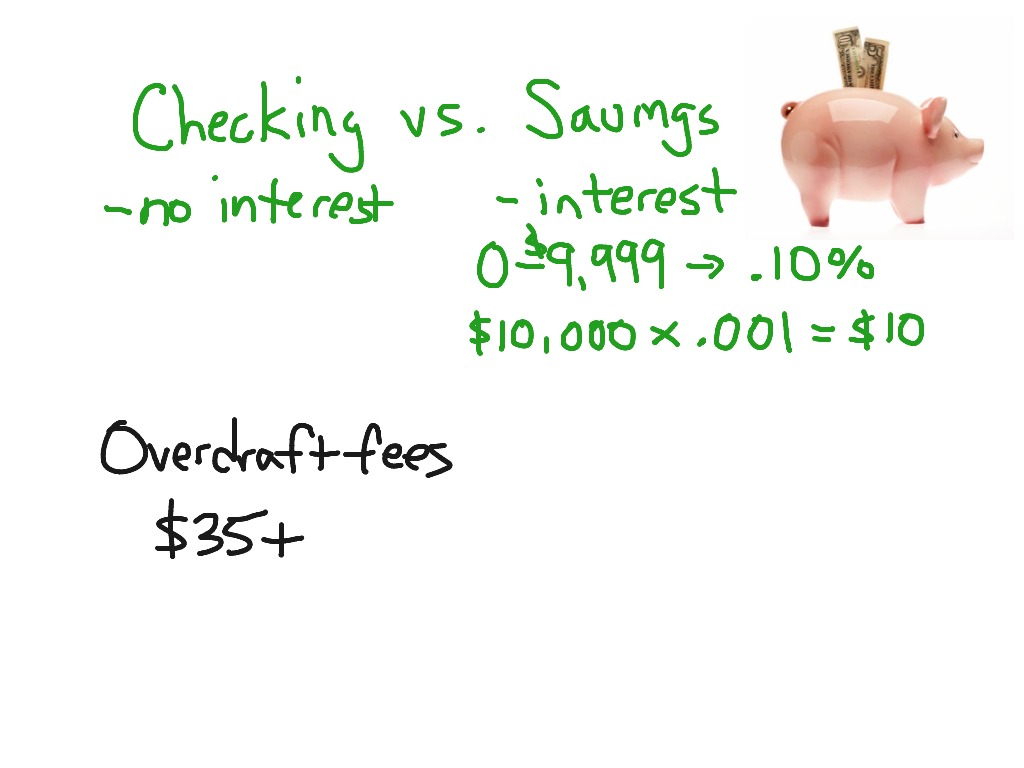

Checking vs savings account. A checking account is an account held at a financial institution that allows you to make deposits and withdrawals. The average apy on interest checking accounts is 0 04 apy while the average savings account apy is just 0 05. Checking vs savings account uses. Checking and savings accounts are different.

You can use debit cards at stores or withdraw cash from atms. Should you have one. These accounts can offer both a debit card and check writing capabilities. Savings accounts typically pay interest so you earn money on the cash you re not using compare that to checking accounts which usually do not pay interest.

In general checking accounts can be thought of as spending accounts. Checking and savings account each serve a different purpose here are the main differences and why you need both. The interest rate depends on the bank the type of savings account e g see money market vs savings account and the amount deposited but is always higher than the interest rate on checking accounts. Checking accounts typically earn little to no interest depending on the bank.