College Tax Credits For Parents

The amount of the credit varies and is subject to a number of rules depending on which credit you use what you use the money for and what area of the country you live in.

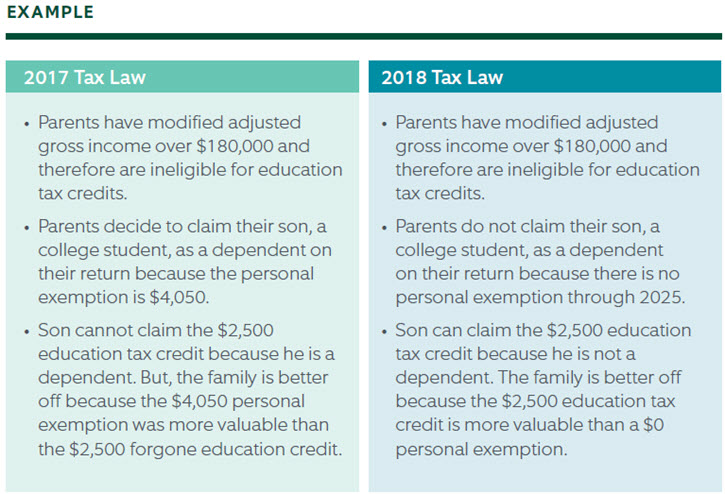

College tax credits for parents. The deduction is worth either 4 000 or 2 000 depending on your modified adjusted gross income magi and filing status. Claiming dependents and filing status. You can use tax free withdrawals from coverdell esas and 529 college savings plans to pay qualified education expenses in the same year as the american opportunity or lifetime learning credits as long as you. Here s a guide on what to consider when deciding who should claim these student tax credits and deduction.

Both 529 college savings plans and coverdell education savings accounts are tax advantaged accounts that help parents and grandparents saving for college. The american opportunity tax credit aotc formerly known as the hope scholarship credit can be very beneficial for parents who are funding their kid s college education. Find out if you can claim a child or relative as a dependent interactive tool. The aotc allows you to claim a tax deduction for up to 2 500 per year for each eligible college student for whom you pay qualified tuition expenses.

Tapping tax free college savings. But everyone s tax situation is different. You can take tax free distributions for qualified education expenses from your child s 529 college savings plan or coverdell education savings account. If your parents pay college expenses for you they get the tax credit.

Parents can claim certain tax credits or deductions depending on their filing status. There are two college tax credits you can. It can be claimed on. As a general rule most of the time the parents should take the tax credit because it s more valuable to them than the kids says joe orsolini president of college aid planners.

College tuition and fees are tax deductible on your 2019 tax return. American opportunity tax credit. If the credit reduces tax to less than zero the taxpayer may get a refund. They do this by reducing the amount of tax someone owes on their tax return.

Determine your filing status with the interactive tax assistant. Read our publication about the tax rules.

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521033/working-family-tax-credits-1.png)