Comprehensive Auto Insurance Definition

Comprehensive auto insurance is supplementary meaning it s an optional coverage which can be added to an insurance policy.

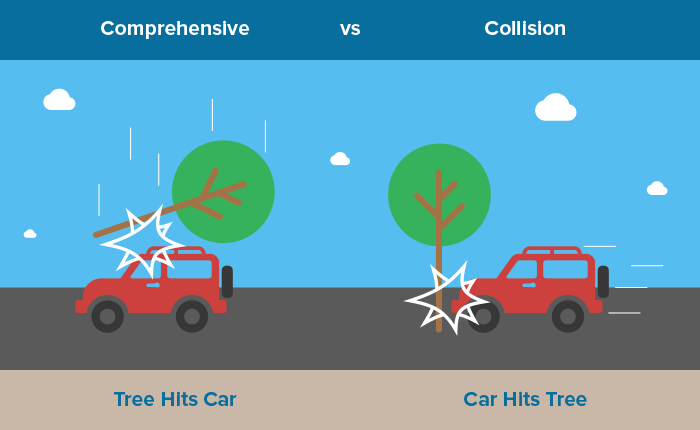

Comprehensive auto insurance definition. If you hit a groundhog squirrel moose or even hit a deer with your car hitting an animal is covered by the comprehensive coverage of your auto policy. The term is most often used to refer to comprehensive car insurance. For maximum protection you can pair comprehensive coverage with liability and collision coverage or choose classic car insurance that provides flexible usage and coverage designed specifically for classic cars. Comprehensive insurance is commonly confused with collision.

Ask your insurance provider about the specifics of when you can add it to your particular plan. Collision covers car accidents and comprehensive covers events out of your control. Usually you can choose for your comprehensive deductible an amount anywhere from 100 to 2 500 deductible choices vary according to state laws and insurance company guidelines. Comprehensive insurance is a type of insurance policy that provides wide ranging coverage for unforeseen mishaps.

Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. While there are other optional auto insurance coverages liability comprehensive and collision are three of the most common. Learn what comprehensive auto insurance covers when you may need it and how it differs from collision coverage. It protects the insured person or company from things that happen to their property or business that are beyond their control.

One confusing part of auto insurance comprehensive coverage which is unlike all the rest of the insured perils under comprehensive insurance is the coverage for hitting an animal. Comprehensive is a nice in between coverage for anyone who wants some protection but does not want to pay for full coverage. But comprehensive can be added to your auto policy without collision. Most car owners choose a deductible of between 250 and 1 000.

Comprehensive insurance can help if your car is damaged by hail fire or even a fallen tree branch. Comprehensive insurance protects your car from damages you can t control like fire hail wind theft vandalism or even hitting a deer. The higher the deductible the less expensive your premium will be because the insurer is taking less risk of paying out for claims.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-501656891-5daf8d0f1d964b439e5cbc4706f8314f.jpg)