401k Rollover Limits Per Year

:max_bytes(150000):strip_icc()/104494896-5bfc3c6f46e0fb00511e018a.jpg)

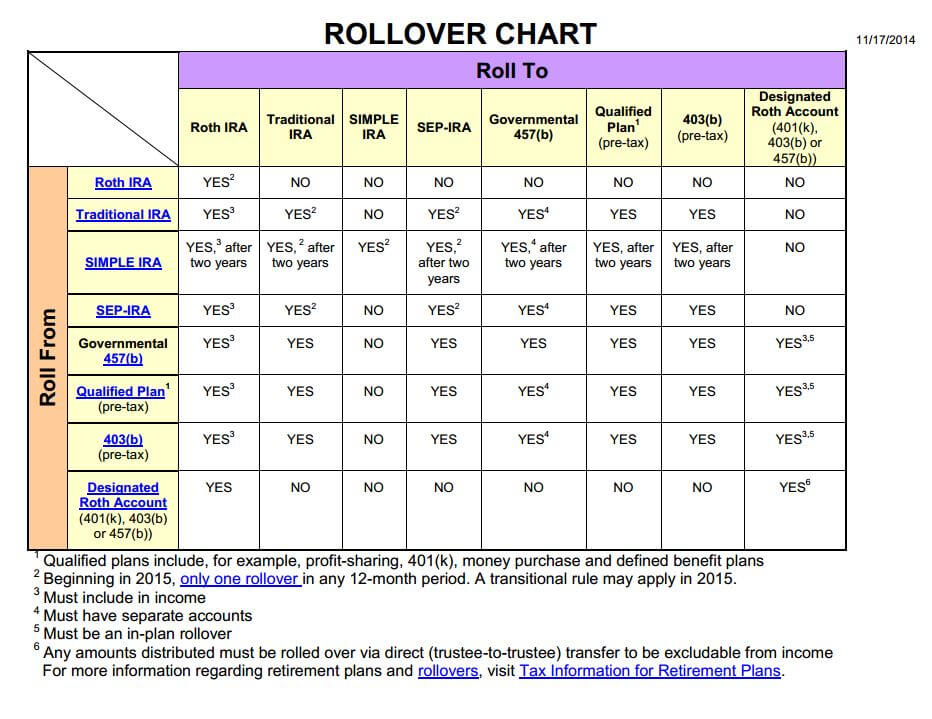

The one rollover per year rule of internal revenue code section 408 d 3 b applies only to rollovers.

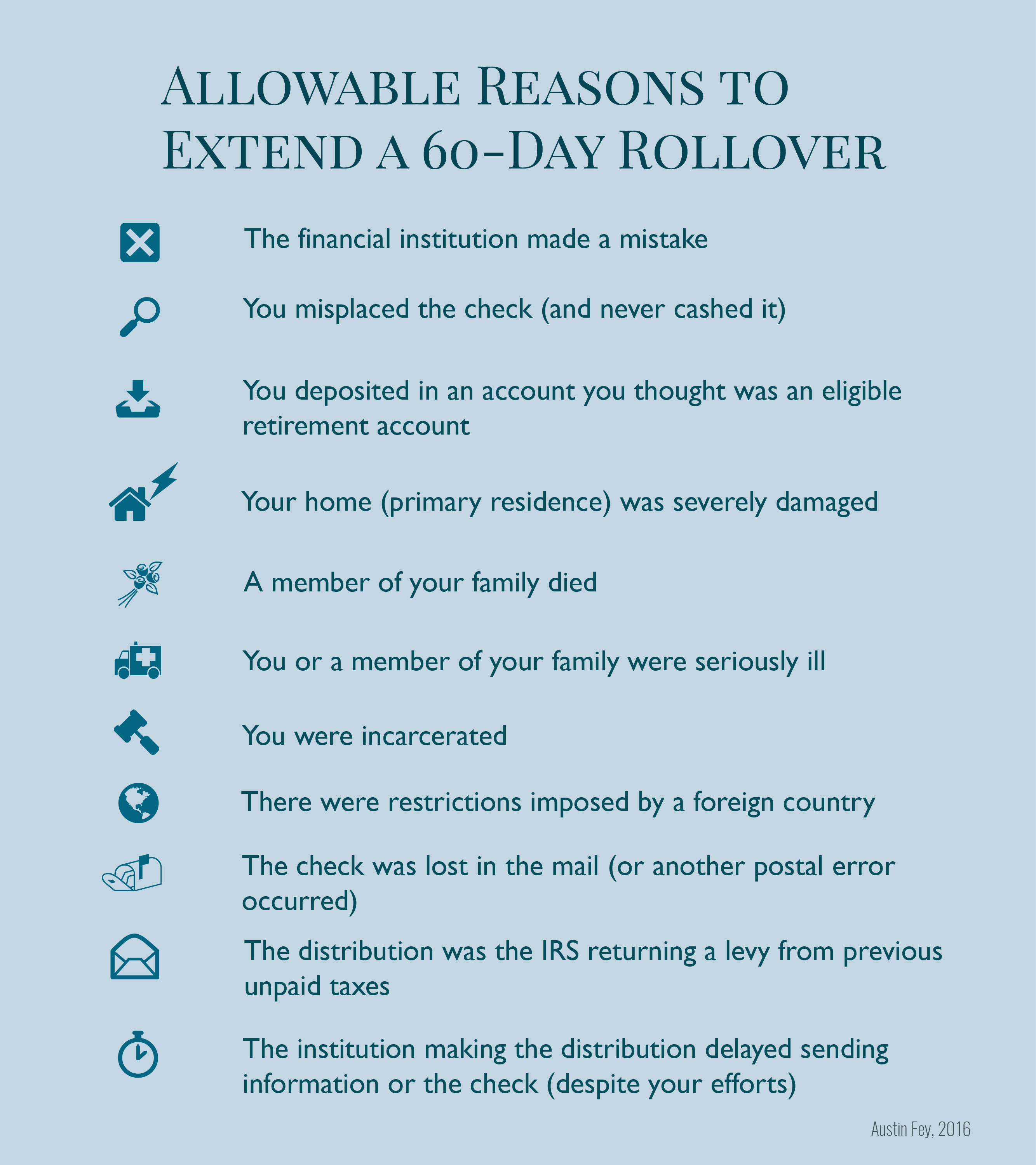

401k rollover limits per year. Irs clarifies application of one per year limit on ira rollovers. Youtube video ira retirement plan 60 day rollover waivers. One distribution option is to roll over the 401 k. The one year wait period begins when the taxpayer receives the 401k distribution not the date when he rolls it over into a.

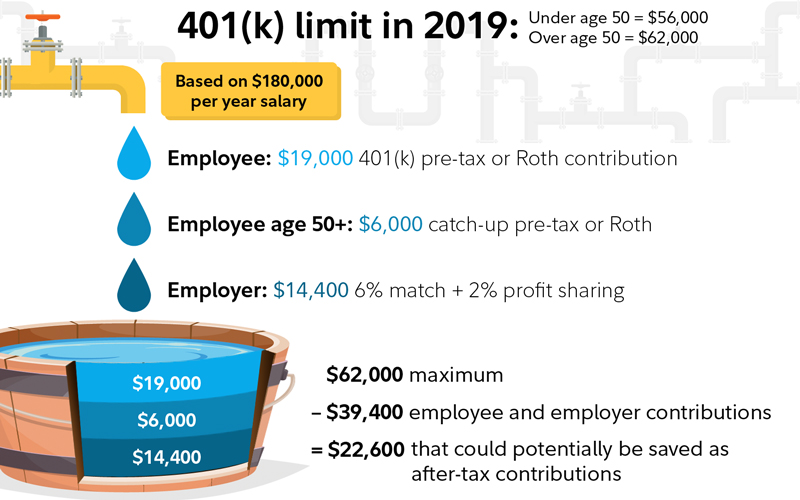

Rollover transactions are treated differently than contributions. Individual retirement arrangements iras rollover of retirement plan and ira distributions. The combined ira contribution limit for both spouses is 12 000 per year or 14 000 per year if you are both over 50. A rollover from a 401k into another ira may be made only once a year.

The new law limits the number of indirect ira to ira rollovers an individual can make to one such rollover within a one year period 365 days. According to the new irs interpretation of this rule you cannot make a tax free ira to ira rollover if you have already made a rollover from any of your iras within the prior one year period regardless of the number of iras you own. An ira can receive any number of rollovers per 12 month period but once an ira has received a rollover a distribution from that ira can t be rolled over within 12 months. Contribution limits don t apply to rollover contributions.

The one ira rollover per year rule doesn t apply to rollovers from. This happens when you contribute more than the contribution limit for. Your rollover does not count towards the annual 5 000 contribution limit 6 000 for those over 50 normally allowed for roth contributions and deductible contributions to traditional iras. So if you roll over contributions made on a pre tax basis as from a traditional 401 k the amount involved must be included as taxable income for the year of the rollover.