Cheap Car Insurance In Nj For Bad Drivers

Stay on the road and look through this easy to read list of facts necessary for every new jersey driver for new jersey residents it is even more important to find cheap car insurance in nj and we will find you the best policy and auto insurance in nj to save you money.

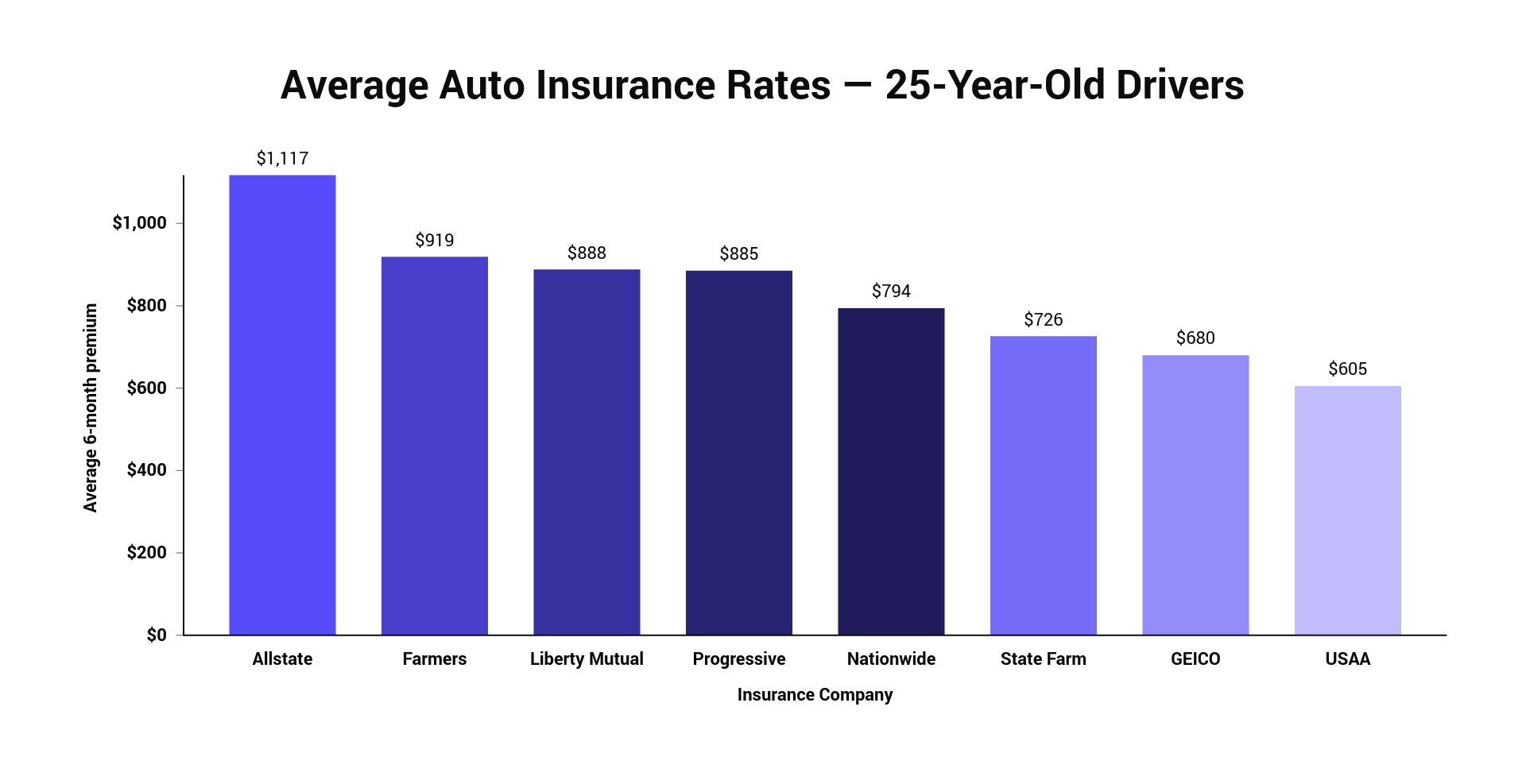

Cheap car insurance in nj for bad drivers. Finding the right cheap car insurance in new jersey for you looking for the right car insurance is never fun. These three insurers offer average annual rates of 2 521 per year 44 cheaper than the new jersey average of 4 542 for full coverage policies with a prior accident history. For new jersey drivers with a recent speeding ticket on their record here are the cheapest auto insurance companies and their average rates. In addition to earning a cheaper premium for driving incident free you may qualify for a safe driving bonus through your car insurance company.

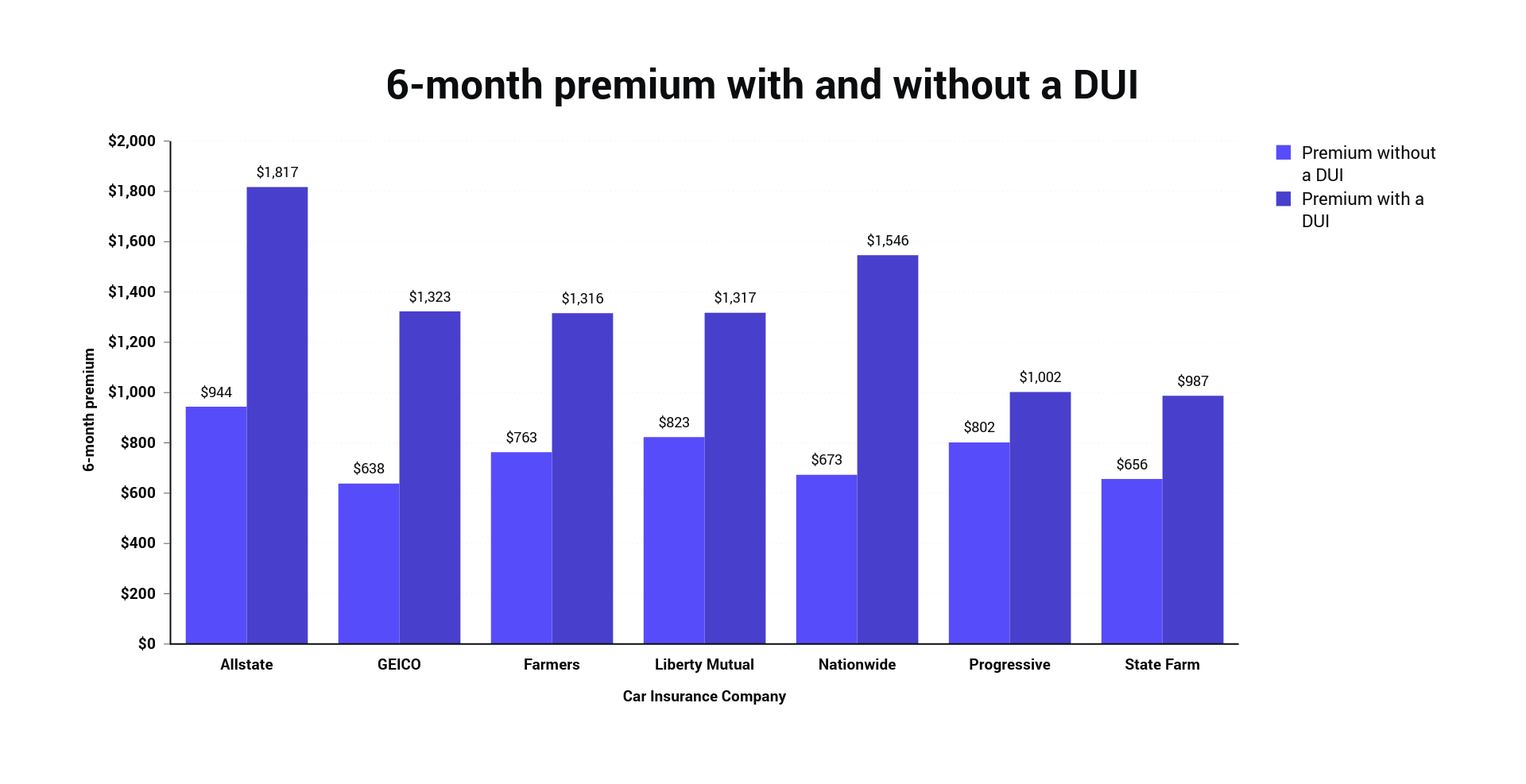

Car insurance with bad credit in new jersey. Often times people are charged higher premiums because they have a bad driving record. However we found that geico and progressive typically quoted high risk drivers the best auto insurance rates. It largely depends on your coverage selections your age and where you live as well as the insurance company you choose.

Car insurance rates for high risk drivers. Rates by company auto insurance rates with bad credit in new jersey. Geico new jersey s cheapest option is best for good drivers and students due to. Assigned companies provide personal private passenger car insurance coverage.

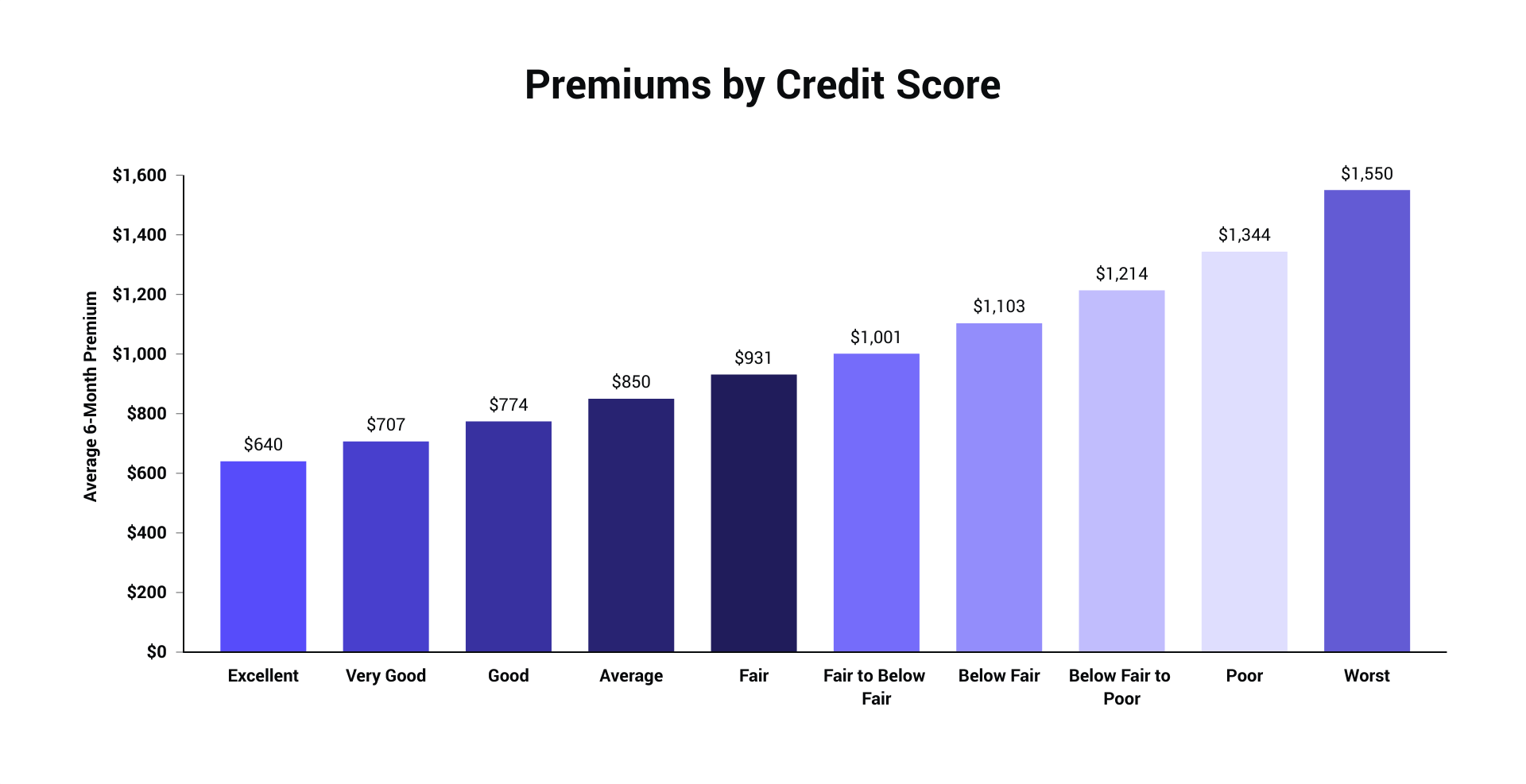

But there are ways to reduce your monthly auto insurance bill for many people to less than 100 per month and for some to as low as 62 per month. Nj high risk auto insurance. Nj paip car insurance or nj state mandated assigned high risk auto insurance for qualified applicants. A driver in either the poor or below fair to poor credit tier will also pay.

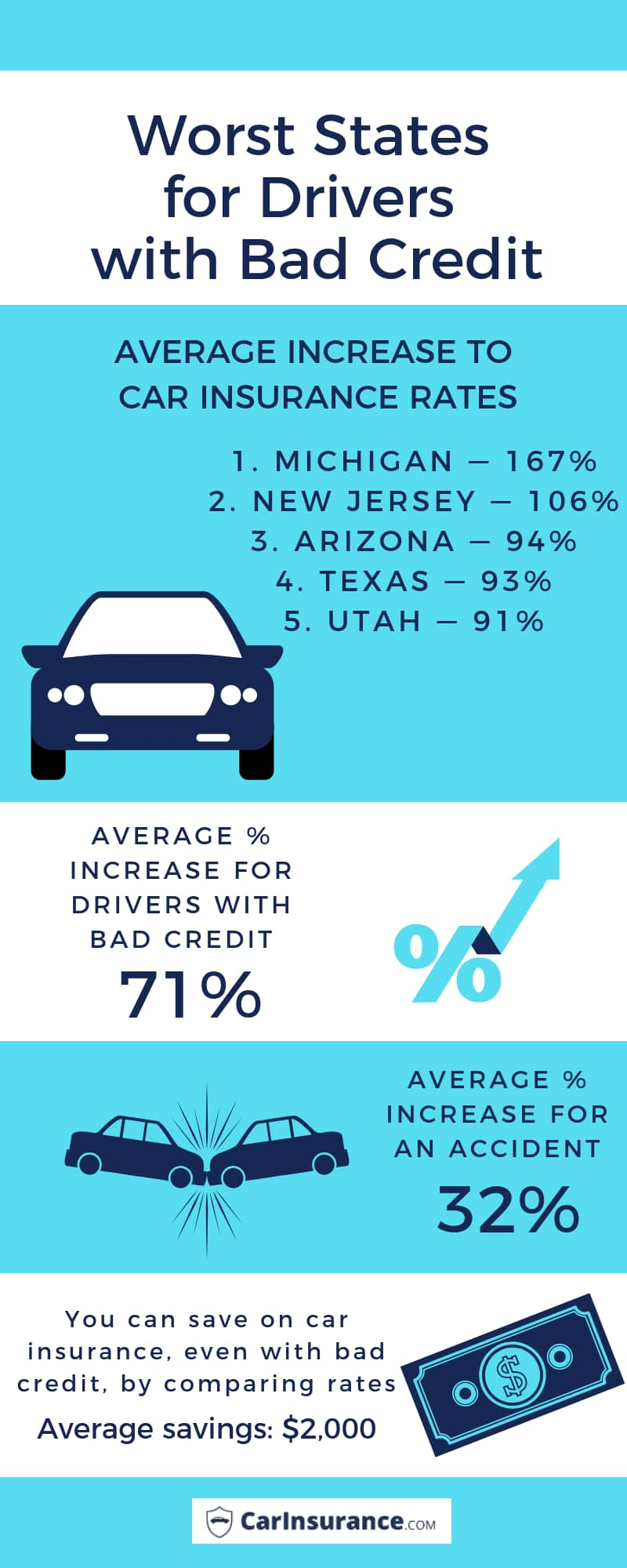

New jersey drivers with an accident on their driving record may be able to find cheap full coverage car insurance quotes at njm geico and palisades group. The plan offers nj drivers another option when they cannot obtain coverage elsewhere in the state of new jersey. Drivers in new jersey pay a penalty of 1 591 per year for having a credit score at the low end of the scale. New jersey drivers without a recent speeding ticket typically save 37 on their car insurance premiums exceeding the 25 national average.

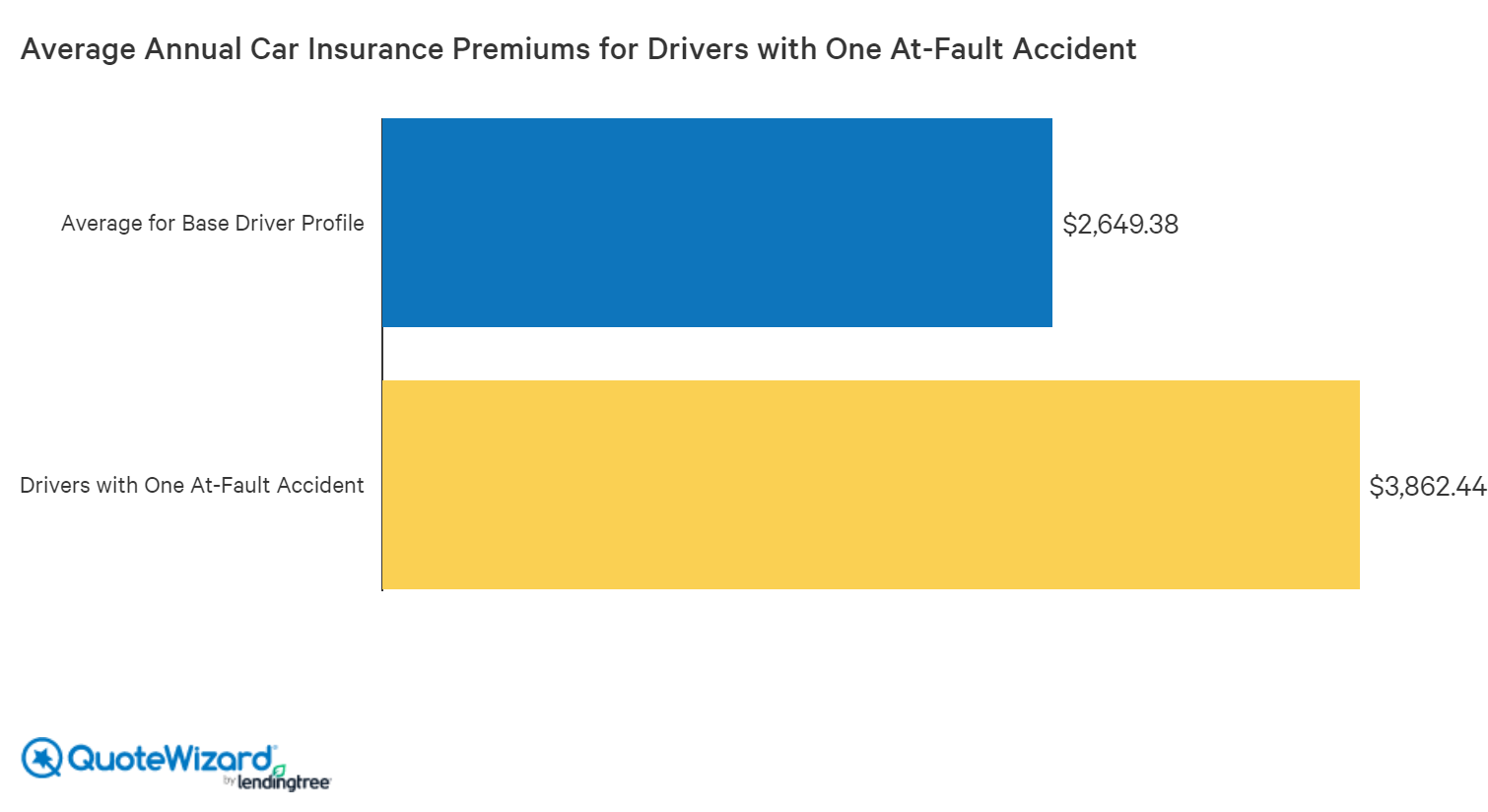

You can see in this table what the average car insurance rates are after just one at fault accident speeding. Auto accidents duis traffic tickets and multiple car accident claims submitted to insurance companies will push a driver into the high risk category.