401k Rollover Limits

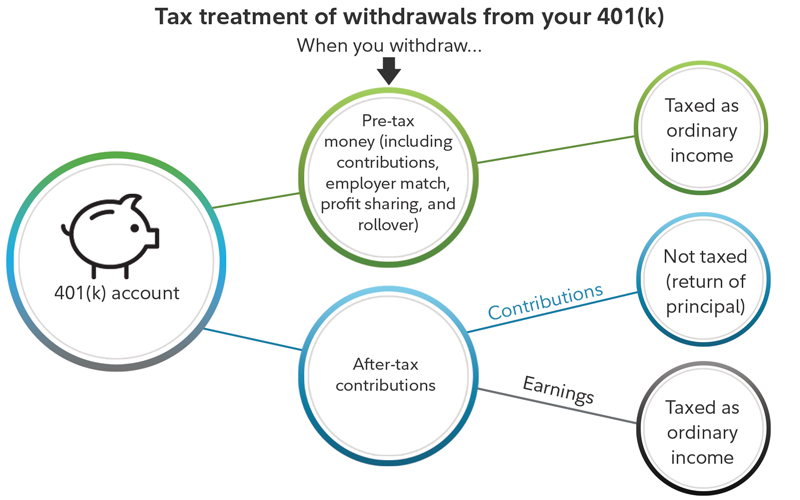

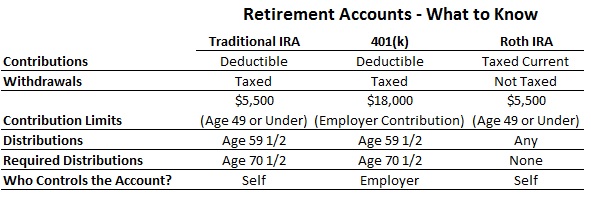

The money you contribute is deducted from your taxable income for the year.

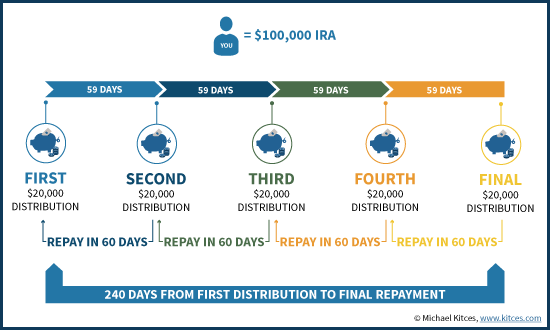

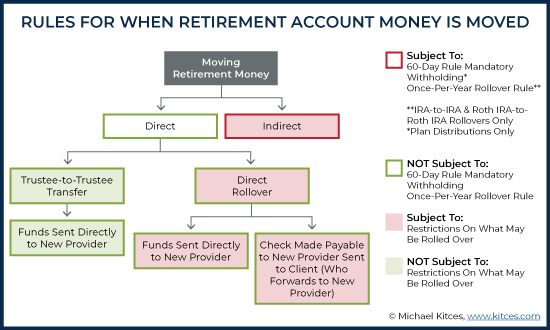

401k rollover limits. Not following the 60 day 401k distribution rule when you have received the funds from your 401k you have 60 days to complete the 401k rollover to another ira or qualified plan. You have up to 60 days to make the ira contribution once the 401 k distributes the funds. Roth ira contribution limits and rollovers. A rollover occurs when you receive a cash distribution from your 401 k and contribute it to an ira.

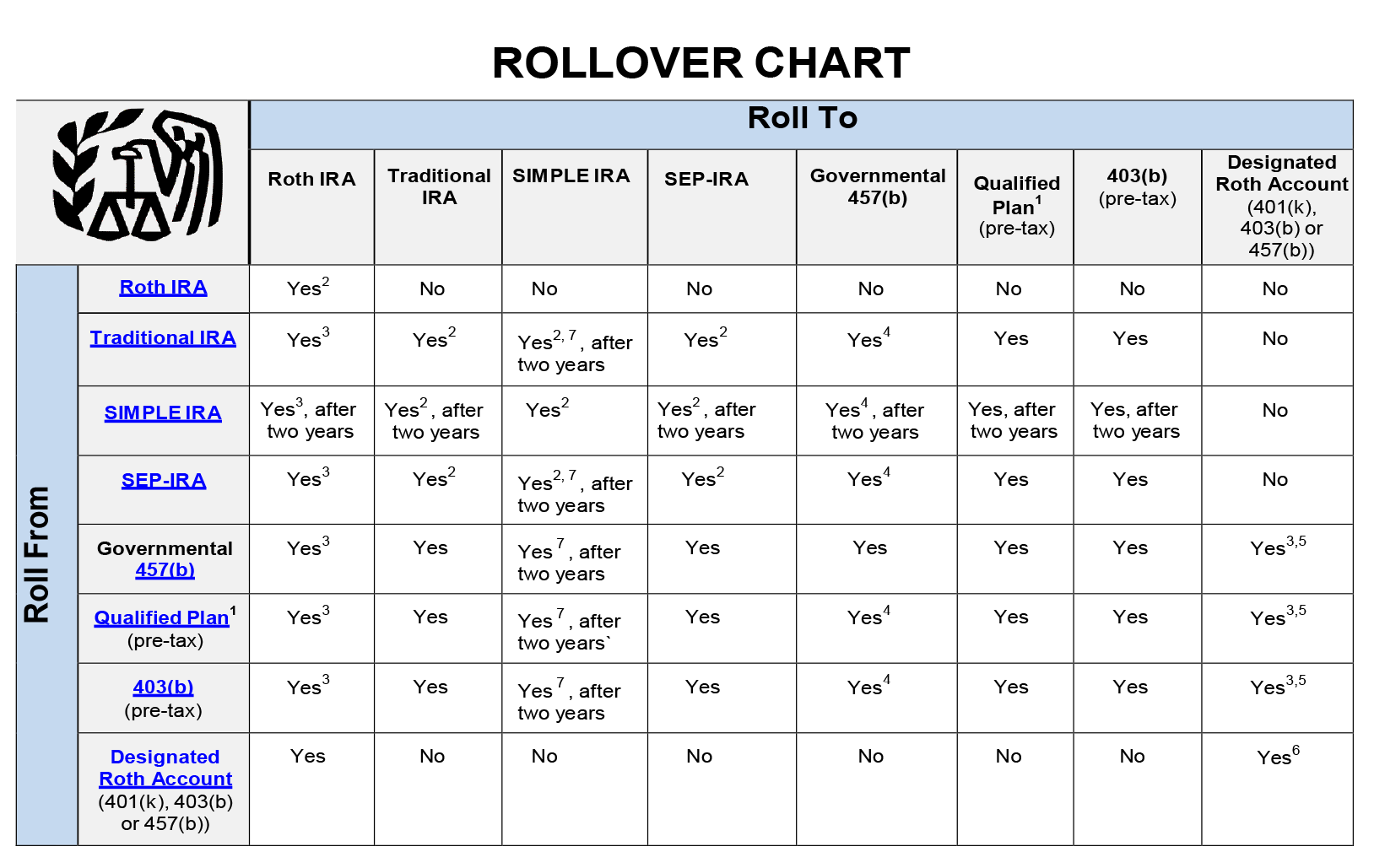

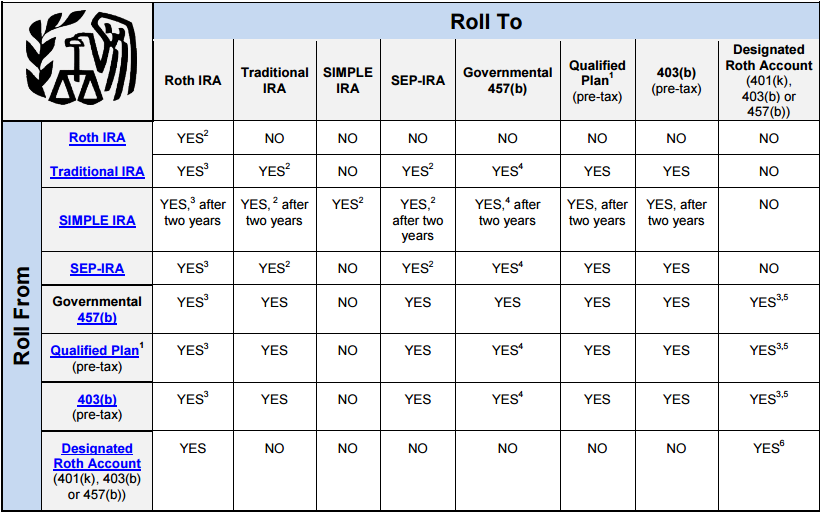

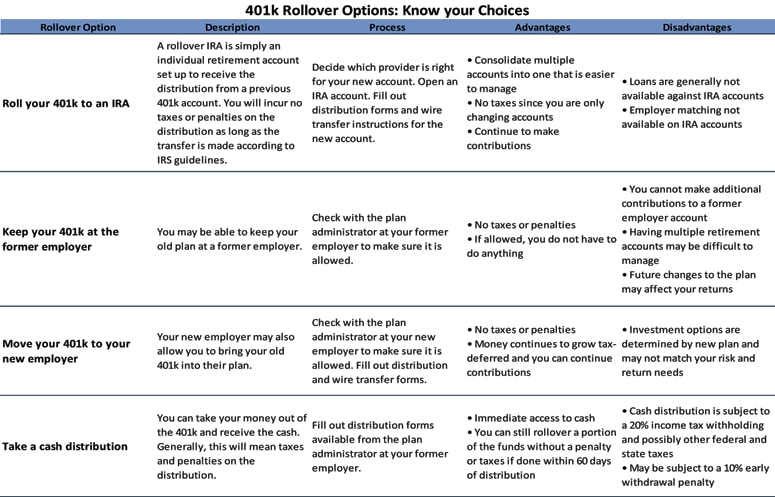

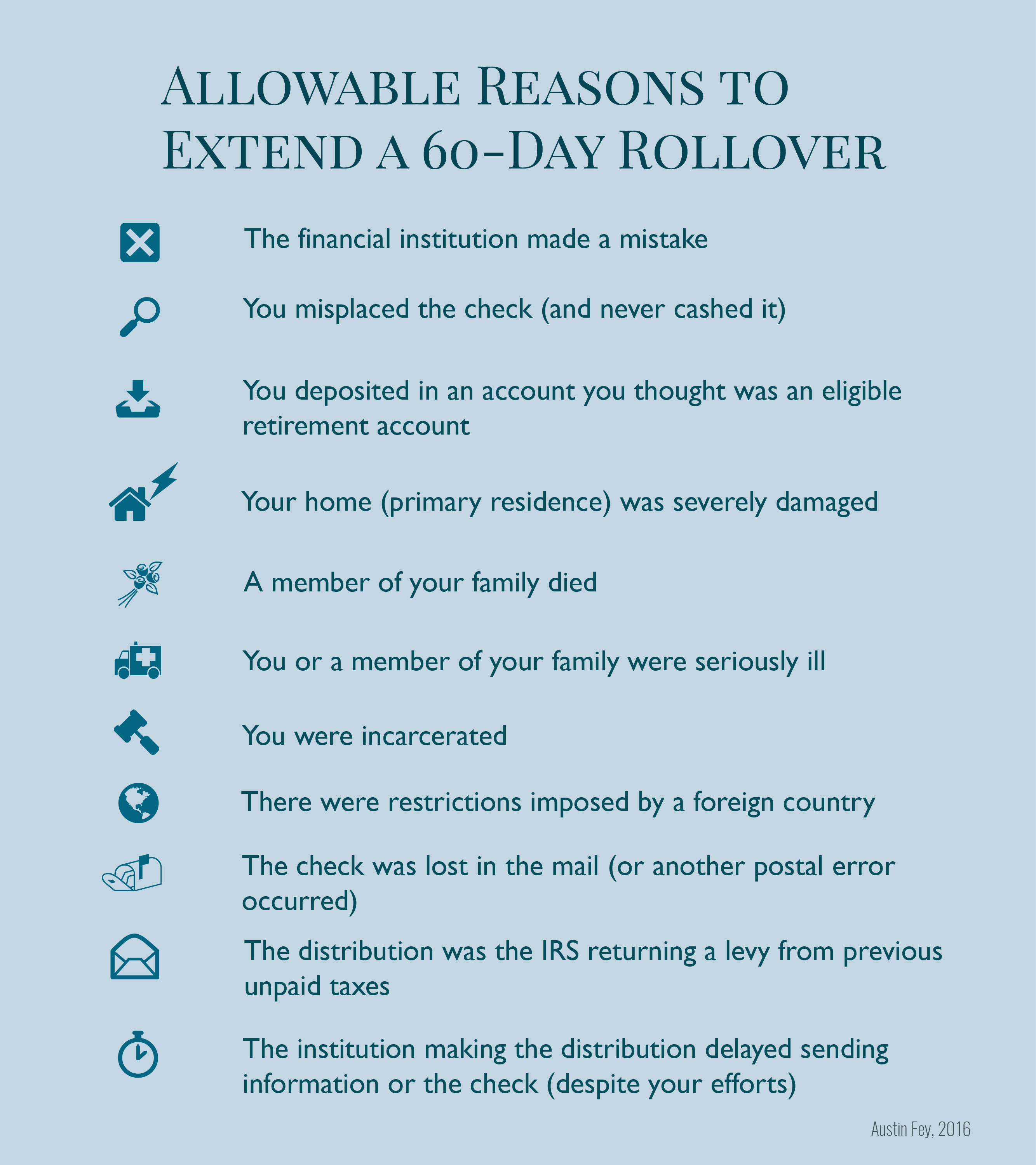

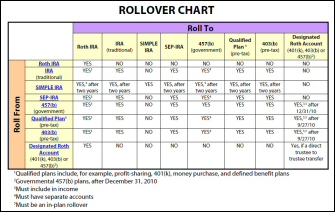

60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. Is there a time limit on a direct rollover from 401 k to ira. There is no income limitation to contributing to roth 401 k as there is with a roth ira. While a direct 401 k rollover is generally the easiest way to facilitate a transfer some people opt for indirect rollovers.

Doing a 401 k rollover to ira isn t terribly difficult. This amount is the same for 2020. This is because the law establishes a maximum allowable modified adjusted gross income to contribute to each type of plan. Top 7 reasons to roll over your 401 k to an ira.

If you miss the deadline by even one day the irs will consider it a taxable distribution. These limits are much higher. Roth ira contribution limits do not apply to rollovers. While your rollover doesn t count as a contribution a rollover from a 401k plan or traditional ira sep ira or simple ira into a roth ira may affect your ability to make a contribution to a retirement plan that year.

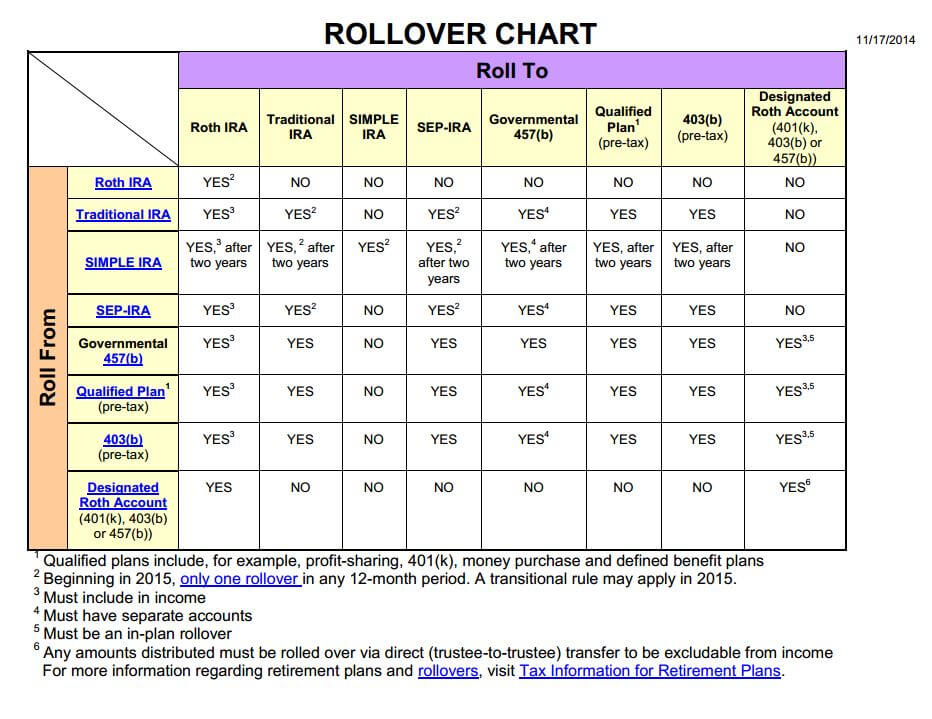

401 k contribution limit increases to 19 500 for 2020. Retirement account owners transfer or roll over more than 300 billion in assets between different accounts each year. How to start a 401 k rollover to ira. Beginning in 2015 you can make only one rollover from an ira to another or the same ira in any 12 month period regardless of the number of iras you own announcement 2014 15 and announcement 2014 32 the limit will apply by aggregating all of an individual s iras including sep and simple iras as well as traditional and roth iras effectively treating them as one ira for purposes of the.

Must know rules for converting your 401 k to a roth.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)