Car Insurance Business Vs Personal

Many personal auto insurers even offer business use coverage on a personal auto policy for a slightly higher charge.

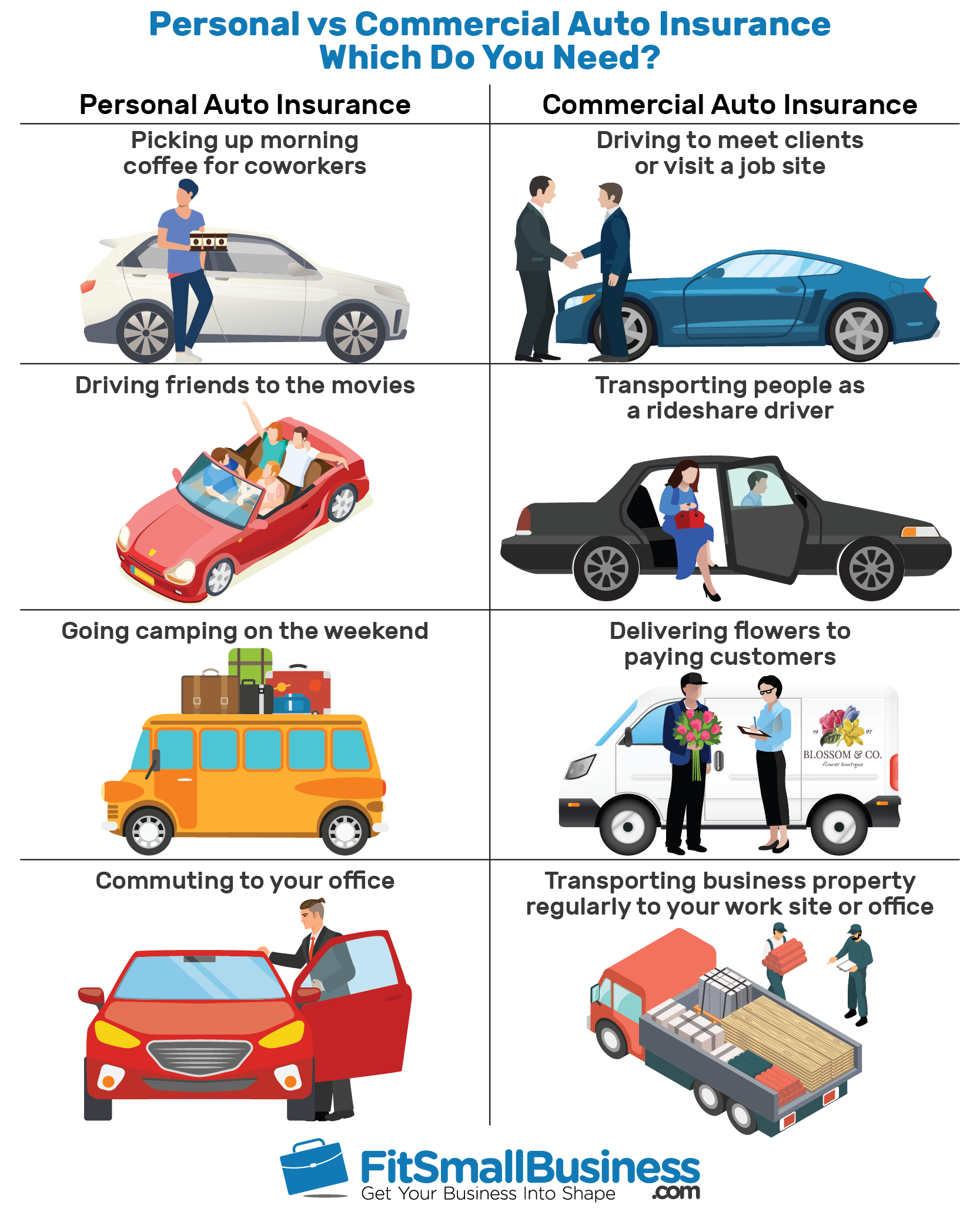

Car insurance business vs personal. This is because of the increased liability issues involved for businesses. However if you require specific commercial auto insurance coverages high liability insurance limits operate an unusual vehicle haul special equipment transport goods or people or have other special needs then you ll need. Think real estate agent more than contractor for this though. If your business owns a vehicle it must be covered by commercial auto insurance.

Although you can pay less for insurance on a personal vehicle you want to check your policy to ensure you are adequately covered if you are in an accident while using your personal vehicle for your business. There are two alternatives to commercial auto insurance. Auto insurance for a business auto can be almost twice as expensive as personal auto insurance. If you have a sign and a ladder rack on your f350 dually you re likely a commercial auto candidate.

You could need commercial auto insurance if you carry work equipment regularly drive to visit clients and more. Whether you own a commercial fleet or use your personal car for business trips having the right nm commercial auto insurance policy is critical. Personal auto insurance may be recommended for those who use their vehicles for work infrequently and do not transport items or people as part of their business operation. Personal auto insurance and relying on commercial auto insurance vs personal cost.

For many business owners driving for business related purposes is a must. The main difference between personal and commercial auto insurance is who owns the vehicle. While many don t think twice about the repercussions of going without it this could mean the difference between staying in business and failing to a lack of insurance.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

:max_bytes(150000):strip_icc()/list-of-Information-to-collect-for-an-accident-report-form-if-you-have-a-car-accident-5758ca1f3df78c9b4634c98e.jpg)

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

/agents-versus-brokers-and-how-they-make-money-462383-color-V2-cc2b7ad3db6c4ee5a0d2302843c1213f.png)