Bank Pre Approval Mortgage

Now you can be pre approved search for a home and get mortgage approval all in one place all online.

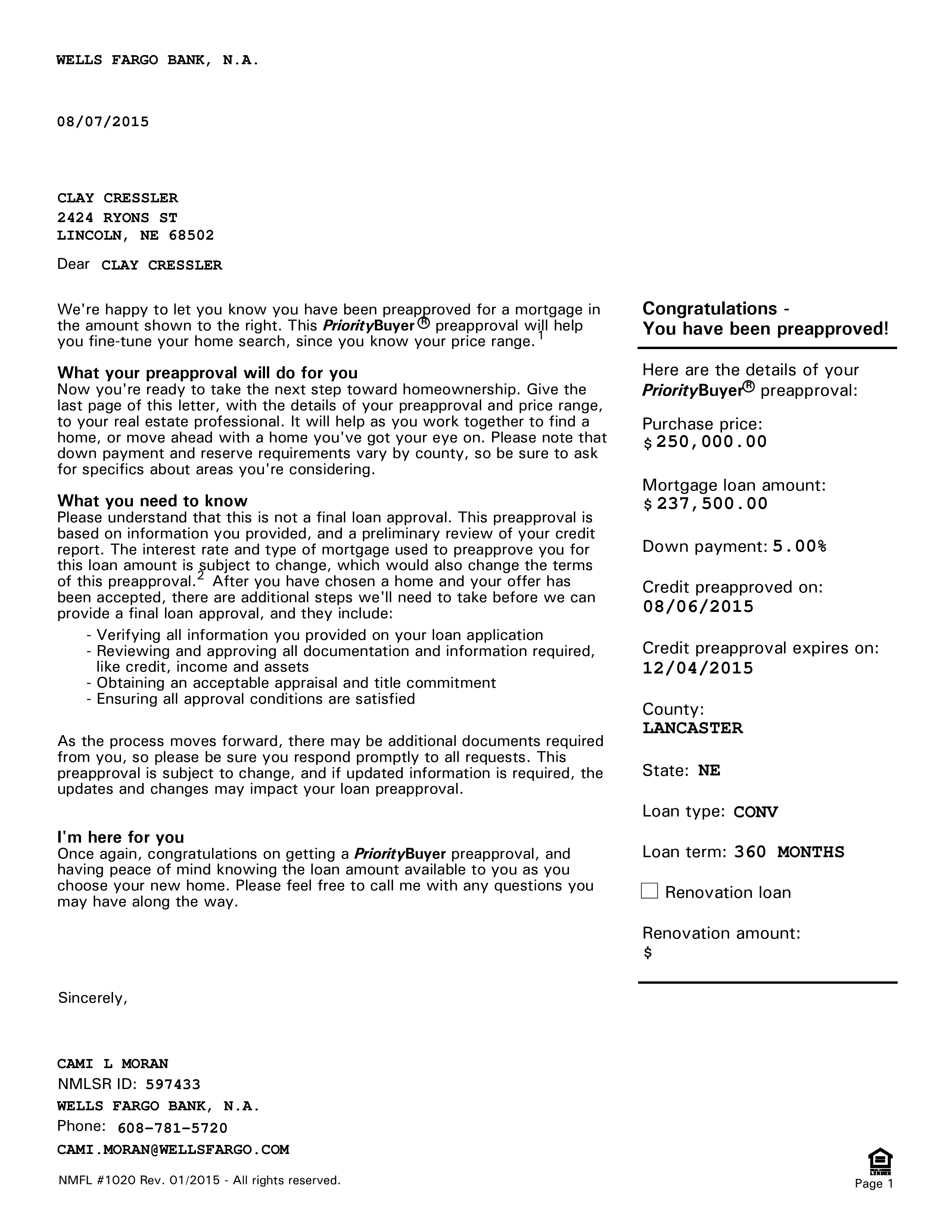

Bank pre approval mortgage. Pre approval means that a lender has stated in writing that you qualify for a mortgage loan based on your current income and credit history. All loans subject to program and full underwriting credit approval. For most pre approval inquiries this process can. Enjoy the benefits of a pre approval for.

Bank 34 is federally chartered and this certifies us to do mortgage loans in any state. Requirements for pre approval. Know the maximum amount of a mortgage you could qualify for. So getting into your new home is now faster and easier than the usual route.

Your borrowing capacity loan repayment mortgage rate it all becomes clear. 10th st alamogordo nm 88310. Mortgage pre approval is a more significant milestone in the process because a lender is actually checking your credit and verifying your financial information. Bank 34 corporate 500 e.

A pre approval usually specifies a term interest rate and mortgage amount. Learn what it means to get pre approved vs. Style body visibility visible style skip to main content bank of america. It concretizes the process of buying your property.

If you re pre approved a lender is making an actual commitment subject to conditions such as a property valuation to loan you money. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. Getting pre qualified for a mortgage so you can determine the option that works best for you. Fees conditions may apply.

With a pre approval you can. It also provides an estimate of how much you may be able to borrow a good first step in your house hunting journey. A pre approval is typically valid for a brief period of time and usually has a number of conditions that must be met. A pre approval goes a step further by verifying your financial information we re able to provide you with a firm lending commitment that tells you exactly what you re qualified to borrow.

To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation. Is a mortgage pre approval necessary. A preliminary pre approval tells you what you may qualify to borrow when the time comes to apply for a mortgage. Estimate your mortgage payments.

This is not an offer to lend.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)