50 Joint And Survivor Annuity

A joint and survivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary.

50 joint and survivor annuity. 50 joint and survivor annuity means with respect to a participant a form of payment that is the actuarial equivalent of a participant s part a retirement benefit and under which the benefit is paid in monthly installments commencing as set forth in section 3 4 and continuing for the lifetime of the participant with 50 of such amount being paid to the participant s beneficiary for so. A joint and survivor annuity is an annuity that pays out for the remainder of two people s lives. The amount of survivor benefit will be defined as a percentage of the initial annuity amount. With a 50 percent joint and survivor annuity the payment will reduce by half when the first person dies.

For an annuity starting date prior to february 1 2006 the pension amount shall be adjusted as follows. Monthly payments are lower than under a single life annuity because you re covering both you and your spouse. Depending on the contract the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent. A qjsa generally requires at least a 50 survivor annuity.

There are also provisions for making payments to a third party. When a 50 joint and survivor pension becomes effective the amount of the participant s monthly pension shall be reduced in accordance with the following. You might be able to choose either a 100 75 or 50 percent joint and. A qualified joint and survivor annuity provides lifetime payments to spouses children or dependents.

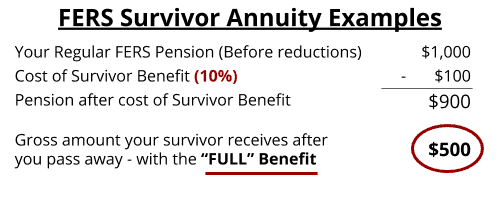

When you choose a joint and survivor annuity over a single life annuity it means making a trade off the payout that you receive from the annuity is lower than what you d get from a single life annuity since you re splitting it between two people assuming you have the same amount of money to invest in purchasing the annuity. A joint and survivor annuity is an insurance product for couples that continues to make regular payments as long as one spouse lives. Joint and survivor annuity disadvantages. Once you pass away your spouse will receive payments for the rest of her life but it will only amount to 50 of your original payment.

With this annuity you will get a payout for as long as you live.