Account Receivable Financing Companies

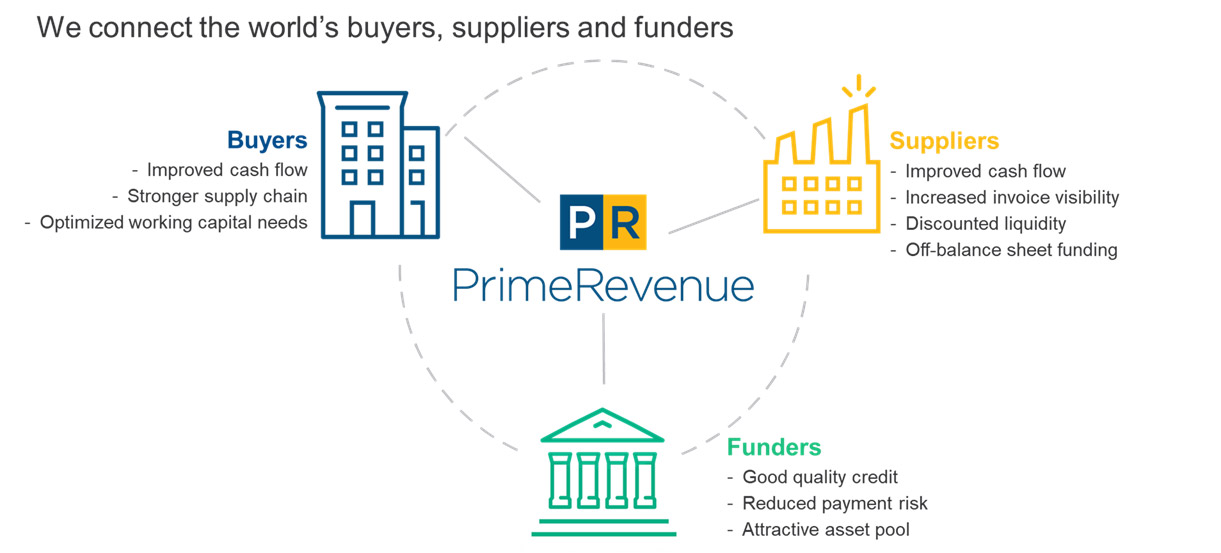

Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them.

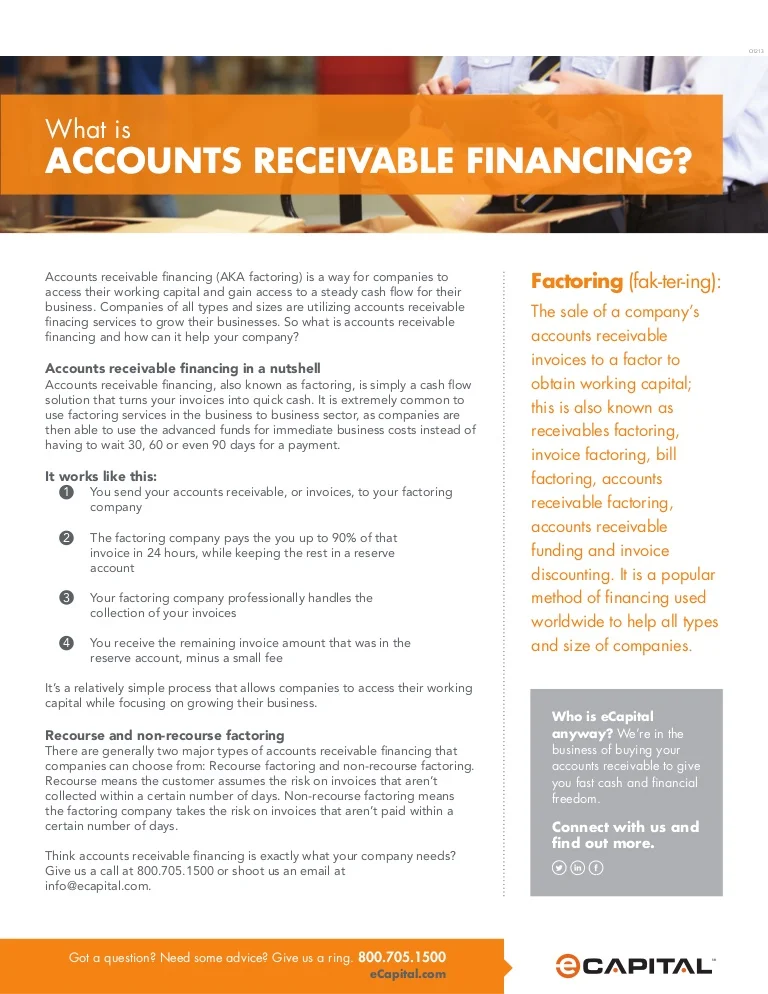

Account receivable financing companies. The only disadvantage of accounts receivable financing is that a there is a financing cost paid to the lender or factoring company that is providing the accounts receivable financing. A r financing is based on the value of outstanding receivables. A key for any business to run smoothly and successfully. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

Accounts receivable financing allows companies to receive early payment on their outstanding invoices. The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable financing has the major advantage of providing the money for the goods and services you sold 30 or more days before a typical a r cycle. We reviewed more than 20 invoice financing companies and selected the six best.

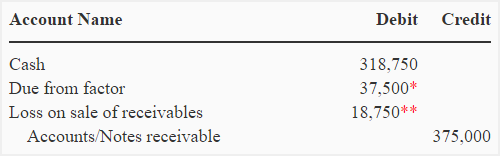

Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor.

This solution allows the business to receive payment sooner. Companies allow their clients to pay at a reasonable extended period of time provided that the terms are agreed upon. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. This helps to improve customers cash flow.

Accounts receivable a r financing companies can provide fast affordable funding to smooth out a small business s cash flow or provide access to short term working capital. To a financing company that specializes in buying receivables called a factor at a discount.