Annuities Selling

This is a growing trend as more and more consumers are comfortable making purchases online especially the younger demographics.

Annuities selling. You need to complete the product training provided by each company you contract with. Selling annuity payments could be the solution for an array of financial woes. Make sure you are well educated before you start selling annuities. In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit.

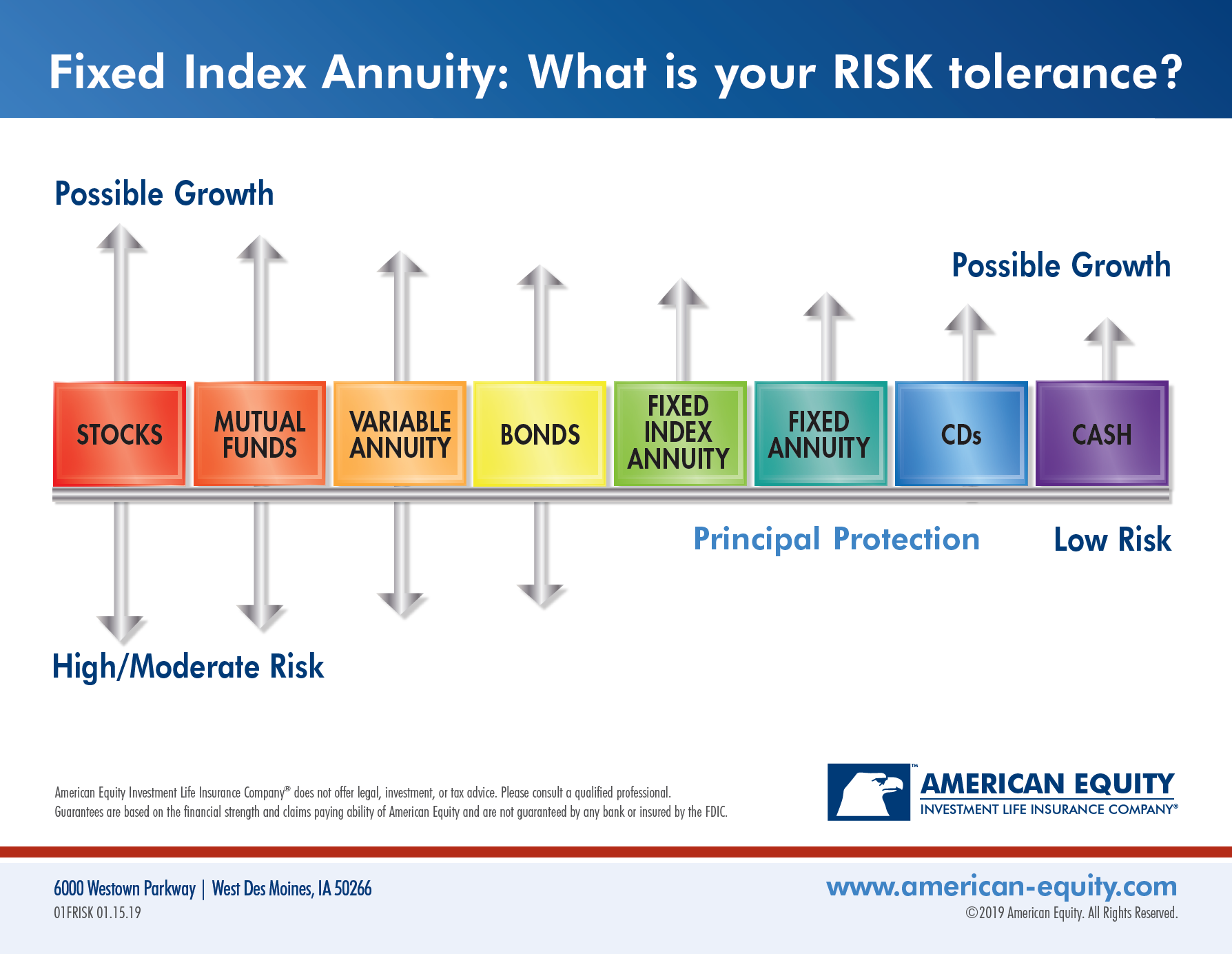

For an agent to sell fixed annuities they only need a life insurance license issued by their state of residence fixed annuities are primarily represented by five different products. In order to sell annuity you do need to check a couple items off your to do list. All fees should be clearly stated in the contract. Selling your annuity payment does have tax implications.

In illinois you need to take a 4 hour annuity suitability course. In contrast to selling annuities purchased through insurance companies selling the rights to structured settlement payments is a legal process that requires court approval. Selling annuities how to sell annuities online. Make sure you read and understand your annuity contract.

Insurance companies sell annuities as do some banks brokerage firms and mutual fund companies. Your most important source of information about investment options within a variable annuity is the mutual fund prospectus. The average surrender fee on the 10 top selling indexed annuities in 201 was 9 percent in the first year according to research by annuityspecs beacon research and fidelity life insurance co. With life insurance and annuity products the commission paid to the selling agent is typically built into the policy.

Offering another layer of protection for sellers structured settlement protection acts the state and federal laws that safeguard the rights of settlement holders govern the practices of purchasing companies. Annuity agent commissions are built into the policy. First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract. Single premium immediate annuities spias longevity annuities also called deferred income annuities or dias fixed rate annuities also called multi year guarantee annuities or mygas qualified longevity.

Below are the 6 simple steps to selling annuities online. Whether that includes buying a new house paying for a new car paying for college tuition or even balancing medical expenses cashing out a portion of your annuity could be the solution to avoiding unnecessary debt. Training and e o insurance for annuity sales.

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)