Auto Insurance Scores

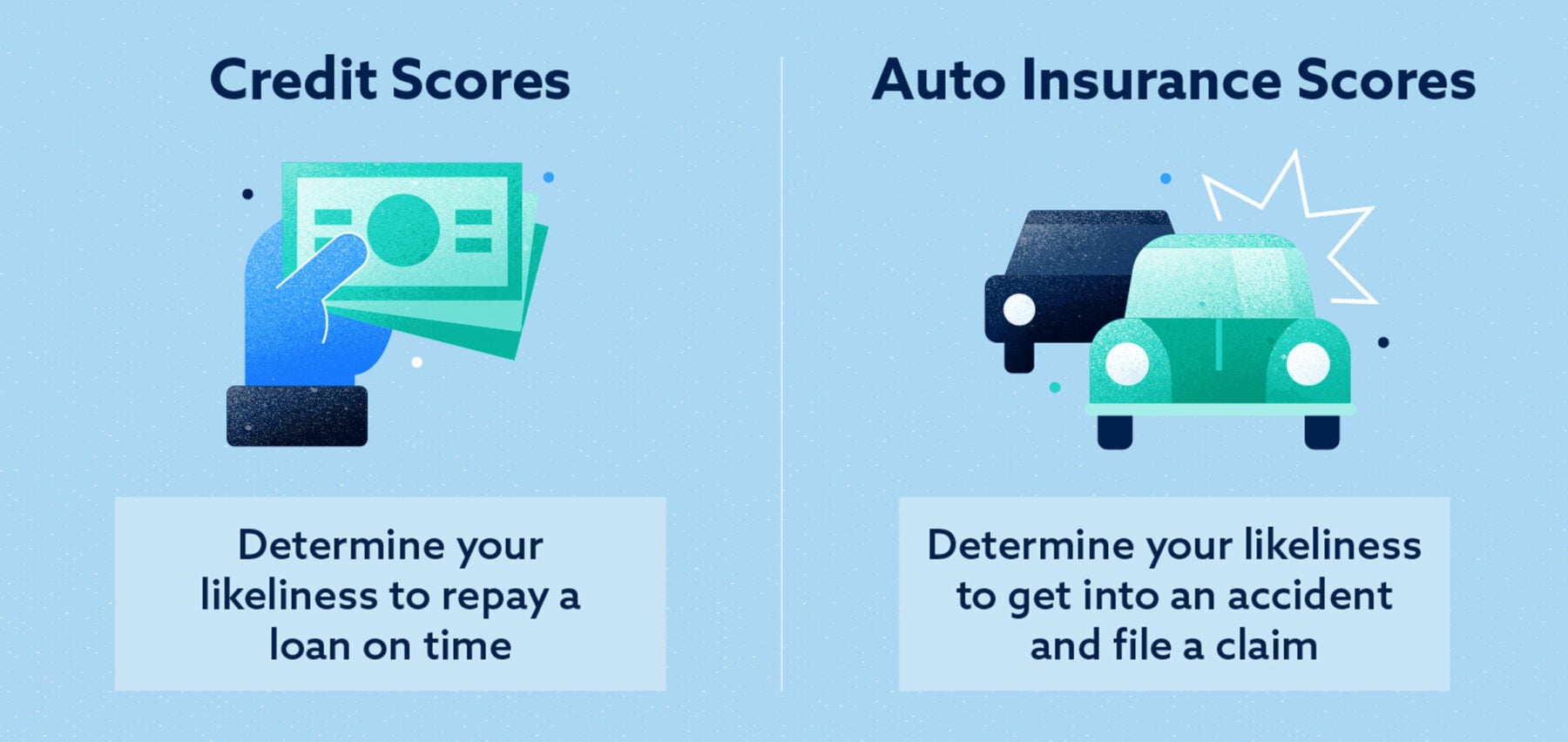

These scores are used to predict risk and help determine how much to charge an individual for coverage.

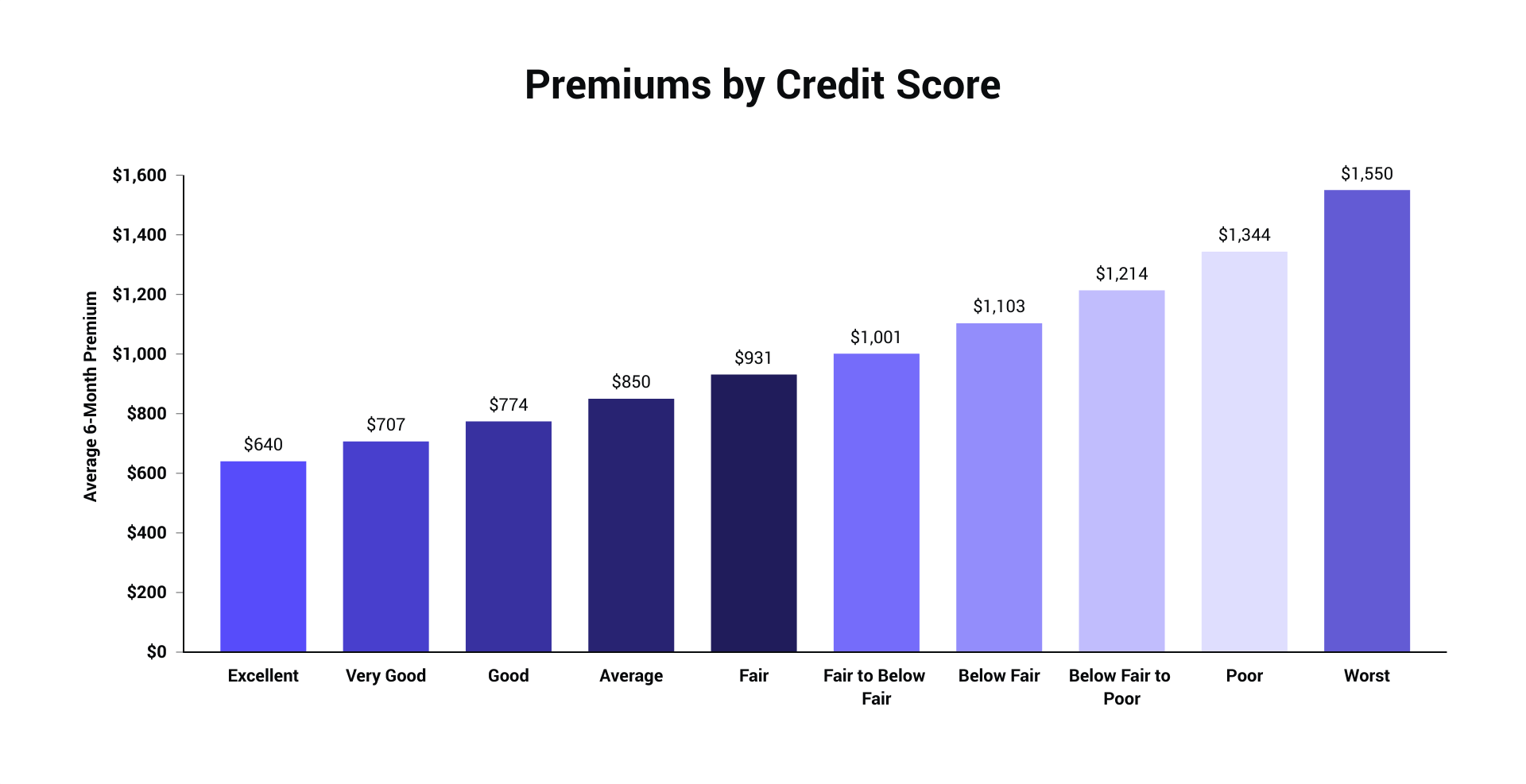

Auto insurance scores. An insurance score is a key component in determining the total premium that an individual pays for health homeowners auto and life insurance policies. An insurance score is a number that the insurance industry comes up with to determine whether you re going to have a high monthly premium a low one or something in between. The final word on your auto insurance score. Find more information about how you can improve insurance score.

Your auto insurance score also called a credit based insurance score or an auto insurance credit score measures how likely you are to file an insurance claim. Understanding insurance scores. Auto homeowners and renters insurance services offered through credit karma insurance services llc dba karma insurance services llc. Your insurance score is a rating used by car insurance companies to figure out the probability that you will file a claim under your car insurance policy.

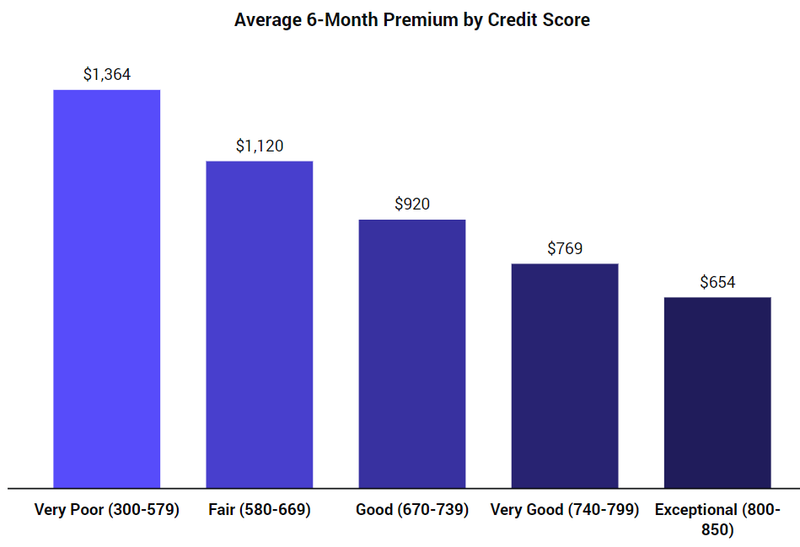

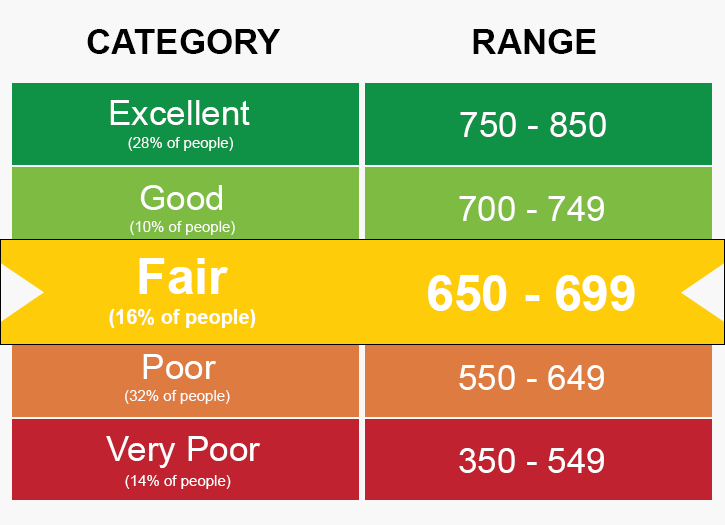

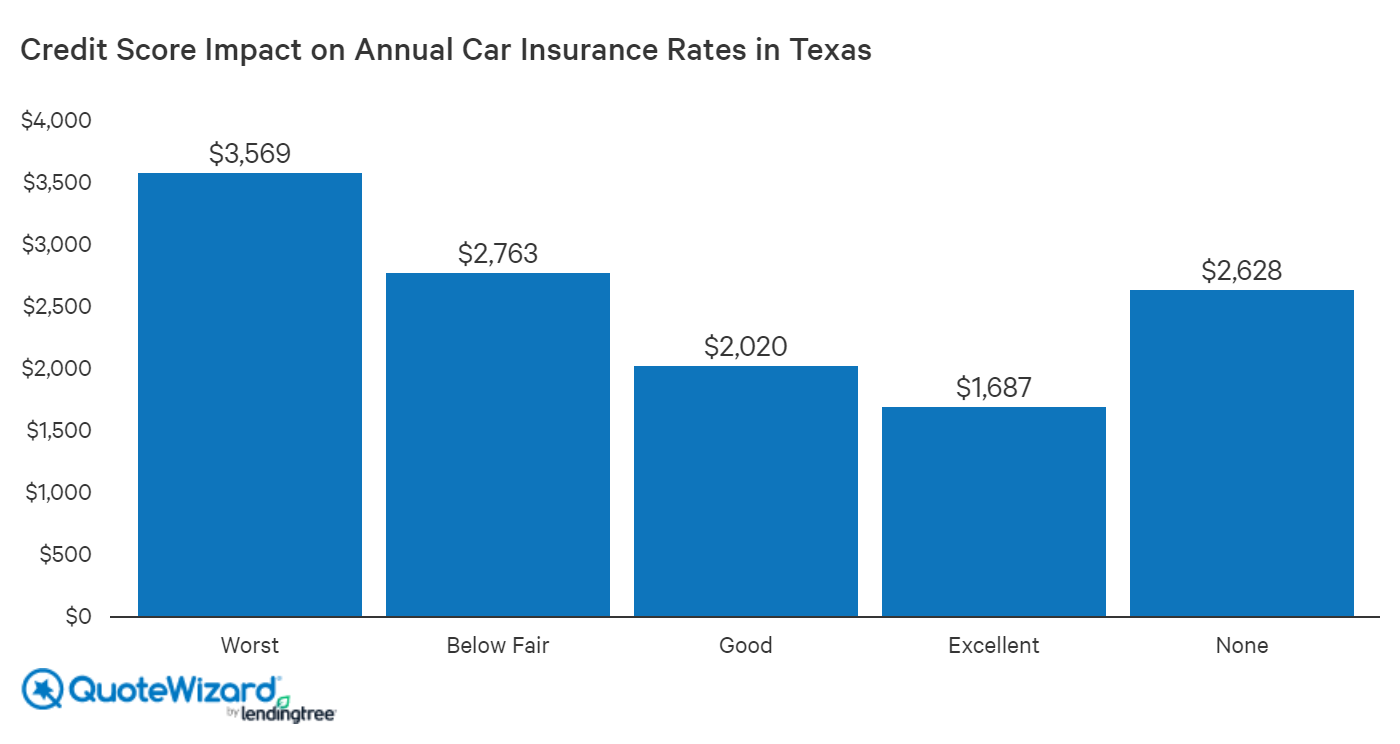

Like other insurance scoring auto insurance scoring takes into account all of the information that is found in your credit score plus your past auto insurance history. An auto insurance score is really just another term for insurance score that is used in the specific context of automobile insurance. Credit information is very predictive of future accidents or insurance claims which is why progressive and most insurers uses this information to help develop more accurate rates. Ca resident license 0172748.

Only mortgage activity by credit karma mortgage inc dba credit karma is licensed by the state of new york. Auto insurance scores are tailored specifically to assess your risk as an insurance consumer and most of them are largely based on the same information as traditional credit scores. Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk so insurance companies use available data to determine which candidates have the lowest probability of filing a claim. The major things that affect your car insurance score are your credit score and your claims history.

An insurance score is a calculation used to help rate the risk of insuring a specific individual. An insurance score also called an auto insurance score insurance risk score or credit based insurance score is a score based on items in a driver s credit history that helps insurers estimate his or her likelihood of filing a claim.