Bankruptcy Judgment

Companies directors duties hamid marine services engrg pte ltd v foo siew wei 2 ors 2020 sghc 190.

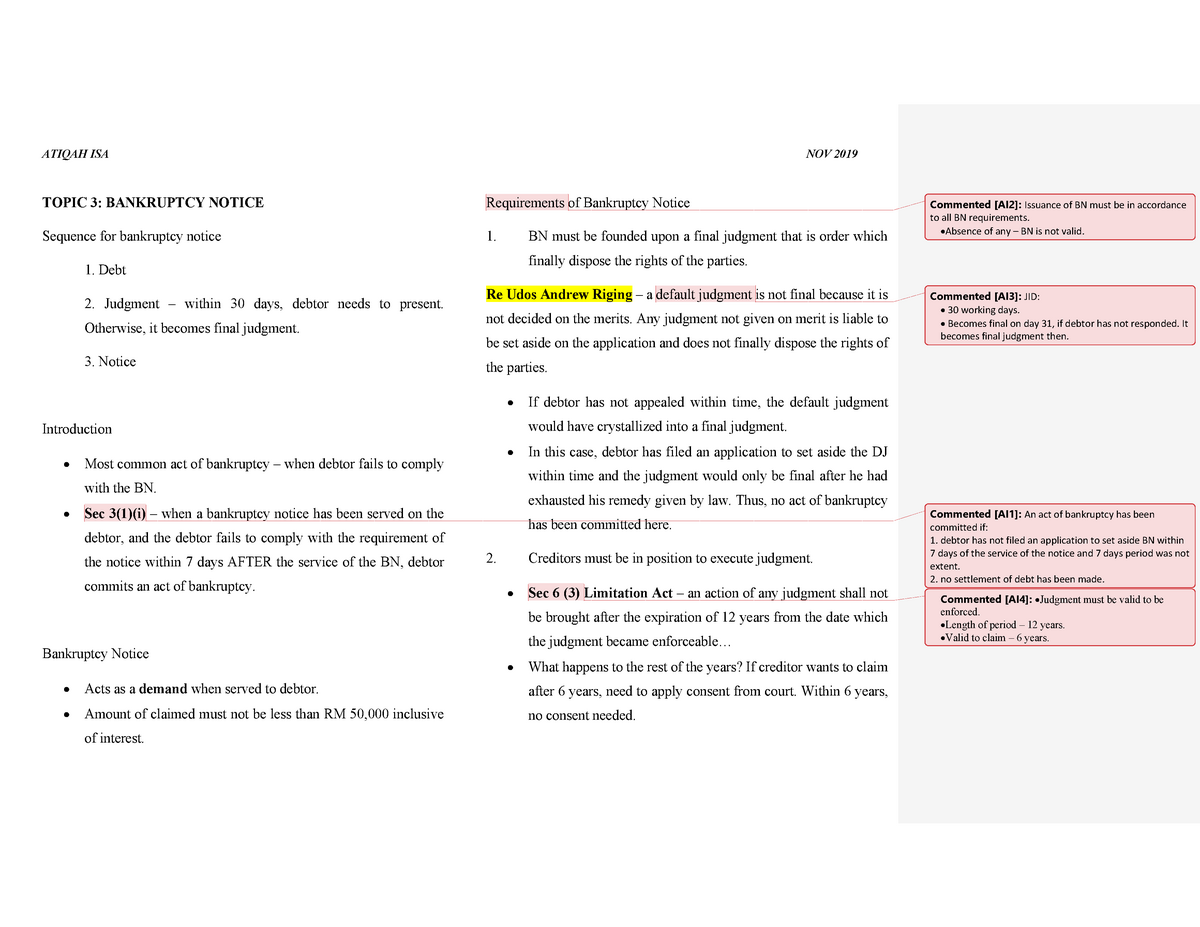

Bankruptcy judgment. When you file for bankruptcy holders of judgments against you are required to stop efforts to collect what you owe them so any wage garnishments or collections from bank accounts must cease. Chapter 7 bankruptcy unless your lender has placed additional liens on your other assets after obtaining the deficiency judgment the judgment is no different than any of your other general unsecured debts such as credit card debt or medical bills. This is a common outcome for judgments relating to credit card balances medical bills installment loans and secured debt such as car loans if the collateral is worth the same or less than the bankruptcy exemption amount. A judgment after trial occurs when you and your creditor argue your case before a court and the court finds you liable for the debt.

Judgments however create a lien on your property and liens don t go away in bankruptcy automatically. In new york a judgment creditor has the right to freeze your bank account take part of your wages and continue to add interest on the amount due at a statutory rate until the debt is paid in full. If you are dealing with an experienced debtor who is a person not a company then they may have taken steps to avoid having their assets seized and sold to satisfy a judgment or court order. Bankruptcy may be the best option to enforce a judgment in some circumstances.

Once the collector obtains a default judgment a default judgment is a common reason to consider filing for bankruptcy.