Automobile Insurance Fraud

Car insurance fraud is a sneaky and complicated business but steps are being taken to fight it.

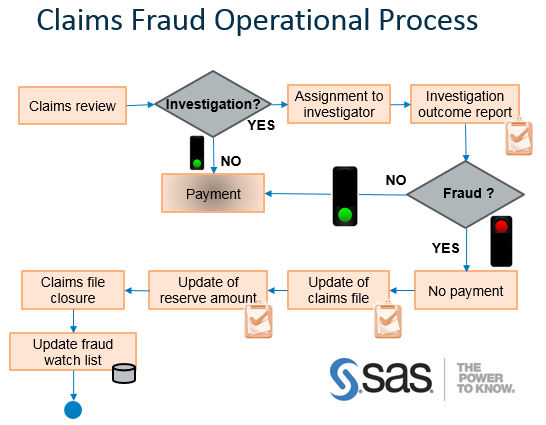

Automobile insurance fraud. Auto insurance fraud cases the cost of accident injury claims and abuse of the system all contribute to rising insurance costs. Common questions about insurance fraud. In choice no fault states drivers may select one of two options. How can i prevent car insurance fraud.

If you suspect you re the victim of fraud let your insurance company know. The insurance research council estimated that in 1996 21 to 36 percent of auto insurance claims contained elements of suspected fraud. Car insurance fraud according to the information insurance institute iii is most prevalent in no fault states. Auto insurance fraud is a commonly perpetrated fraud in the u s occurring when people fake traffic accidents inflate claims and even fake auto related deaths in order to receive auto insurance payouts.

A no fault auto insurance policy or a traditional tort liability policy. Workers compensation committed by both employees and employers especially during economic downturns and in high risk industries. This blog post examines. Car insurance fraud is a serious and potentially dangerous criminal offense.

There is a wide variety of schemes used to defraud automobile insurance providers. If you suspect you ve seen fraud get in touch with your state s department of insurance. Resources used on traffic closures investigations and law enforcement. Harm to the victim s credit rating.

The consequences for car insurance fraud vary from denied claims and dropped policies to fines and even jail time. Injuries and or fatalities to the victims. Of which there are three specific kinds of systems. And health insurance and medical fraud which.

Types of auto insurance fraud. Insurance fraud is a crime that involves knowingly providing false information to an insurance company in order to receive compensation or benefits. Auto insurance fraud penalties and fines. Car insurance fraud can take many forms from omissions on an application to filing false or exaggerated claims.

While fraud is constantly evolving and affects all types of insurance the most common in terms of frequency and average cost are. All drivers need to be aware of the signs of car insurance fraud. Additional effects of car insurance fraud can include. Automobile insurance which is widely believed to be most affected by fraud.

If you suspect insurance fraud call 1 800 tel nicb to report it. Insurance investigators have even discovered some insurance adjusters getting in on the act for a fee. Car insurance fraud is when someone lies to the insurance company for financial gain. Even if you never find yourself in the middle of one of its sleazy scams car insurance fraud affects you.