Bb T Business Loans

If you re considering a bb t business loan or other financing we ll break down what you can expect from the financial institution.

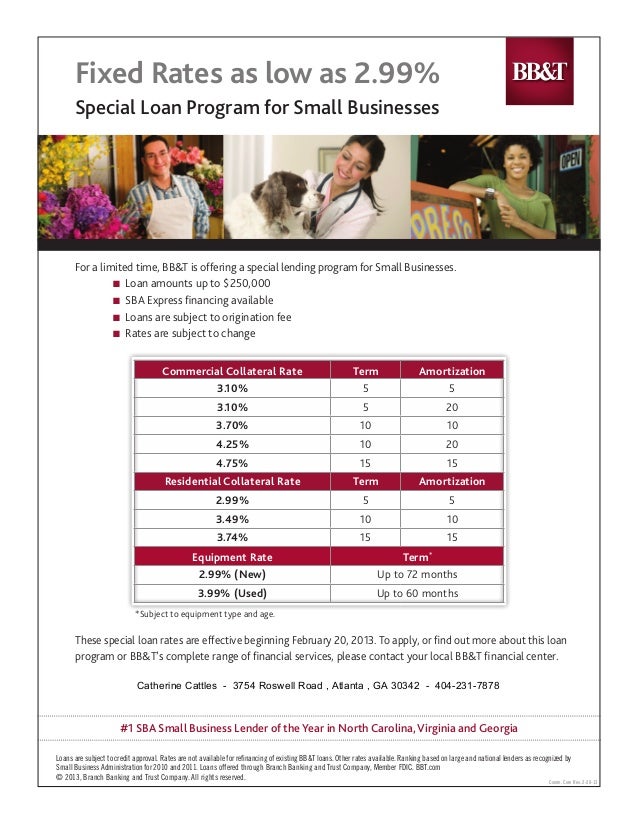

Bb t business loans. Bb t commercial equipment capital provides leasing and financing solutions to all types of business entities nationwide. Bb t is also a small business administration sba preferred lender issuing sba backed loans. Bb t offers flexibility in repayment options and also provides a secured and unsecured line of credit. Bb t offers mortgage and home equity products in 15 states and washington d c.

We specialize in financing for commercial use equipment and software. Mutual fund products are advised by sterling capital management llc. Bb t s small business loans could help owners who need an influx of capital. Bb t borrowing products offer convenient access to funds when you need to finance working capital purchase equipment expand the business buy a building pay employees and more.

Commercial lending at bb t offers a variety of loans to meet your business needs including equipment or inventory financing business lines of credit or loans. Bb t didn t disclose the average apr range but said your credit quality repayment term loan amount and whether the loan is backed by collateral affect your rate which can be. Bbt is a good option if you have fair to good credit and need money fast loan officers say they can approve and fund a loan in the same business day. The bank issues conventional adjustable rate jumbo veterans affairs u s.

Mortgage products and services are offered through suntrust mortgage a tradename for suntrust bank now truist bank. Through our bank and syndication divisions we can provide financing for transactions over 1 000 000. Bb t offers not just loans but other business services for merchants such as payment processing and cash management option that coordinates the collection of receivables and invoice payments to maximize cash flow. Business owners can get a secured or unsecured loan for up to 5 000 000 according to a representative repayment terms are generally between 36 and 120 months depending on collateral per the representative.

With the combined strengths of heritage firms suntrust robinson humphrey and bb t capital markets at its foundation truist securities offers extensive investment banking capital markets and corporate banking capabilities for growth oriented companies and institutional investors.

/bbt_3x1-3ba08b1e39b2486f8c4c6b272121a765.png)

%20v2.jpg)