Benefits Of Refinancing Student Loans

Student loan refinancing can mean big savings in the right circumstances.

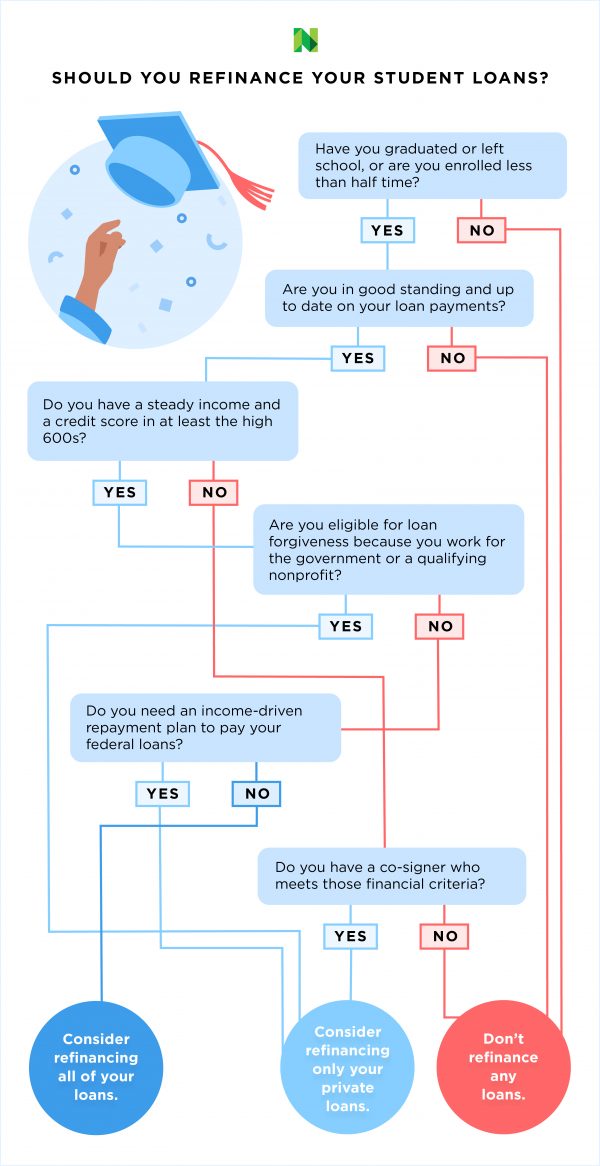

Benefits of refinancing student loans. Before you decide if refinancing is the right course for you it s key to understand how student loan refinancing works. It might make sense to consolidate multiple other loans into a single loan if you can get a lower interest rate than what you re currently paying. Consider the pros and cons of refinancing student loans. When you refinance your student loans you are working with a private company.

Pros and cons of refinancing student loans. While student loan refinancing can save you money it might not help if you end up losing your job and can t make payments. Sofi is perhaps best known as a student loan refinance lender but it also makes loans to undergraduates graduate students law and business students and parents. Overall there are many benefits to refinancing your student loans that have a positive outcome on you and your financial state.

As such you are on their playing field dealing with their rules. A new private company typically a bank credit union or online lender pays off the student. Whether you want to refinance student loans individually or consolidate your loans together student loan refinancing may help make your monthly payments more manageable and possibly reduce your interest rate or overall debt. You d have the loan paid off in 15 less years.

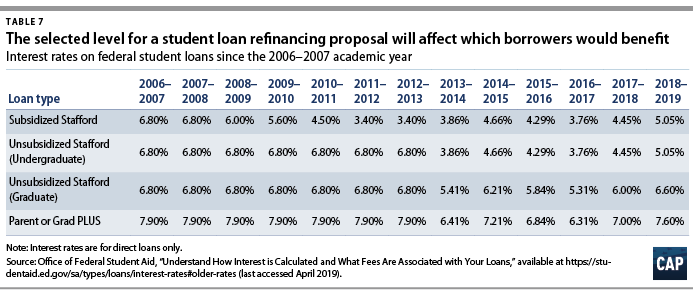

Here s how it works. For example you might want to refinance a 30 year home loan into a 15 year home loan that comes with higher monthly payments but a lower interest rate. Its undergraduate student loan. The benefits of refinancing student loans if you have a secure job emergency savings strong credit and are unlikely to benefit from forgiveness options it may be a choice worth considering if you re looking to lower your payments.

Another benefit of refinancing student loans is the ability to receive an estimated rate without affecting your credit score which eliminates the risk of prequalifying. There are also loan discharge benefits in the case of death or permanent disability on certain federal student loans. But federal student loan borrowers give up these benefits if they refinance. Refinancing means lumping your existing federal and private loans into a new loan with a private lender.

Here are the main benefits of refinancing your student debt. Perhaps the biggest benefit of refinancing student loans is qualifying for a lower interest rate. Snagging a lower interest rate on your loans. If you refinance a federal loan with a new private student loan you will no longer be eligible to participate in these federal loan forgiveness programs.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/rescue-592684016-5c1a697b46e0fb0001312f8c.jpg)