Best Business Line Of Credit Company

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)

A business line of credit is a revolving loan with a credit limit that s available to draw on whenever you need some cash for your company.

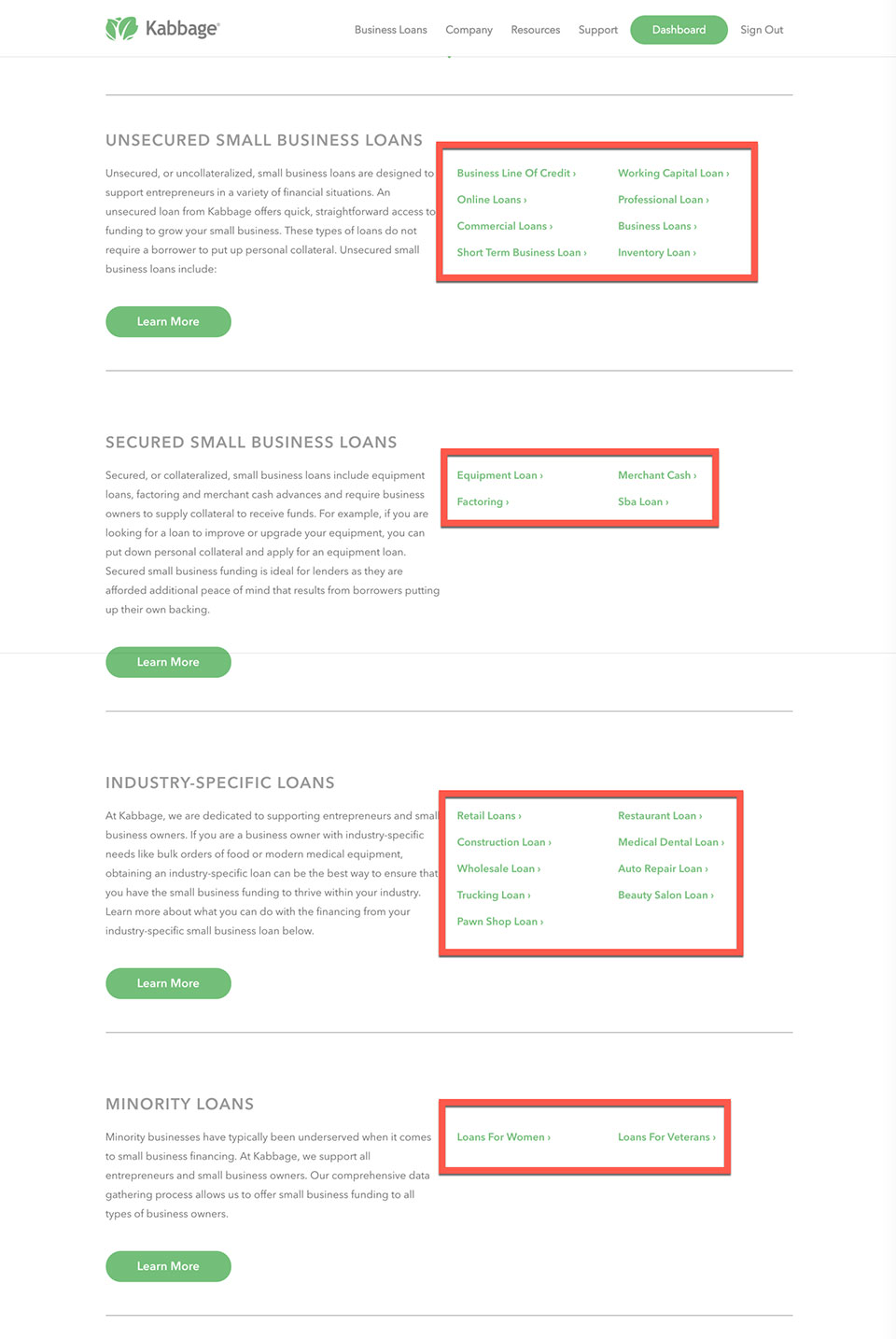

Best business line of credit company. Who it s best for. Best business line of credit for your company. A business line of credit such as the option offered by american federal credit union is a flexible option that can provide a significant funding stream to cover equipment supplies inventory marketing and countless other operational costs. September 2020 how we evaluated the best business lines of credit when evaluating the best business lines of credit we considered rates terms qualifications and funding speed to be equally important.

A business line of credit provides small businesses flexible short term financing. A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. The line of credit is yours to access as you need without having to apply for a loan or explain why you need the funds. Learn more about this type of credit and compare options up to 250 000.

A business line of credit works best for businesses that are in need of flexible ongoing access to financing. For example a business owner may use a business credit line for funding payroll or overhead expenses during a seasonal slump or may draw on the credit line for a major expense that comes out of the blue. Aside from banks small companies can take advantage of federal loans such as small business administration loans work with credit unions or even consider online alternative lenders. A business line of credit lets you keep borrowing and paying back over and over this is called revolving credit so you don t have to reapply for financing every time a new need arises within the term of the credit line.

Best business line of credit for established businesses. While most traditional lenders offer better rates they also have higher qualification requirements and slower funding speeds on lines of credit. For these online lenders working with smaller companies is more useful considering they can be growth partners and create lasting working relationships. It s kind of like a business credit card but lines of credit usually work better for large working capital expenses.

Which is best for your company. For example the company s credit line incurs fees of 13 99 39 90 apr but repeat customers may be eligible to receive discounts on their rates depending on their credit line standings.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/cash-flow-how-it-works-to-keep-your-business-afloat-398180-v3-5b734281c9e77c0057b67a4c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)