Best Life Insurance With Living Benefits

/Prudential-29bf7b6cf6dc4470a6b1761d68abfd0c.png)

In no way should a life insurance living benefits policy ever replace a health insurance plan as the two are not comparable.

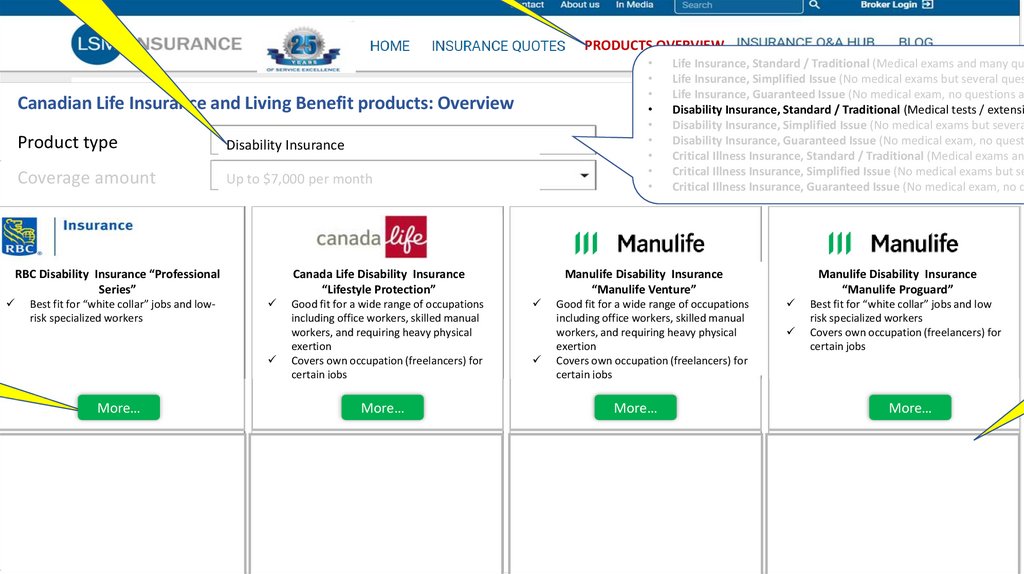

Best life insurance with living benefits. In some cases a life insurance company may provide living benefits as part of a life insurance policy package. This allows the policyholder to access a portion of the death benefit while he she is still alive. Moreover it is dependent on the state and there is also a limitation to the benefits regarding frequency and amount of cash. Living benefits are offered before you die and death benefits are offered well you get the picture.

The living benefits on each one add extra bonuses for people looking to make the most out of their term life insurance. The main reason to have life insurance is for the death benefit. That not only is having living benefits on your policy well worth it but in 2018 most companies include them at no additional cost to you. Examples of living benefits include critical illness riders long term care riders and other cash advance arrangements that take money from your death benefit amount and pay you while you are still alive to access care or due to pre defined hardships like disability or loss of.

Learn how your life insurance policy can benefit you and your family while you re alive. But what if i told you. When considering life insurance with living benefits it s important to understand that this is a life insurance policy first. All three companies provide great life insurance policies.

Term life insurance that offers living benefits is the top choice. Yes life insurance can offer the advantages of both death benefits and living benefits. But that s only part of the story. Life insurance also provides benefits that you can access while you re living.

The living benefits of life insurance allow the policy owner to access cash while still living. Life insurance with living benefits is a rider provision that is added on to most life insurance policies at no additional cost to you. Living benefits life insurance comes with many advantages and very few disadvantages. Living benefits are a useful way to advance part of your death benefit early while alive or living if certain covered events happen.

You probably have seen several sites online talking about how life insurance with living benefits isn t worth the money or is a bad option. Others like terminal illness insurance are included as a rider. Dealing with a critical chronic or terminal illness let s say you develop a chronic illness that s going to require a long term approach to getting better. That s where life insurance with living benefits also known as an accelerated death benefit rider can help you when you need it most.

And living benefits are the subject of this article. While living benefits are a great option you want to choose life insurance with living benefits carefully.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)