Can I Make Contributions To A Rollover Ira

Contribute to a rollover ira.

Can i make contributions to a rollover ira. With a traditional rollover ira you can make contributions as long as you re under 70 1 2 and have compensation during the year. Just because you have rolled your ira or qualified plan into another ira doesn t mean that you can t contribute to it anymore. Be sure to write your schwab rollover ira account number on the check and deposit it within 60 days to avoid taxes and penalties. Yet for a long time there were restrictions on your ability to commingle new ira contributions with money in a rollover ira that you had moved from an employer 401 k or other retirement plan.

Under the terms of the secure act of 2019 all retirees can now contribute to traditional iras if they earn income. As of 2013 the maximum contribution your employer can make into your sep ira is 51 000 or 25 percent of your compensation whichever is less. If your employer sends you a rollover distribution check made payable to you you can deposit it directly into your rollover ira. The contributions are always deductible if both you and your spouse aren t covered by an employer retirement plan.

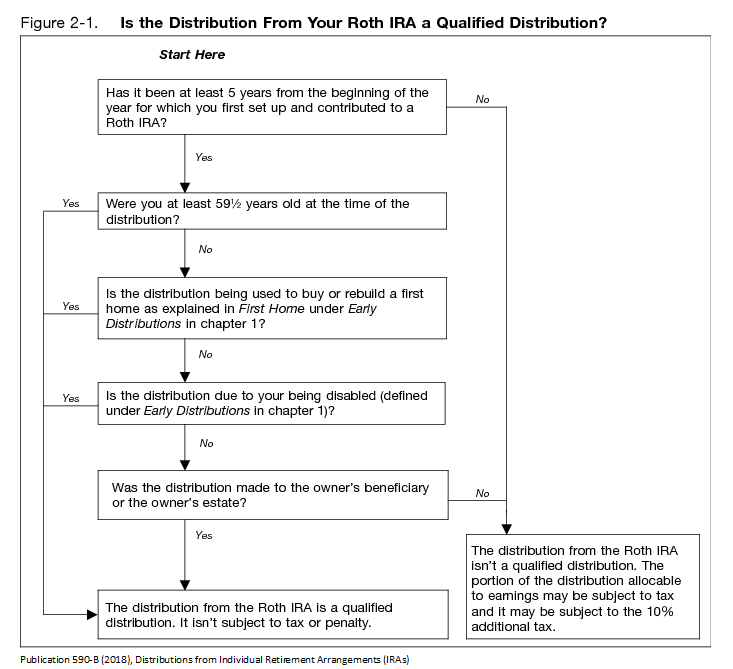

For 2019 you can contribute up to 6 000 annually as long as you. Retirees can continue to contribute earned funds to a roth ira indefinitely. By making a contribution to a rollover ira you may be commingling qualified plan assets such as 401 k assets 403 b plan assets and or governmental 457 b plan assets within your rollover ira with annual ira contributions. If you continue working you can contribute to your rollover ira within ira contribution limits.

As of the publication date you can take a full deduction if your income is 98 000 or less as a joint income tax filer or 61 000 or less as a single filer. You can only deduct your contributions to a rollover ira if you and your spouse are not covered by a retirement plan at work or if your income falls under certain limits. Beginning after january 1 2015 you can make only one rollover from an ira to another or the same ira in any 12 month period regardless of the number of iras you own. You also cannot make a rollover during this 1 year period from the ira to which the distribution was rolled over.

Your plan administrator may have withheld 20 for federal income tax.

/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

/GettyImages-499783375-568137fa3df78ccc15af6215.jpg)