Can I Contribute To An Ira And A 401k

/istock-91516278.jygallery.retirement.funds.cropped-049023f83f1a478cbb86e17ac539be66.jpg)

The amount you can contribute each year to an ira depends on factors like your age income and whether or not you re covered by another retirement plan.

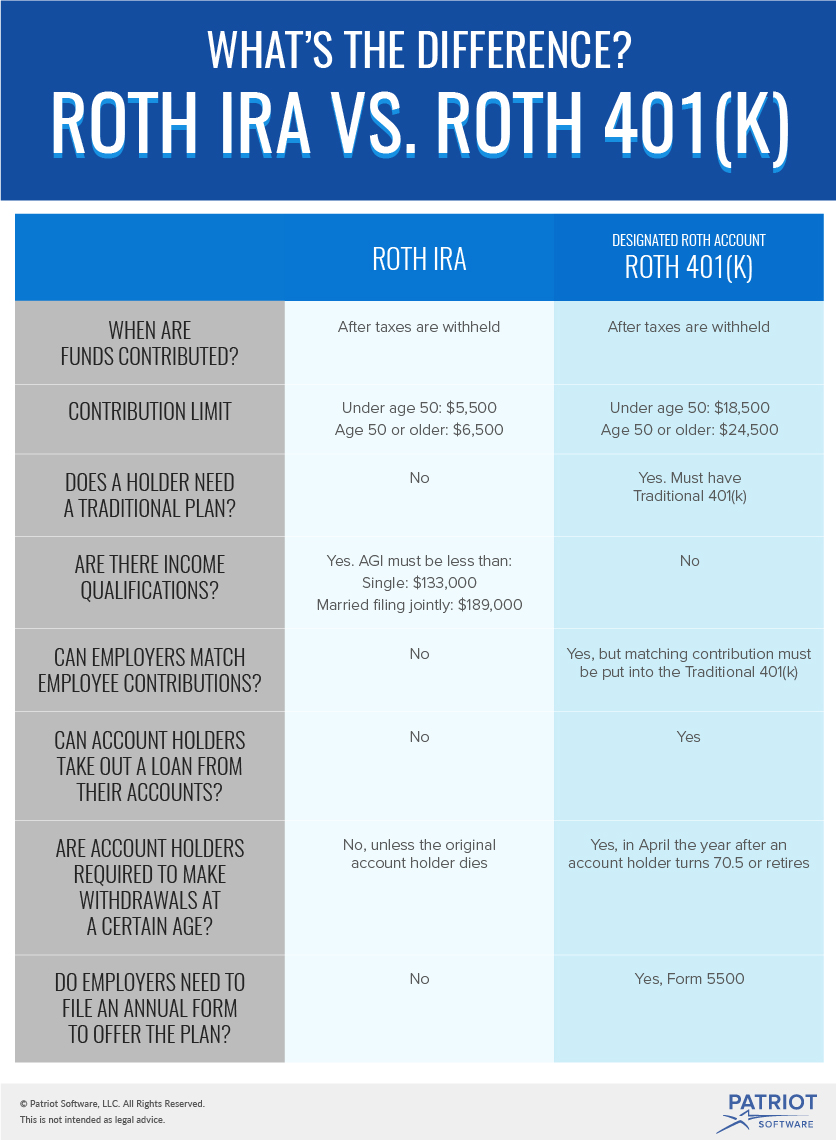

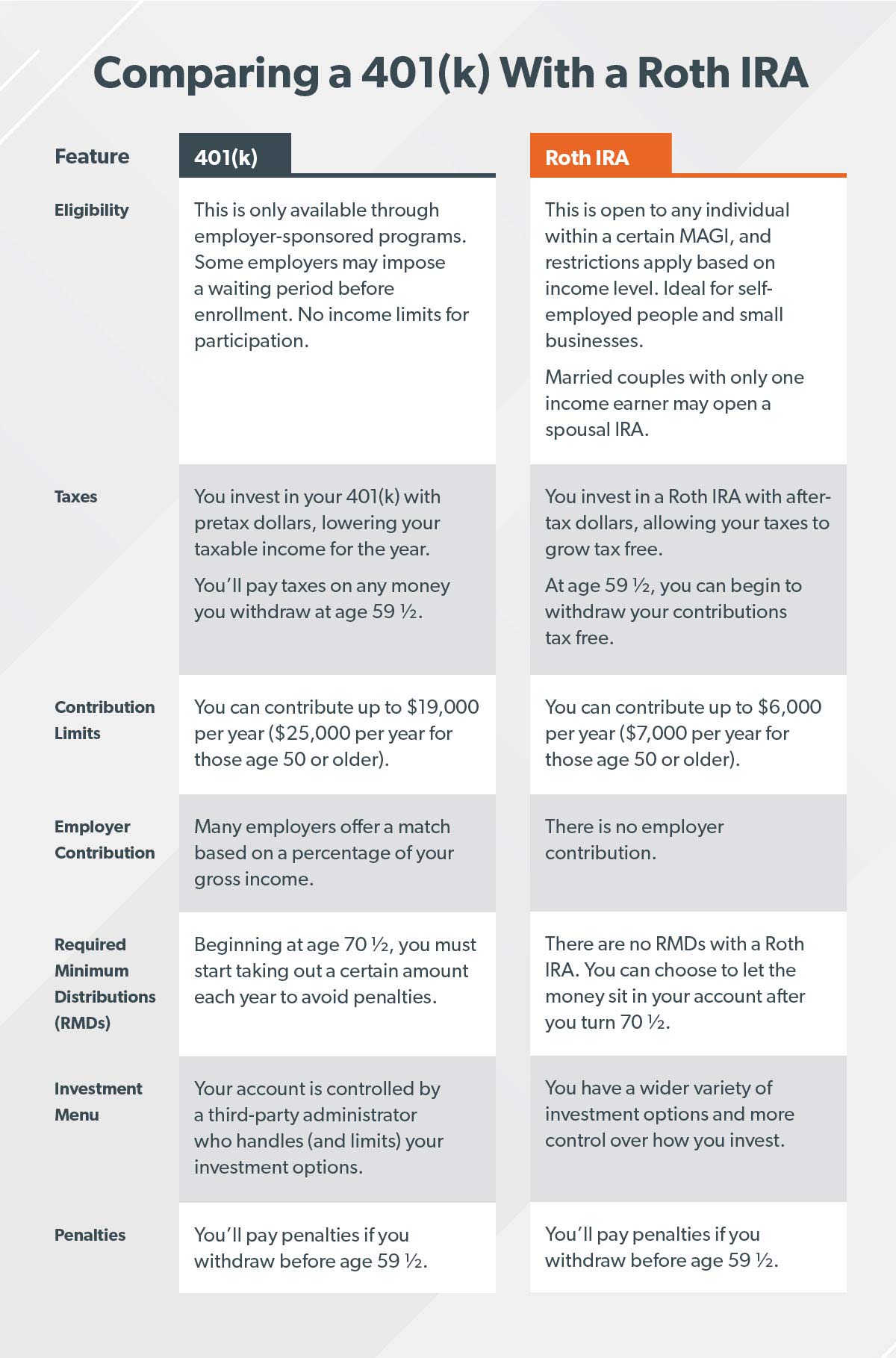

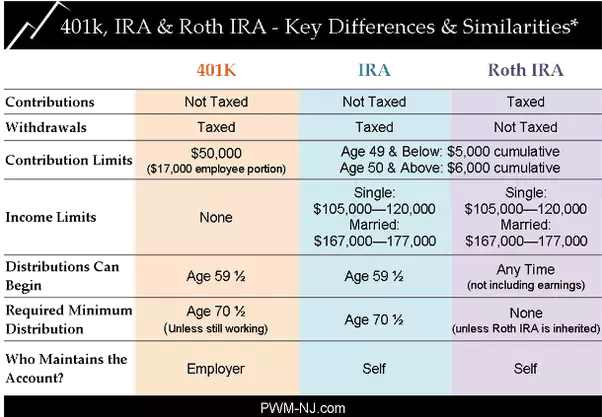

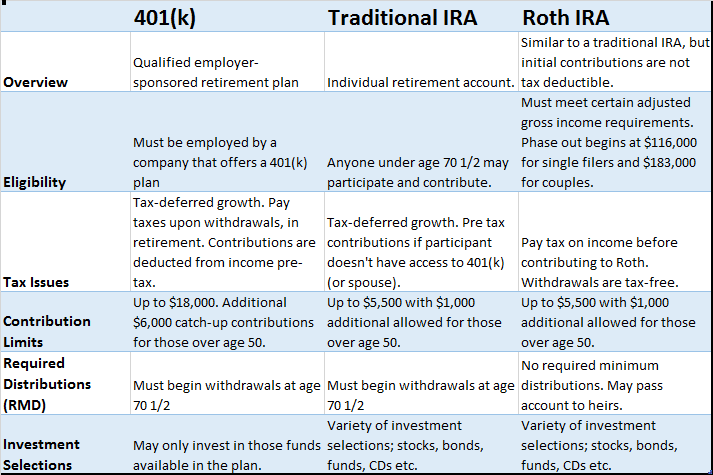

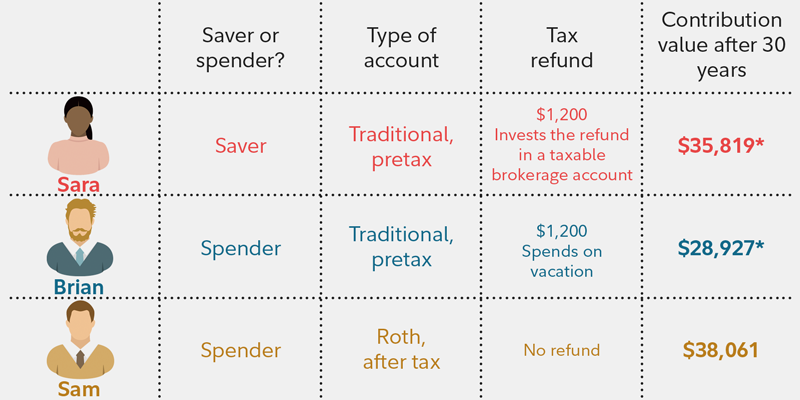

Can i contribute to an ira and a 401k. If you or your spouse is covered by an employer sponsored retirement plan and your income exceeds certain levels you may not be able to. You might not be able to. You can always contribute to both an ira and 401 k. There are certain limitations you should consider though.

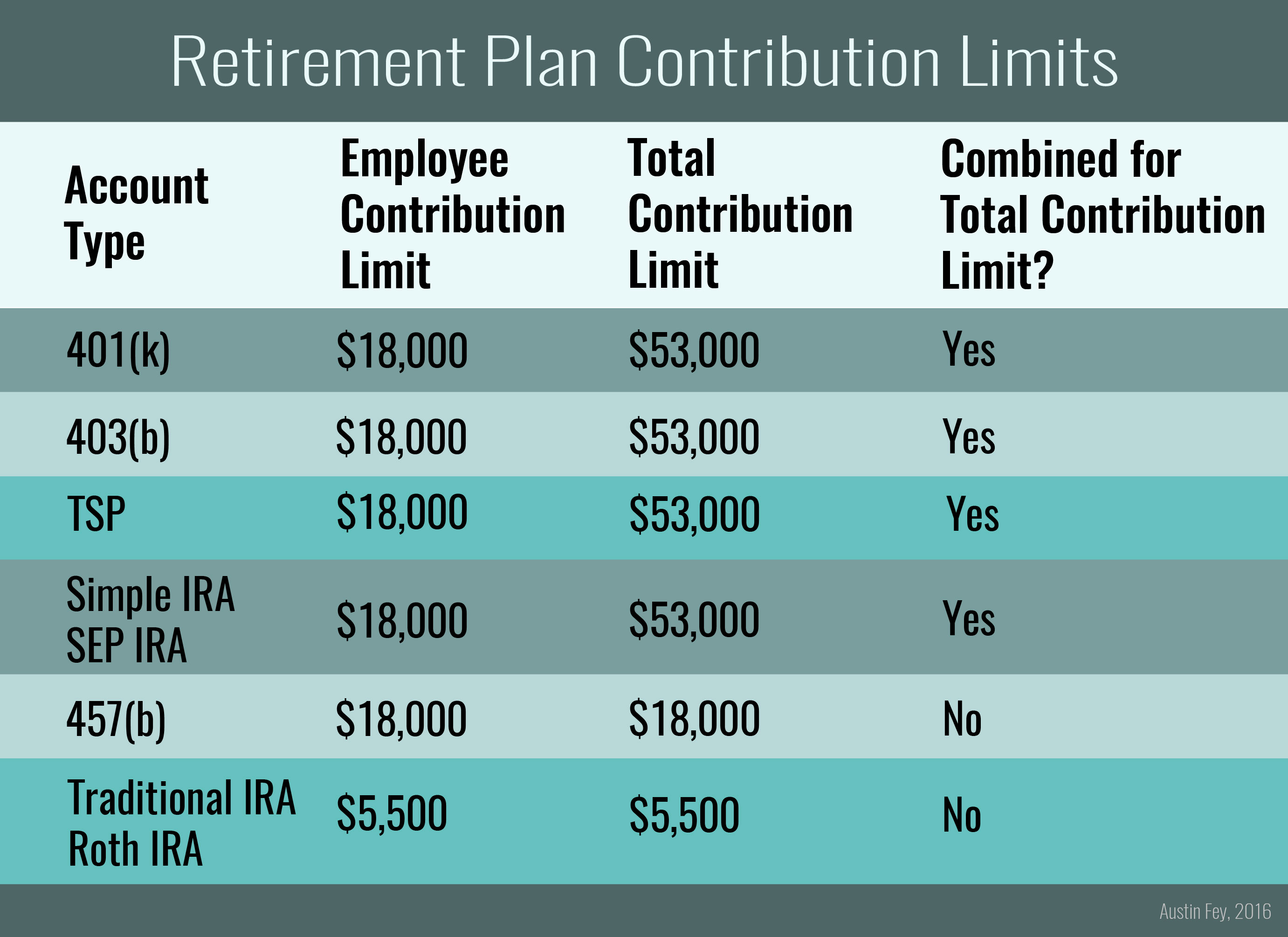

Frequently made with pre tax dollars. Can contribute up to 19 500 in 2020. See the discussion of ira contribution limits. Even if you contribute to both a simple ira and a 401 k at the same time you are still bound by the federally regulated contribution limits.

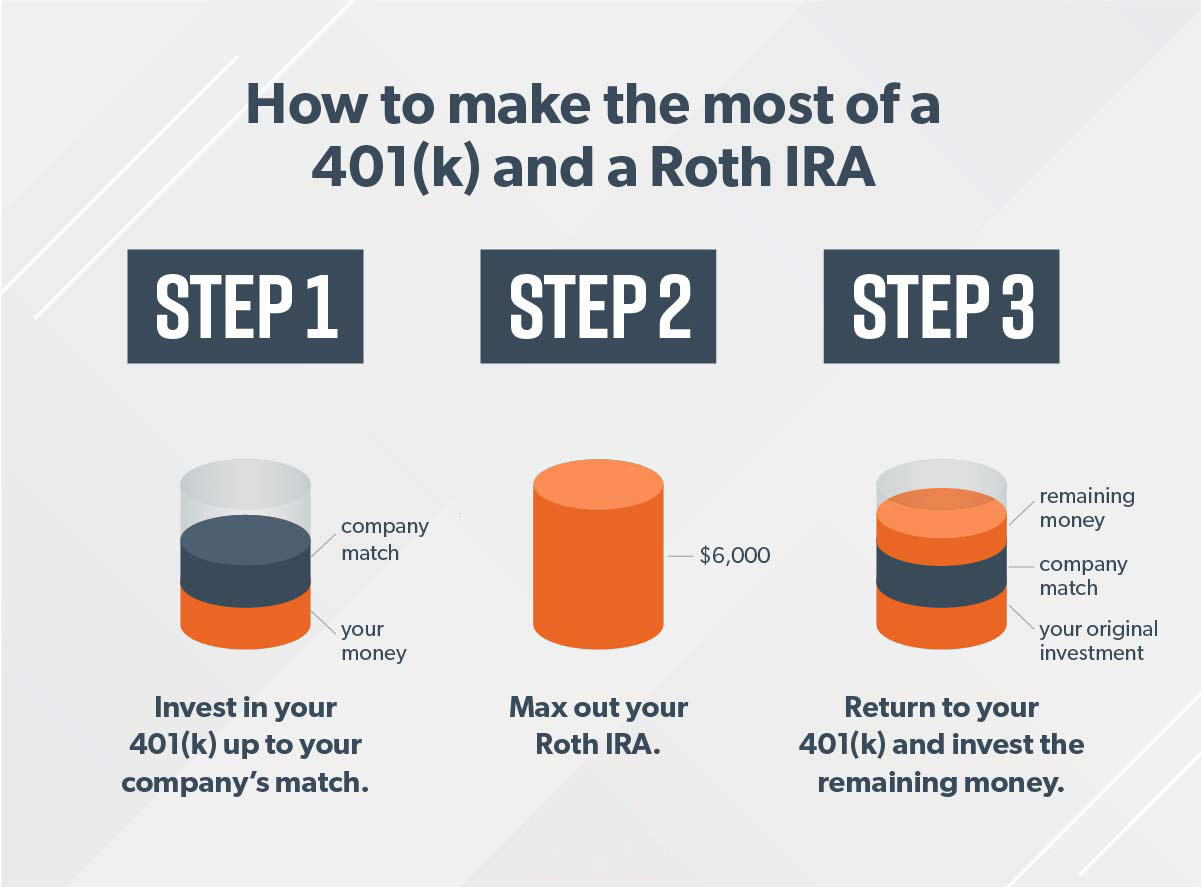

Here s everything you need to know. Pros of having a 401 k and a roth ira. However if your income exceeds the phase out limit 74 000 for individuals and 123 000 for joint filers then you will likely want to couple a traditional 401 k with a roth ira in order to maximize the tax benefits of each respective account. Anyone age 50 or over is eligible for an additional catch up contribution of 6 000 in 2019 and 6 500 in 2020.

Roth ira traditional 401k roth 401k. Yes you can contribute to both a 401 k and an ira but if your income exceeds the irs limits you might lose out on one of the tax benefits of the traditional ira. Yes you can contribute to a traditional and or roth ira even if you participate in an employer sponsored retirement plan including a sep or simple ira plan. Can contribute up to 6 000 in 2020 7 000 if you are age 50 or older made with pre tax dollars.

Even if you participate in a 401 k plan at work you can still contribute to a roth ira and or traditional ira as long as you meet the ira s eligibility requirements. Employees can contribute up to 19 500 to their 401 k plan for 2020 up 500 from 2019. If you have both a 401 k and a simple ira in the.

/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)