Can You Do A Reverse Mortgage On A Condo

You can even contact a lender who can then broach the subject of reverse mortgages to your hoa for you to see if it is feasible to do reverse mortgages in your project.

Can you do a reverse mortgage on a condo. You can get a reverse mortgage if you own a condominium as long as it is your principal residence. To obtain a reverse mortgage against the condo you ll need to make sure you ve successfully transferred the title from your mother s trust to your name. I recommend that borrowers contact a lender or find out themselves if their condo is fha approved then inquire with the hoa if they re willing to get approved cook says. That can be done while we are working on the condo approval.

Reverse mortgages allow seniors age 62 years and up to tap into a portion of their home equity and convert loan proceeds into disposable income during retirement. If you are eligible for a reverse mortgage you may be able to obtain one on a condominium unit depending on certain rules and restrictions. Reverse mortgages are not limited to single family detached homes. Reverse mortgages aren t your average everyday loan.

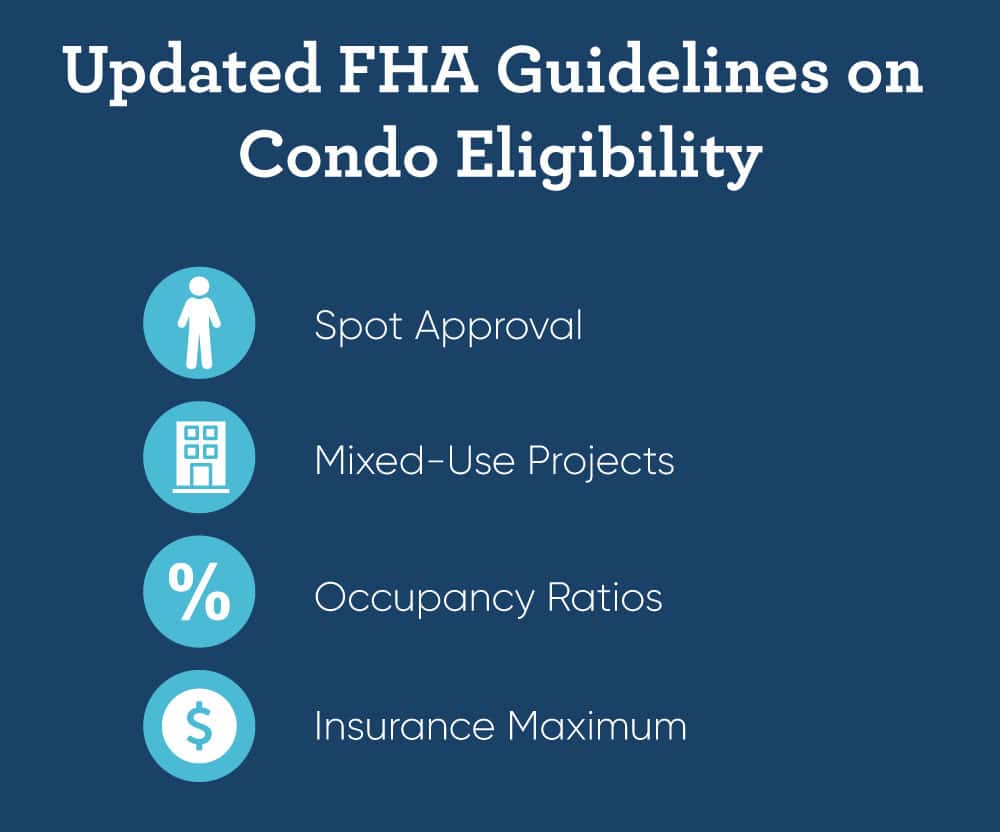

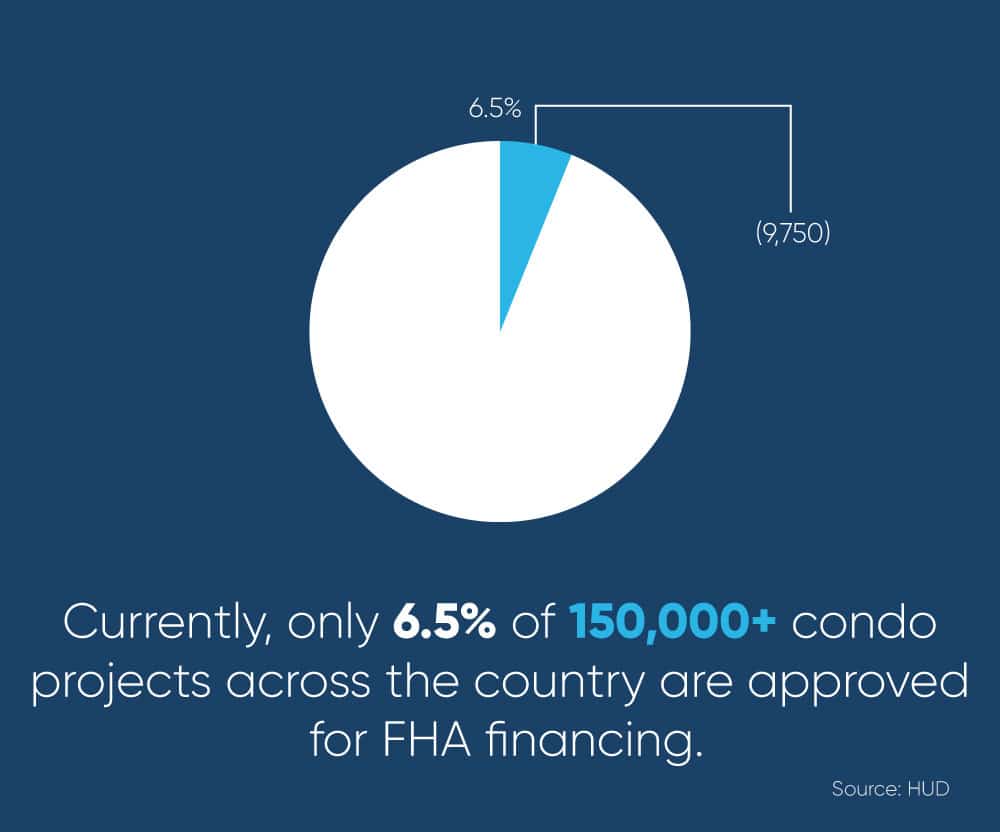

For hecm originators the task of helping a condo owner get a reverse often comes with the added hassle of obtaining fha approval of the entire complex which some associations are unwilling to do. If you do not find your condo listed on that page that does not necessarily mean you do not qualify. October 16 2015 at 10 33 pm. Unlike typical mortgages and other home equity loans reverse mortgages are heavily regulated and involve many additional rules that you may not be aware of.

Certainly the reverse mortgage industry has been waiting lobbying hud. Mortgage fha loosens condo eligibility requirements for reverse mortgages. Yes you can get an hecm reverse mortgage on a condo as long as the condo association is fha approved. For those living in condominiums getting a reverse mortgage isn t as simple as it is for most homeowners.

In order for a condo to qualify for a reverse mortgage through hud or the fha it needs to contain at least two units. Read on to learn more about how an fha home equity conversion mortgage the most common type of reverse mortgage works. It is not a complete database so it is important to familiarize yourself with the requirements.

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)

/GettyImages-1002993164-bc84ffb3d31c43b087ab3342c97af0fa.jpg)