Car Insurance Full Coverage Vs Liability

In states where car insurance is required the minimum coverage you ll need will include liability insurance which covers property damage or injury you cause with your vehicle.

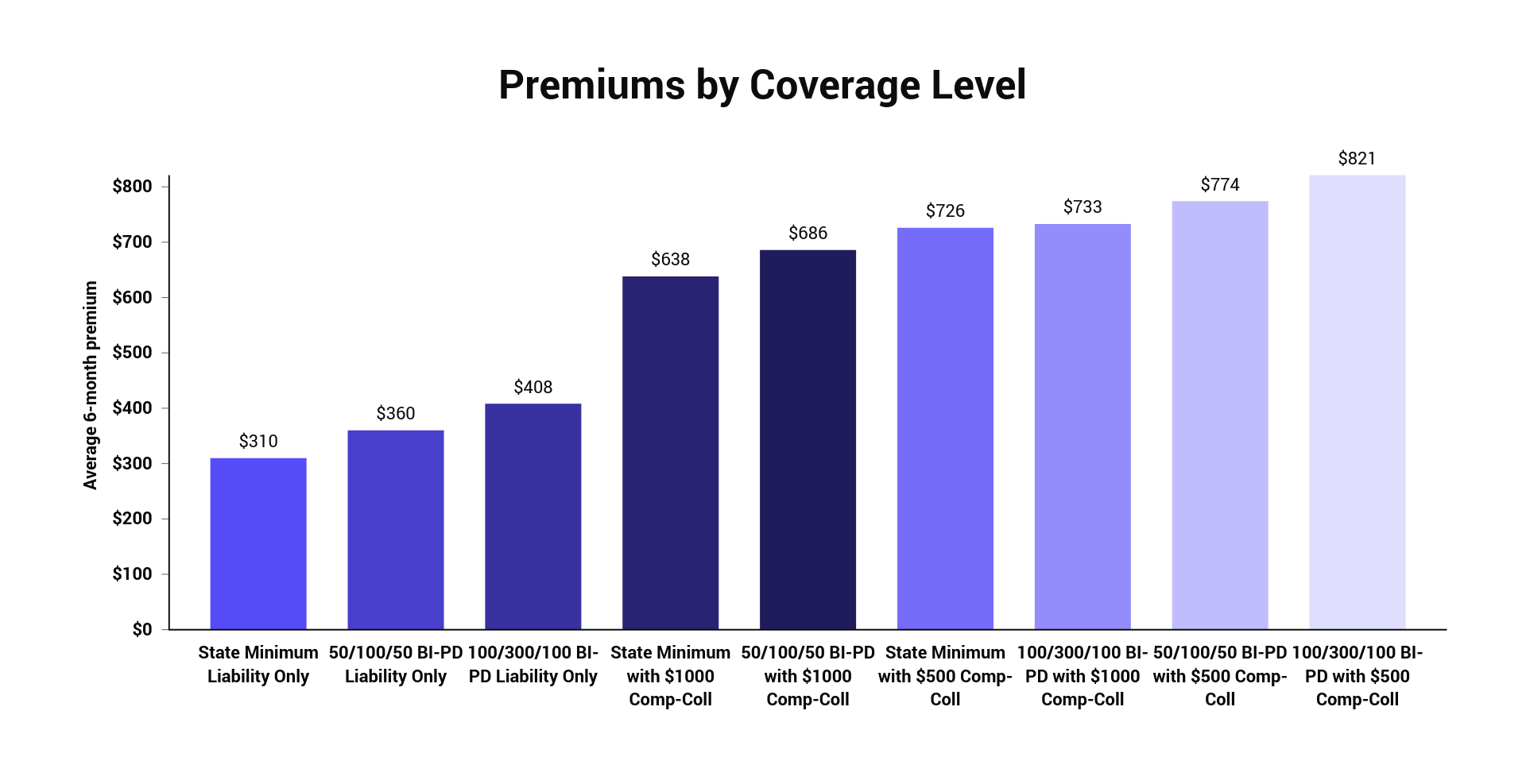

Car insurance full coverage vs liability. How much car insurance do you need. In some states liability insurance is all that s required. Full coverage price difference keep in mind that you re getting a lot more with full coverage. Liability vs full coverage car insurance.

In this article we ll explain the difference between liability and full coverage. For example in a state like ohio the minimum coverage requirements are 25 000 per person injured with a maximum of 50 000 for people injured in an accident and 25 000 property damage coverage. Liability car insurance and full coverage car insurance. There are three key numbers to look out for with liability insurance.

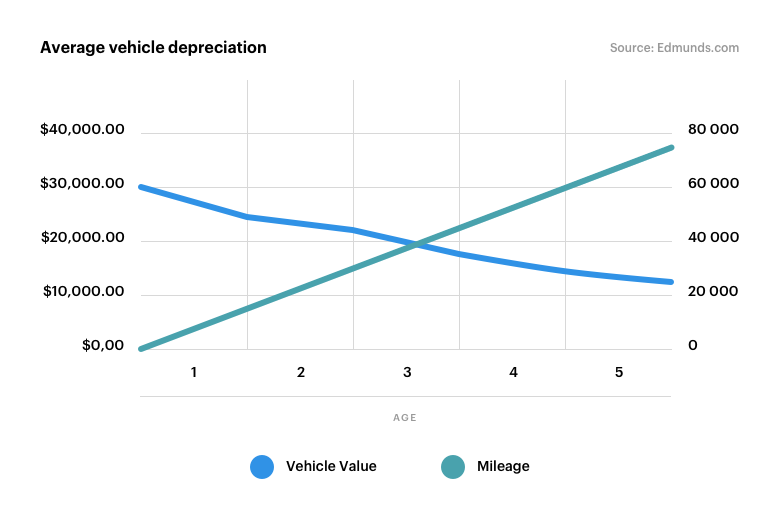

When to drop full coverage and keep just liability is a question a lot of. In addition to liability coverage full coverage includes comprehensive coverage which covers everything that could happen to your car and damage it other than an accident like theft or storm damage collision coverage which covers damage to your. What is full coverage car insurance. Here s what you need to know about liability vs.

When thinking about the liability vs. Coverage for injuries per person total injury coverage per accident and coverage of property damage per accident. But first let s take a look at what each kind of insurance coverage is and what s offered. There are two main forms of car insurance.

And we ll take a look at when you might consider dropping full coverage to save on your monthly insurance premium. When to drop full coverage and keep just liability is a question a lot of people ask. Having your vehicle insured is a must not only because it is the law but also because it protects you and others should an accident occur.