Cash Flow Financing Activities Example

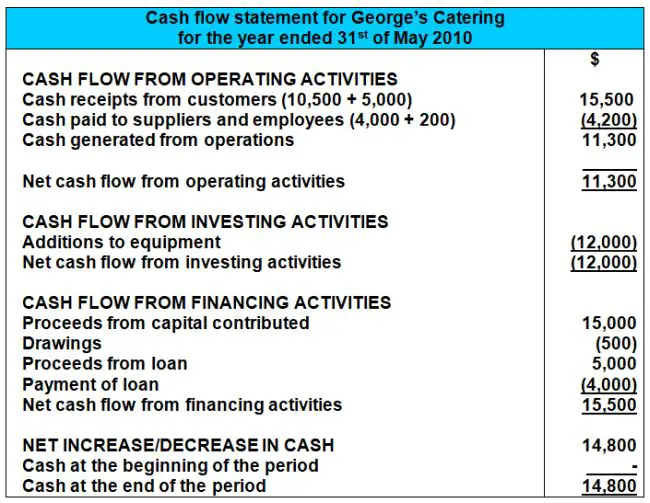

Operating activities cash flows from operating activities include transactions from the operations of the business.

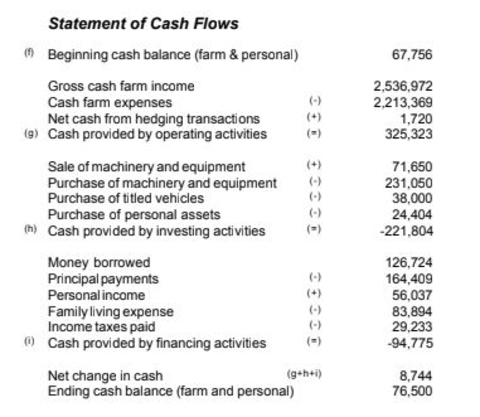

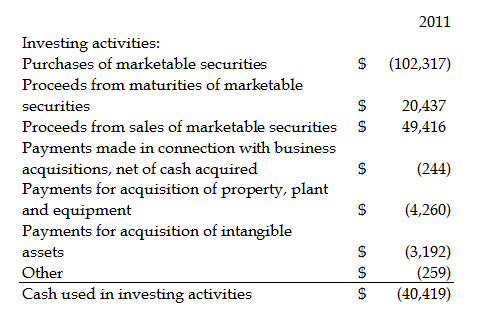

Cash flow financing activities example. Let s take an example to calculate cash flow from financing activities when balance sheet items are provided. Figure 12 1 examples of cash flows from operating investing and financing activities shows examples of cash flow activities that generate cash or require cash outflows within a period. The cash flow statement format is divided into three main sections. Calculate cash flow from financing.

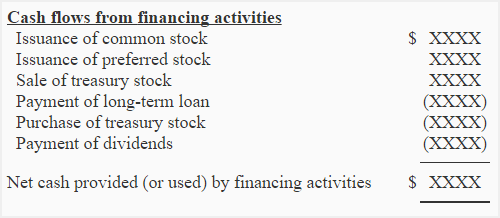

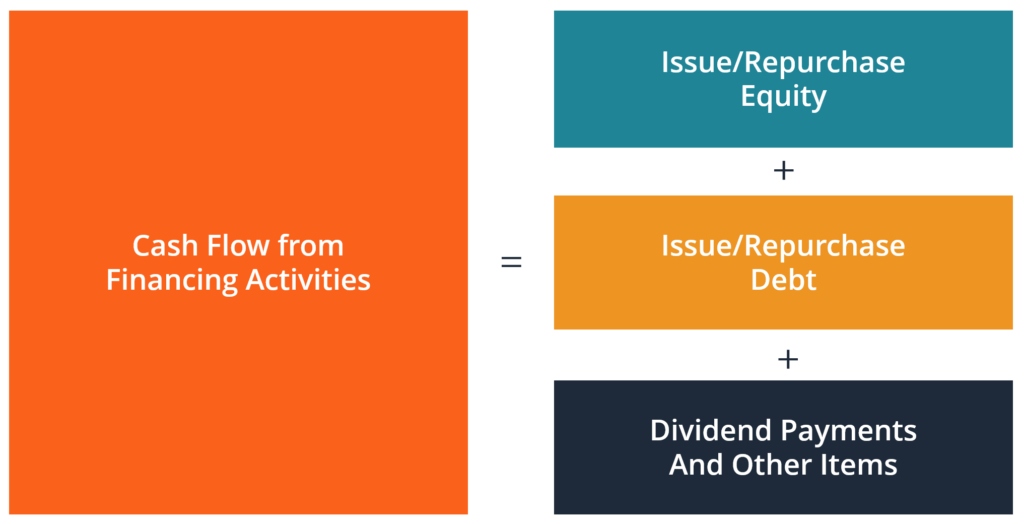

Financing activities section is the third and the last section of the statement of cash flows that reports cash flows resulting from financing activities of the business. When a company borrows money for the short term or long term and when a corporation issues bonds or shares of its common or preferred stock and receives cash the proceeds will be reported as positive amounts in the cash flows from financing activities section of the scf. Cash flow from financing activities is one of the three categories of cash flow statements. Cash flow from financing activities example.

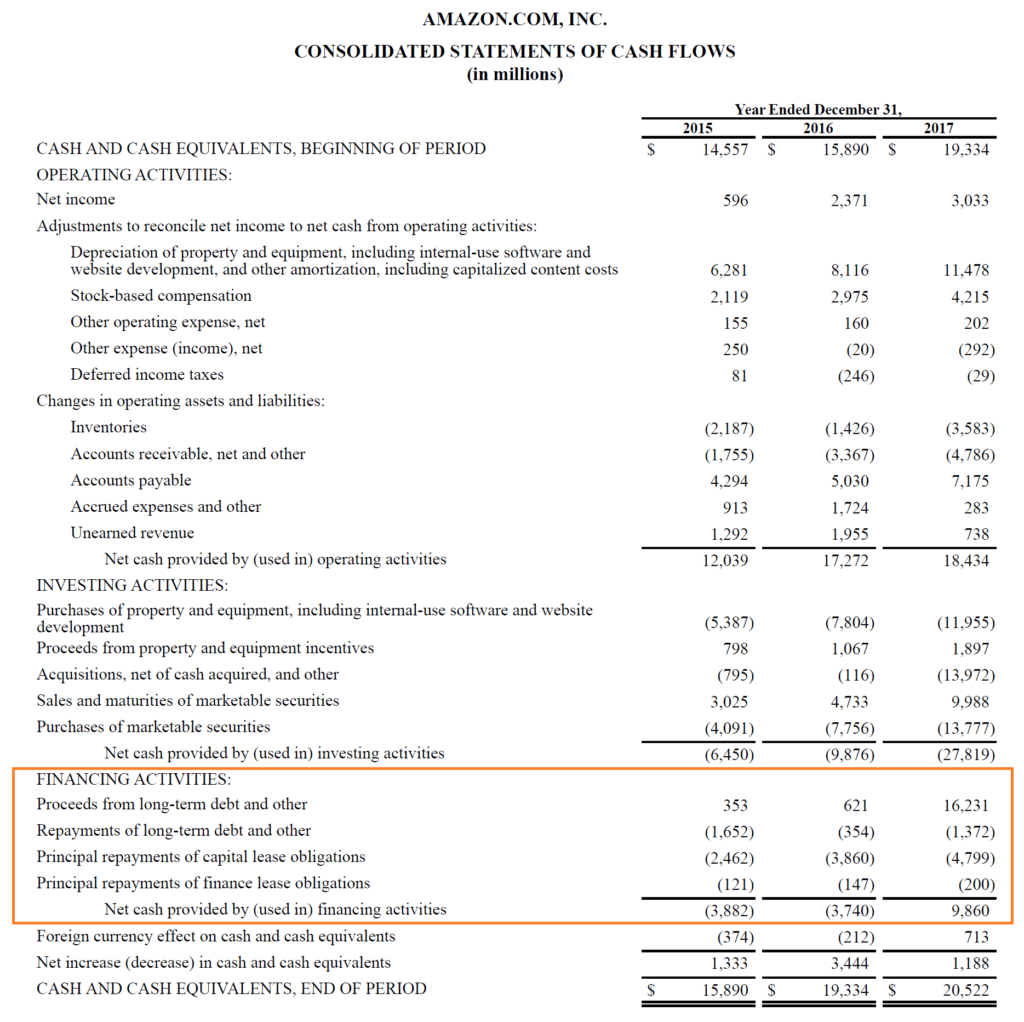

Example of cash flow from financing activities below is an example from amazon s 2017 annual report and form 10 k 10 k form 10 k is a detailed annual report that is required to be submitted to the u s. Figure 12 2 examples of cash flow activity by category presents a more comprehensive list of examples of items typically included in operating investing and financing sections of the statement of cash flows. Here the creditors mean the creditors for non trading liabilities such as. It shows the cash inflows and outflows related to transactions with the providers of finance i e.

Below is a balance sheet of an xyz company with 2006 and 2007 data. Investing cash flow cash inflow from investing activities cash outflow from investing activities. The owners and the creditors of the company. Cash flow from financing activities.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back. In other words financing cash flow includes obtaining or repaying capital be it equity or long term debt. It usually involves flow of cash between company and its sources of finance i e owners and creditors. Securities and exchange commission sec.

Cash flows from financing activities is the last of the three sections of a statement of cash flows. Financing cash flow comes from conducting financing activities for the business. Examples of financing activities. Cash flow from financing cff activities is a category in a company s cash flow statement that accounts for external activities that allow a firm to raise.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)