Comprehensive General Liability Insurance For Small Business

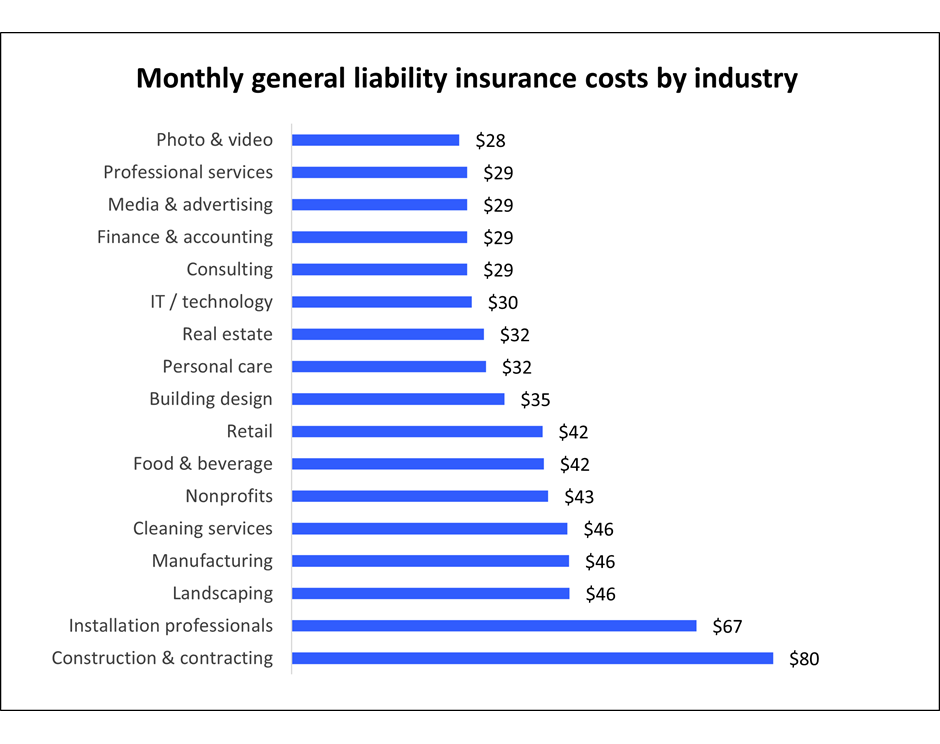

Get a free quote online or from a licensed agent for as low as 30 month.

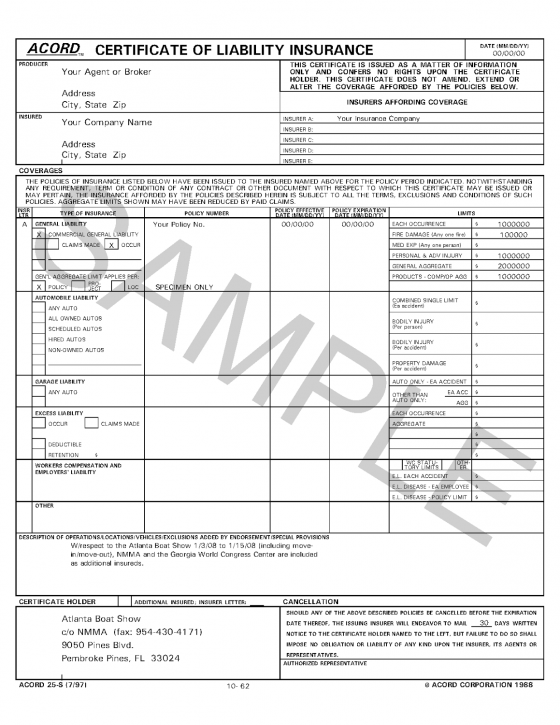

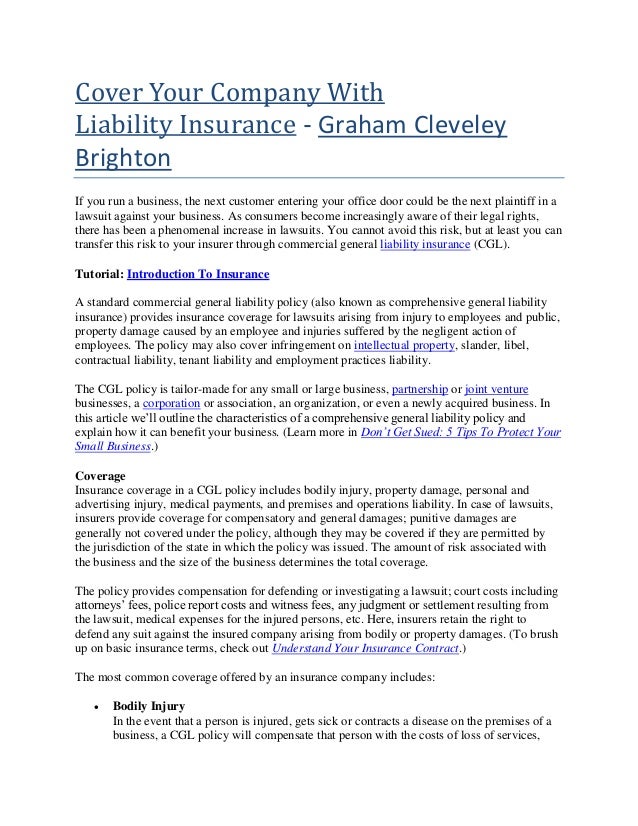

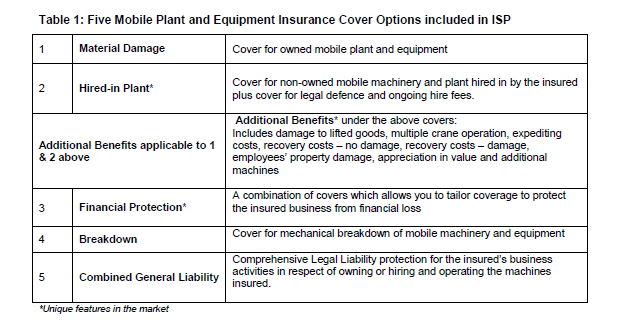

Comprehensive general liability insurance for small business. Commercial general liability cgl is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business s operations or products or on its premises. Comprehensive general liability insurance policy information. General liability insurance protects small businesses from claims of bodily injury associated medical costs damage to property. Comprehensive general liability insurance is an outdated term for general liability insurance a business insurance policy that provides coverage for customer injuries customer property damage and lawsuits related to both.

When you run a business there are a wide range of risks that you need to be aware of that could potentially turn into a problematic legal situation. Needs analysis can give you a better idea of what. Comprehensive liability insurance often referred to as comprehensive general liability insurance is a form of business insurance that protects businesses against most types of liability claims. Comprehensive general liability insurance cgl is a type of insurance that every business needs to have if it wants to be able to protect itself from the many types of costly claims that it faces.

Learn how these coverages protect small businesses and how much you ll want to consider for your unique risk. General liability insurance is often combined with property insurance in a business owners policy bop but it s also available to many contractors as a stand alone coverage through the progressive advantage business program. Who needs general liability insurance. Comprehensive liability insurance.

Definition of comprehensive general liability insurance cgl. A type of liability insurance held by businesses. Ohio comprehensive general liability insurance protects your business from lawsuits with rates as low as 27 mo. Contractor s comprehensive general liability our public liability insurance covers accidents due to acts of negligence of your employees or representatives in connection with your businesses.

Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. Our product liability insurance covers claimants cost and legal liabilities against products you company manufactures or offers. Having the appropriate insurance policy can save a small business a lot of money.

/GettyImages-1141164585-a0d6f756cc6646f79638989d4fbbe59e.jpg)