Audit Vs Tax Career

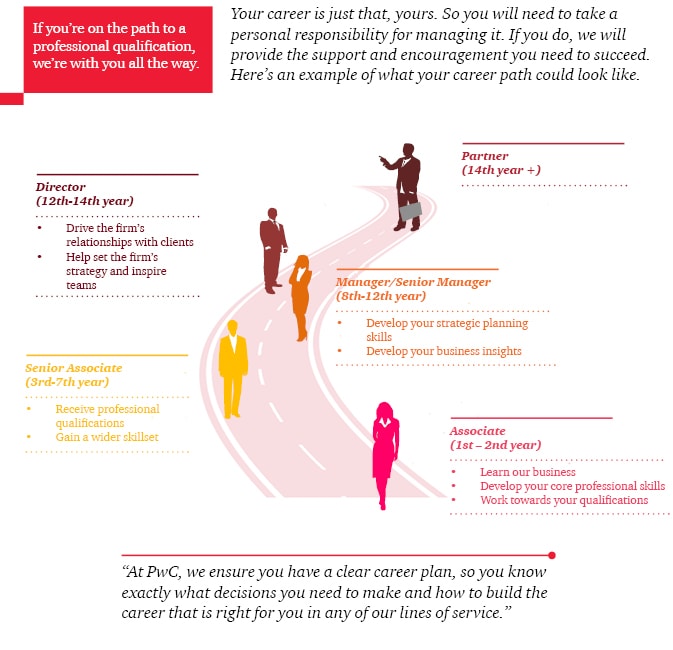

After five years you might be earning 50 000 and after ten years it could be 100 000.

Audit vs tax career. Content strategist becker marketing in accounting your career could go in many different directions but most of your choices will fall under tax or audit. So which track is right for you. Here are the pros and cons of each as i see them currently. Too often people associate audit and tax with factors like seeing more clients working in teams or future career paths.

You can exit to controller cfo if banking doesn t work out. 02 17 2010 i was wondering what you guys think is the better career path since it looks like i ll be stuck in accounting for a bit. In school you typically choose accounting as a major without choosing a designation of which field you will go into. Audit vs tax is probably the first question that people will start asking you in your senior year of college when it s time to start thinking about your career.

Choosing between tax and audit. What to do afterwards. Sometimes this decision is not black and white. If you are finishing undergrad or pursuing your masters it is completely normal to question the decision of whether to go into tax or audit.

Which career is right for you. Now is a great time to pursue a career in accounting. I still felt i needed a 15 month rotation between audit and tax before selecting my career track. This changes after a few years as you get closer to graduation and as you start interviewing for internships at the big 4.

10 min read hannah kohut. Tax vs audit is a popular question from many big 4 candidates. Choosing between tax and audit as a career path was not a decision that i made overnight. Fortunately for me and you there are some accounting firms that will provide you with the opportunity to try both tracks.

Partners in the big four can earn over 1 million. It really is. According to the bureau of labor statistics bls employment of accountants and auditors is expected to grow 11 percent through 2024. How to choose a career path.

You should be thinking about your accounting career path way before your senior year in college. The best advice that i got on choosing my path was from speaking with those who have made the decision themselves and had real world experience as opposed to college courses. Each profession has its pros and its cons and sometimes this choice can either lead to other opportunities or prohibit them. Which do you choose.

Tax has a clear career progression and your salary should rise steadily. Audit vs tax accountant originally posted.

:max_bytes(150000):strip_icc()/GettyImages-1160738322-c067919304c44e6a8a67bd54d49681aa.jpg)