Automobile Insurance Limits

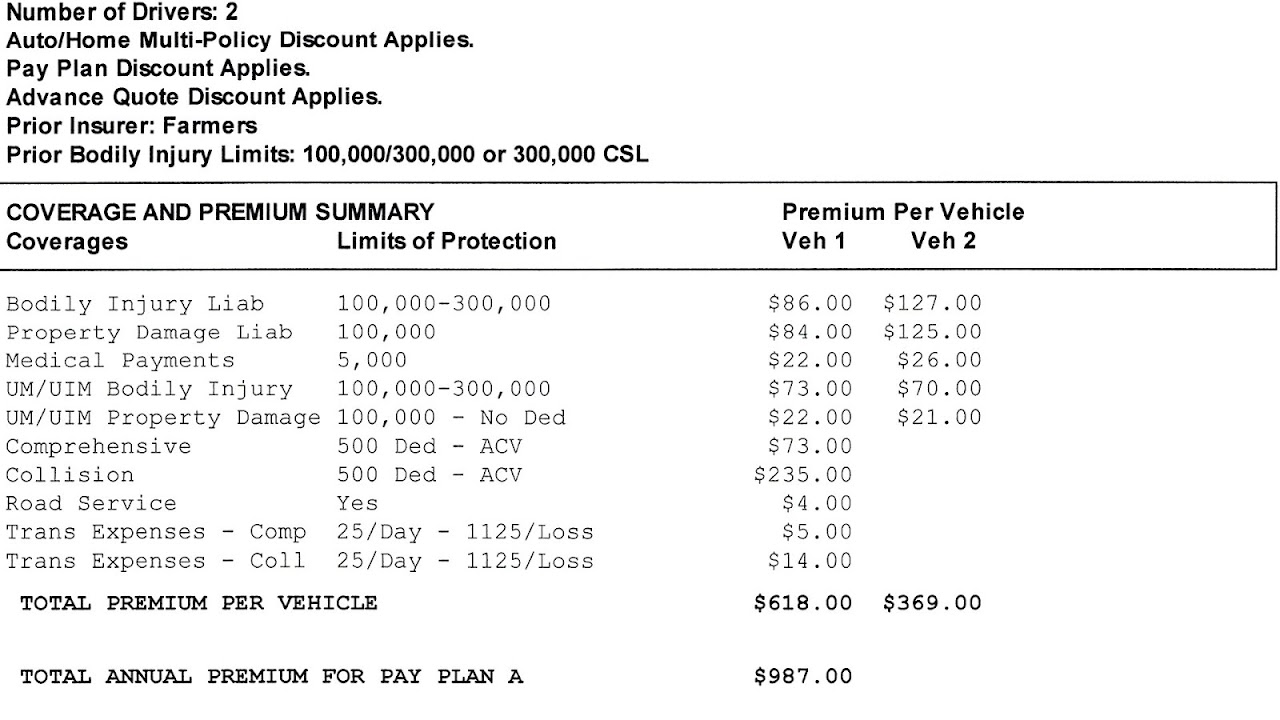

Insurance experts generally recommended that you purchase 100 300 limits of bodily injury liability meaning 100 000 for one person in an accident and 300 000 for all people injured in one.

Automobile insurance limits. Minimum car insurance limits may not be enough to protect you it is easy to see how these limits may not cover all the liability and property damage needs. In the event of hail damage or a tree limb falling on your car risks not involving an automobile collision this coverage insures you. The coverage limits are written out as a single number showing the max amount paid out per accident. Failing to secure the right coverage may violate the terms of the loan.

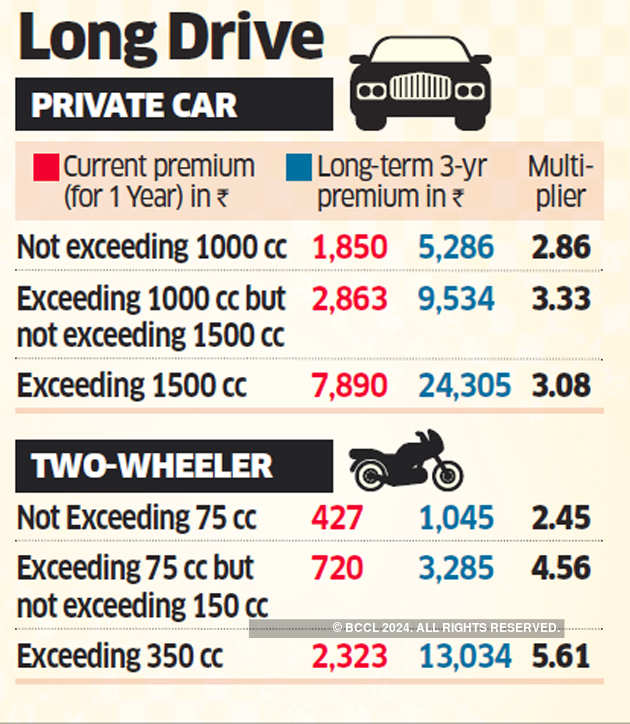

The higher the insurance coverage limits on your policy the more the insurance company will pay. What are car insurance coverage limits. Car insurance coverage limits are maximum amounts of money that your car insurance will pay out if you make a claim. Comprehensive coverage pays to repair your vehicle subject to.

However under most insurance policies. Typically increasing your auto coverage limits will increase your monthly rate and decreasing limits will decrease your rate. Minimum auto insurance requirements coverage. If you re in an automobile accident regardless of who is at fault collision insurance provides protection to replace or repair your vehicle subject to a deductible.

Typically it is either a 10 000 15 000 or 25 000 limit. 250 000 of coverage for bodily injury per person 500 000 of coverage for bodily injury per accident. The liability limit per accident is a financial cap for the total amount that the insurance company will pay for all of the individuals involved in. For example if the limit on your collision coverage is 20 000 that is the most that your policy would pay out for damages to your vehicle after a collision.

Liability limit for bodily injury per accident. A 2 000 death benefit in addition to the 50 000 basic no fault limit payable to the estate of a person eligible for no fault benefits who is killed in a motor vehicle accident. Now that you understand what the numbers mean check the listing of each state s minimum insurance requirements. Coverage limits and your insurance rate.

Here s how that breaks down. When looking at your auto insurance coverage limits you may see something like 250 000 500 000 250 000 or 250 500 250 for your liability coverage.