Best Car Insurance Rates In Ohio

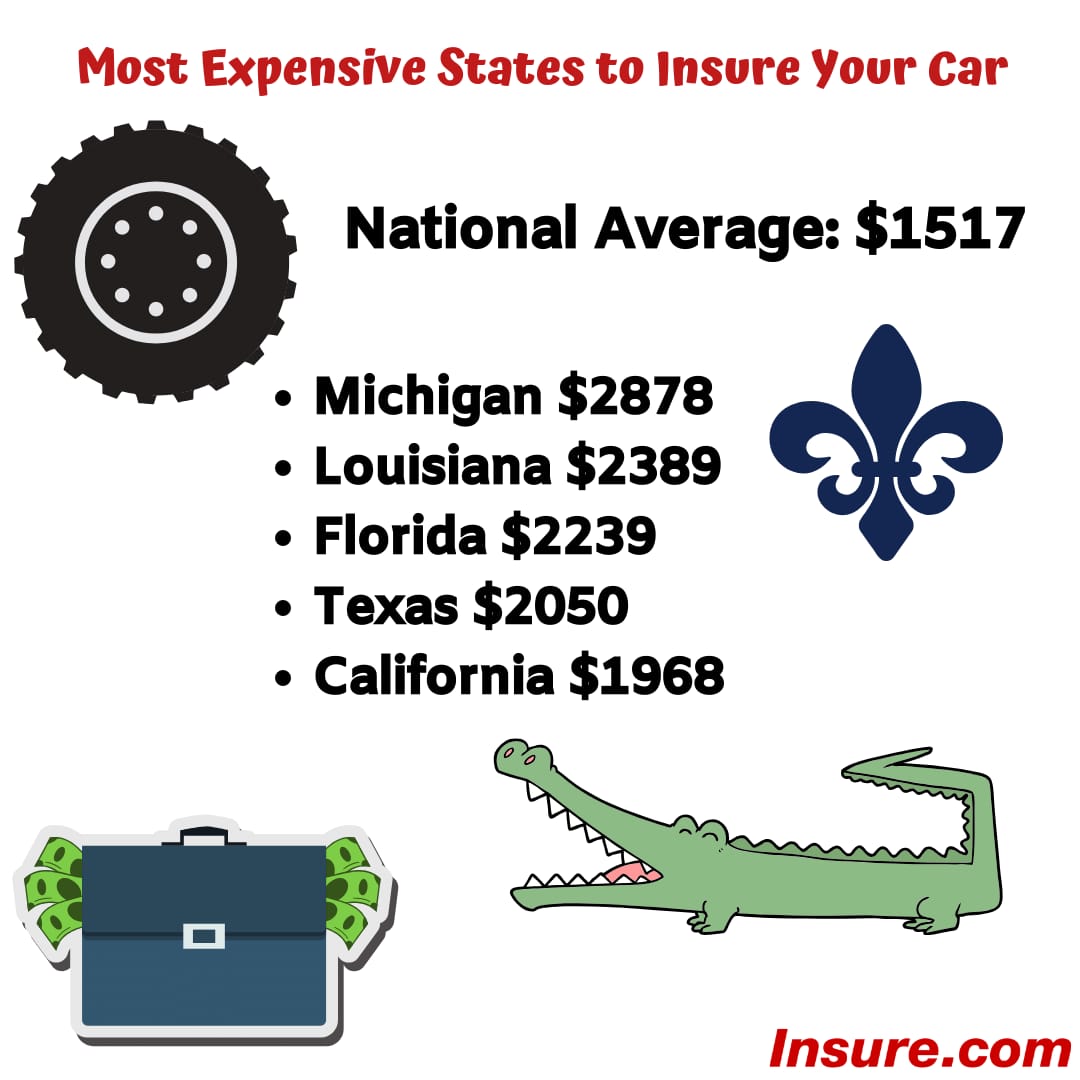

When you compare car insurance rates by state why are some so much more expensive than others.

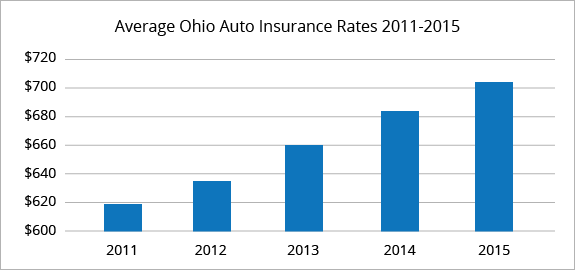

Best car insurance rates in ohio. The best cheap auto insurance in ohio depends on a number of factors. Average car insurance costs in ohio by city. The price you pay depends on several factors including your zip code your age your credit score your claims history the age of your car. Car insurance rates in ohio are highly personalized.

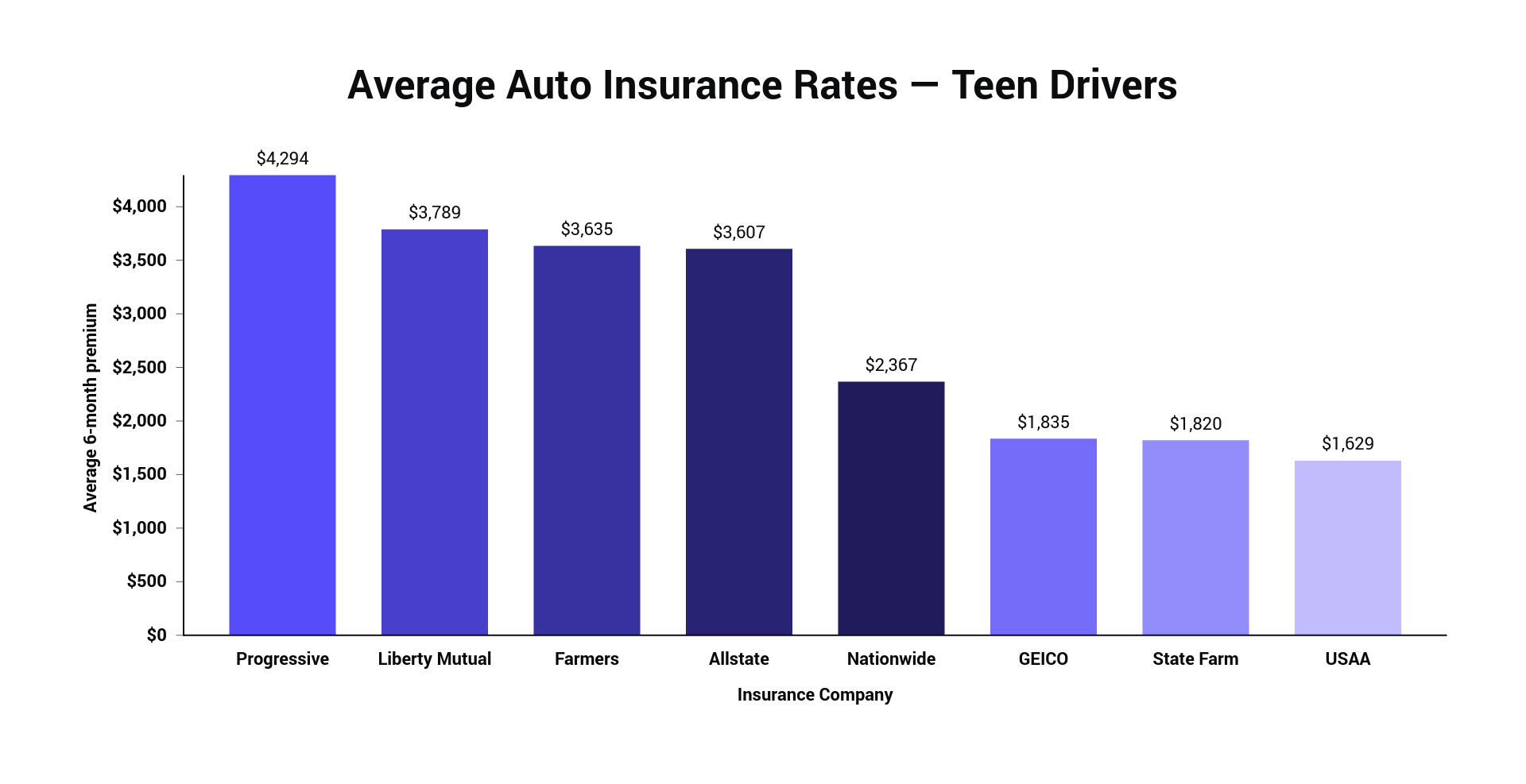

Average annual cost 1 835 9 higher than ohio mean with geico state farm and westfield we found low cost car insurance for locals in akron for an average as low as 1 328 a year. The best way to lower your car insurance rates might actually be to move to another state. To find which car insurance company offers the lowest rates in ohio our study used representative driver profiles with good credit medium insurance coverage a clean driving record and 12 000 miles of annual mileage. Moving from new jersey to idaho for example could save the average driver nearly 700 per year on insurance.

Average annual car insurance rates for major cities in ohio below you ll see how average annual rates for several of the largest cities in the state compare to state and national averages. To help ohioans navigate the car insurance market quickly nerdwallet looked at rates from the 11 largest insurers in the state and found the five cheapest options for several driver categories.