Best Reverse Mortgage Banks

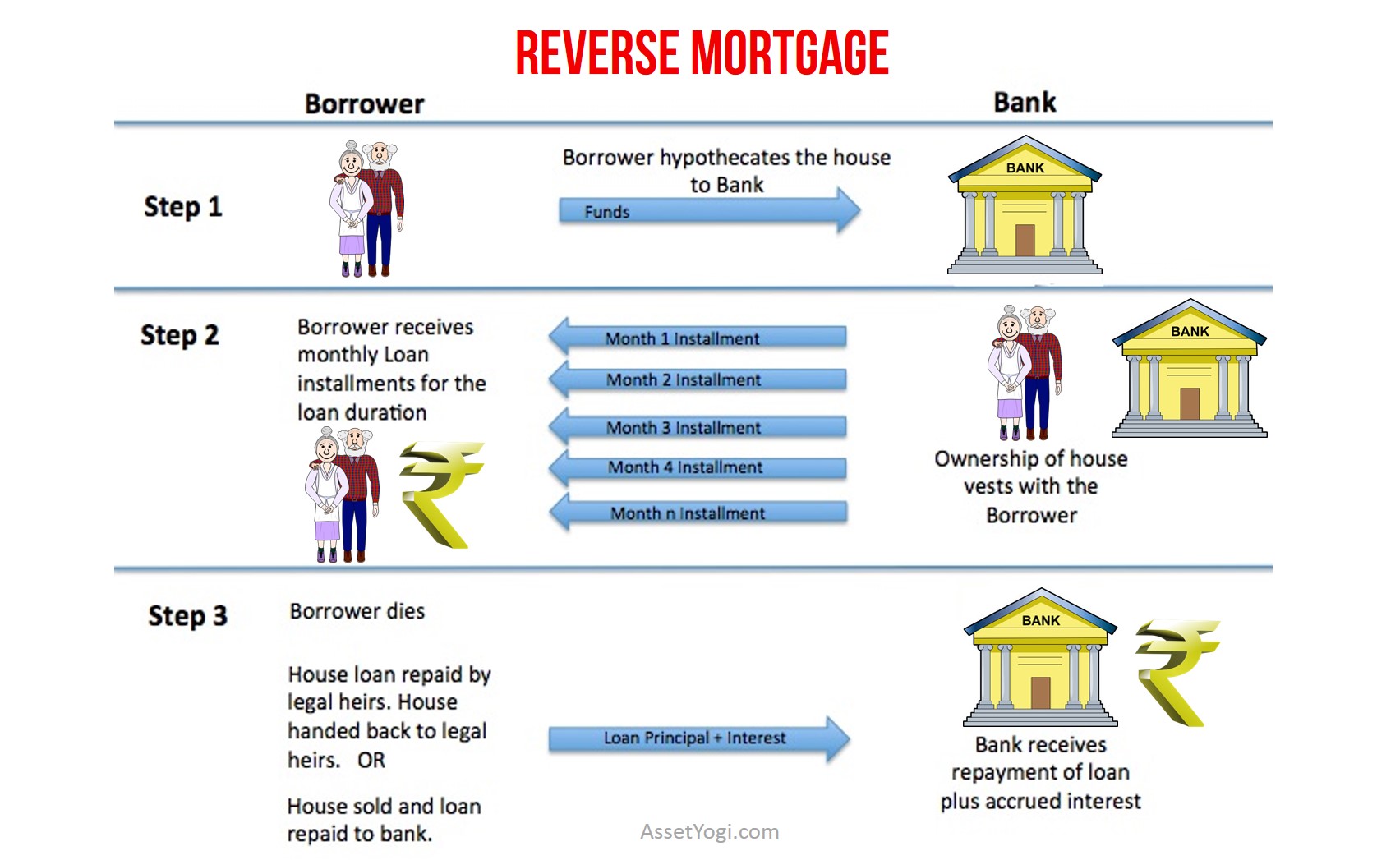

Historically the home equity conversion mortgage hecm program in the united states was dominated by large banks.

Best reverse mortgage banks. There are also varying fees charged on a reverse mortgage much as there are for a standard home loan. Some companies will be willing to lend you more. Use our guide to compare the best reverse mortgage lenders. Liberty reverse mortgage specializes in reverse mortgages funding more than 7 5 billion in loans since its inception.

Banks that offer reverse mortgages last 12 months list of banking institutions that have closed reverse mortgages within the last 12 months. The 5 best reverse mortgage lenders for 2020 quontic bank best digital option. Most major banks exited the reverse mortgage industry several years ago leaving non bank lenders brokers small banks and credit unions as the remaining lending sources. Some will offer different types of reverse mortgages or more flexibility.

Best reverse mortgage companies. When we rated reverse mortgages in early 2017 the interest rates on offer for reverse mortgages ranged from 6 19 to 6 37 with an average rate of 6 25. The hecm is the most common type of reverse mortgage. Standard hecm and hecm for purchase.

They do significant advertising so they have big name recognition. Click here to pre apply safely and securely for a reverse mortgage from aag now. Rates accurate as of july 2020. Learn about the types of reverse mortgages.

It offers two types of reverse mortgage loans. While most reverse mortgages are insured by the federal housing administration fha and adhere to the same rules each lending institution offers their own margins and interest rates. There are still many banks that offer reverse mortgages. When it comes to reverse mortgages lenders offer different deals and provide different terms.

In 2011 the largest providers were wells fargo bank of america and metlife bank. Read thousands of verified consumer reviews. They include firstbank quontic bank m t bank the federal savings bank townebank goldwater bank and many more. Among the things they do well is to explain to their customer the different types of reverse mortgages available.

In recent years quontic bank formerly a regional bank in the northeast has expanded its digital footprint and does business in all 50 states its reverse mortgage options are limited to hecm meaning you must meet all of the standard requirements for the fha s program. The average fees in 2017 were as follows. Some companies will charge more in interest and fees on your loan.

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)