Betterment Vs Schwab Intelligent Portfolio

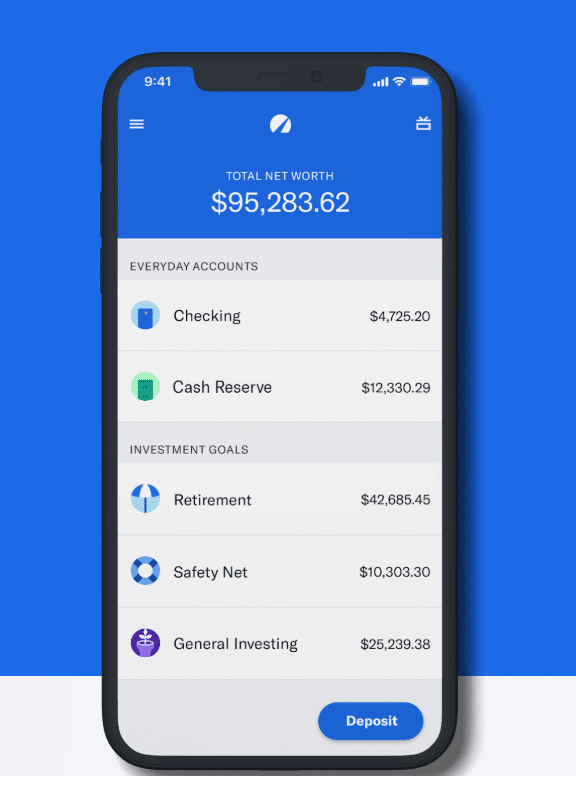

Unlike betterment schwab requires 5 000 to begin its computerized service.

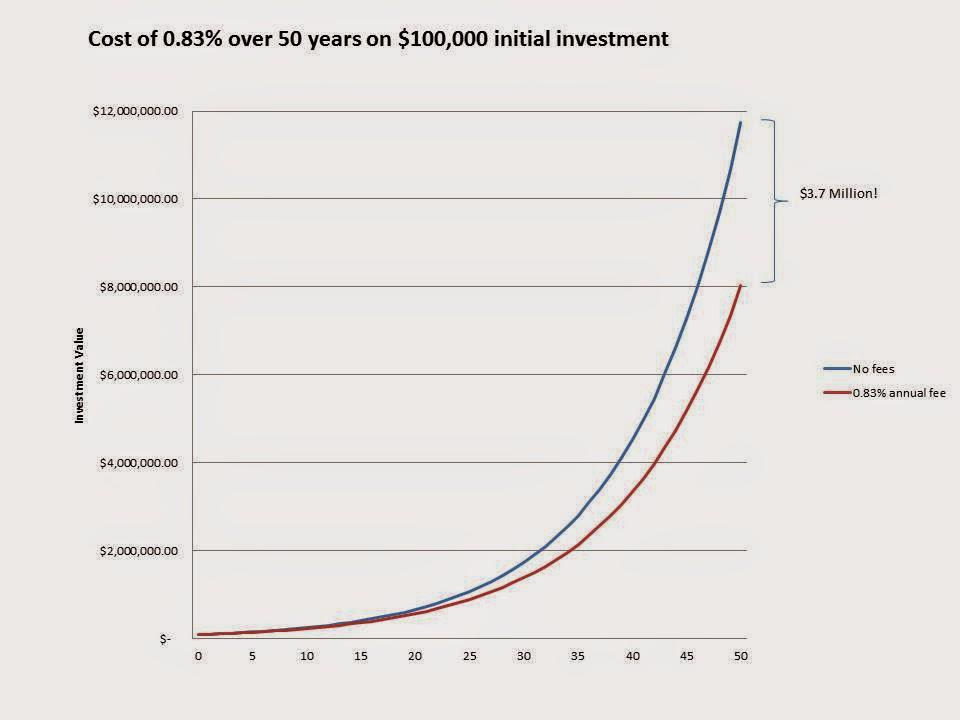

Betterment vs schwab intelligent portfolio. That includes a robo advisor product similar to what betterment offers but schwab s version is free of annual fees. Both of these services offer cheap automated ways for investors to accumulate wealth for their future. As you might expect from one of the best robo advisors schwab offers a tax strategy called tax loss harvesting. Goals based robo advisors ask potential investors questions to determine the client s risk tolerance any target retirement dates or other lifestyle milestones that may impact the client s financial needs.

Schwab offers just about anything you could want from a brokerage. In sharp contrast betterment offers tax loss harvesting free to all clients regardless of the amount invested. Suggest that the logic is already there to allow interested clients to provide more detail and get a better targeted portfolio. An intelligent portfolios account has no annual fee.

Charles schwab intelligent portfolios. Schwab intelligent portfolio is a good option for the investor who has the 5 000 account minimum. The gotcha is it s available only to clients who invest a minimum of 50 000. Charles schwab is one of the biggest discount brokerage firms in the u s.

So what is the final verdict. Betterment vs schwab intelligent portfolios overview both schwab intelligent portfolios and betterment are goals based robo advisors which makes them seem more similar than they are. Schwab intelligent portfolios vs betterment tax strategy. Like betterment schwab charges nothing to place trades in an account or to rebalance it.

/betterment-vs-charles-schwab-intelligent-portfolios-78bc10d3cec844cdadf3f96ebc73ca9f.png)

:max_bytes(150000):strip_icc()/Betterment-productcard-5c61e44bc9e77c00010a4e52.png)

:max_bytes(150000):strip_icc()/768px-Charles_Schwab_Corporation_logo.svg-0a759799615e40de953ea3001a498f0b.png)

/charles-schwab_inv-c39b35f51ebc4d8490927ec6e90529b2.png)

:max_bytes(150000):strip_icc()/wealthfront_productcard-5c74508fc9e77c000136a5cb.jpg)