Can I Use Hsa For Lasik

I m considering getting lasik done and would like to use my hsa to pay for it.

Can i use hsa for lasik. Most lasik surgery is not covered under medical or vision insurance so an fsa hsa can be a financial lifesaver. Having an fsa or hsa account can be useful as it can help you cover some if not all of the cost of your lasik surgery. Although the irs sets limits on which procedures can and can t be covered by an hsa lasik is currently considered to be an eligible expense meaning you can use your hsa to pay for your lasik surgery here in dallas. I understand that an hsa can be used for qualified medical expenses and that lasik falls under this category.

Many patients have used money in their fsa and hsa accounts to pay for a majority or even the full amount of their procedure. If you have an hsa you can only cover expenses with funds that are in your account. You can allow the funds to accumulate until you are ready to use them. An hsa also includes a catch up contribution provision which allows participants 55 and older to contribute an additional 1 000 toward their hsa.

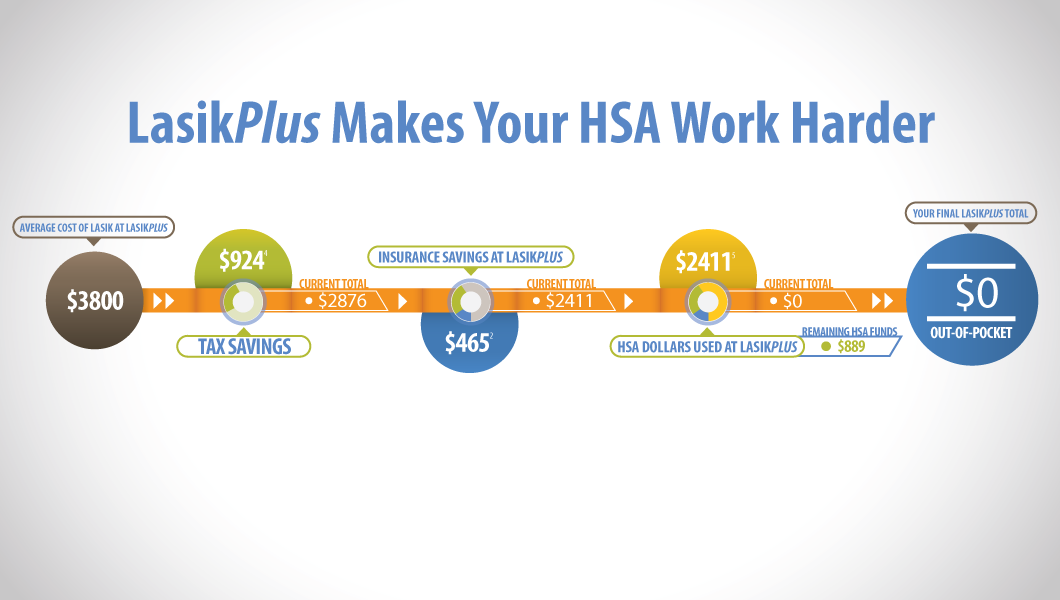

Funds from your hsa can be used to pay for lasik surgery and speaking with your employer is a great way to learn more about your hsa options. With a tax free health savings account hsa or flexible spending account fsa you can pay for your lasik surgery with pre tax dollars which could mean a 20 30 discount for those who are eligible. With an hsa contributions from your employer are excluded from your gross income and you can claim tax deductions from your personal contributions as well as ones made by anyone other than your employer. Others can contribute to your hsa.

The funds held in your hsa will be available without a time limit. But if you pay for lasik out of pocket or if your hsa only covers part of the cost you can keep the receipts and essentially pay yourself back w pre tax or tax deductible contributions. Increases spendable income. Using the money in your flexible spending account fsa or health saving account hsa is a great way to pay for lasik eye surgery and save money through pre tax dollars.

Your hsa can also be used to help cover the cost of lasik eye surgery. You can then fund the account up to the yearly limit set by the irs. There is no use it or lose it requirement with an hsa like there is with an fsa. Since hsa funds are treated on a pre tax basis you may even be able to save on surgery compared to paying cash out of pocket.

Using fsa or hsa for lasik eye surgery. Using your hsa for lasik is simple. When you open an hsa you get a debit card or checks that are associated with the hsa account. By setting up an hsa you can pay for elective medical services like lasik and other laser eye surgery procedures while maximizing your tax savings.

Since the money rolls over you do not have to worry about using up the funds by the end of the year. However it will take a couple years to build up enough of a balance to cover the surgery.